PNC Bank 2007 Annual Report Download - page 45

Download and view the complete annual report

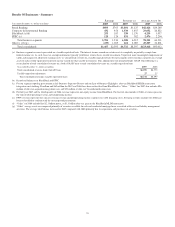

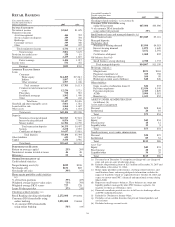

Please find page 45 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Average total loan balances increased $2.9 billion or

16%, to $21.3 billion in 2007 compared with 2006. The

Mercantile acquisition accounted for a large part of this

increase and fueled growth in all loan categories.

Continuing customer demand was also a factor in the

increase in corporate loans.

• Commercial mortgage loans held for sale totaled $2.1

billion at December 31, 2007, driven by origination

volumes along with an increase in the holding period

during the second half of 2007 due to adverse market

conditions. Subject to market conditions, our plan is for

held for sale loans to decline as a result of placing loans

in CMBS securitizations and reducing origination

activity in the first half of 2008.

• Beginning in 2008, we elected to identify commercial

mortgage loans held for sale that we intend to securitize

as instruments to be accounted for at fair value under the

provisions of SFAS 159, The Fair Value Option for

Financial Assets and Financial Liabilities – Including an

amendment of FASB Statement No. 115 (SFAS 159. This

change will result in the difference between the cost and

fair value of these instruments being recognized in other

noninterest income, where we also report the change in

fair value of related economic hedging activities. Prior to

the adoption of SFAS 159, under lower-of-cost-or-market

accounting, gains were recognized when loans were sold

and securitized. Losses were recognized either upon sale

and securitization or at quarter-end if cost was greater

than fair value.

• The provision for credit losses increased $83 million, to

$125 million, in 2007 compared with 2006. This increase

was due to growth in total credit exposure and credit

quality migration primarily related to commercial real

estate exposures.

• Nonperforming assets increased $180 million at

December 31, 2007 compared with December 31, 2006.

Higher nonaccrual loans, the largest component of

nonperforming assets, were driven by increases in

commercial real estate and commercial real estate related

loans. Of this increase, $102 million occurred during the

fourth quarter of 2007. Included in the December 31,

2007 amount was $103 million of nonperforming assets

associated with the Mercantile portfolio. Given the

current environment, we believe provision levels and

nonperforming assets will continue to rise in 2008.

• Average deposit balances for 2007 increased $3.1 billion,

or 30%, to $13.4 billion in 2007 compared with 2006.

The increase in corporate money market deposits

reflected PNC’s action to avail itself of the opportunity to

obtain funding from alternative sources. Growth in

noninterest-bearing deposits was attributable primarily to

our commercial mortgage servicing portfolio. In the

current interest rate environment, deposits in this

business segment will be less valuable and we expect the

percentage growth in net interest income in 2008 to be

less than it was in 2007.

• Noninterest expense increased by $72 million, or 10%, to

$818 million in 2007 compared with 2006. This increase

reflected the impact of acquisitions as well as expenses

associated with other growth and fee-based initiatives

and customer growth. In addition, the noninterest

expense increases reflected our business of originating

transactions whose returns are heavily dependent on tax

credits, whereby losses are taken through noninterest

expense and the associated benefits result in a lower

provision for income taxes. These losses were $25

million higher in 2007 compared with 2006.

See the additional revenue discussion regarding treasury

management and capital markets-related products and

Midland Loan Services on page 24.

40