PNC Bank 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

8C

OMMERCIAL

M

ORTGAGE

L

OAN

S

ALES AND

R

ETAINED

I

NTERESTS

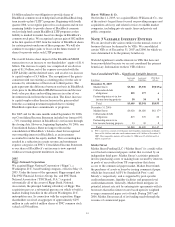

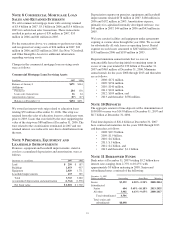

We sold commercial mortgage loans with servicing retained

of $3.4 billion in 2007, $3.1 billion in 2006 and $3.4 billion in

2005 for cash in loan sales transactions. These transactions

resulted in pretax net gains of $39 million in 2007, $55

million in 2006 and $61 million in 2005.

For the transactions above, we continue to perform servicing

and recognized servicing assets of $26 million in 2007, $24

million in 2006 and $23 million in 2005. See Note 7 Goodwill

and Other Intangible Assets for additional information

regarding servicing assets.

Changes in the commercial mortgage loan servicing assets

were as follows:

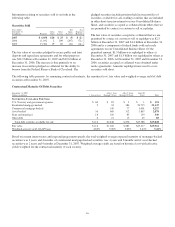

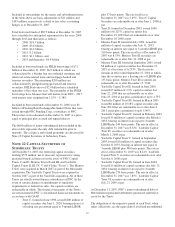

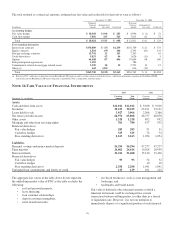

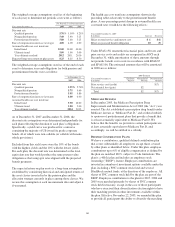

Commercial Mortgage Loan Servicing Assets

In millions 2007 2006

Balance at January 1 $471 $344

Additions

Purchases 284 150

Loan sales transactions 26 24

Amortization expense (87) (47)

Balance at December 31 $694 $471

We owned an interest-only strip related to education loans

totaling $59 million at December 31, 2006. This strip was

retained from the sales of education loans to a third party trust

prior to 2003. Loans that were held by the trust supporting the

value of the strip were $88 million at December 31, 2006. The

trust related to the securitization terminated in 2007 and our

retained interest was reduced to zero due to distributions from

the trust.

N

OTE

9P

REMISES

,E

QUIPMENT AND

L

EASEHOLD

I

MPROVEMENTS

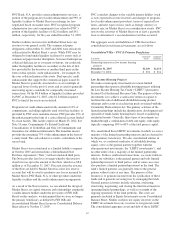

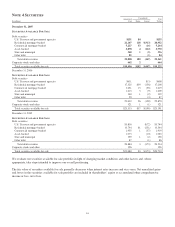

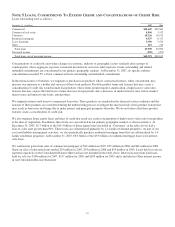

Premises, equipment and leasehold improvements, stated at

cost less accumulated depreciation and amortization, were as

follows:

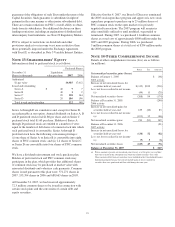

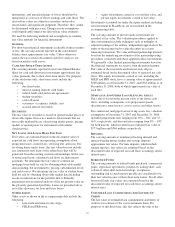

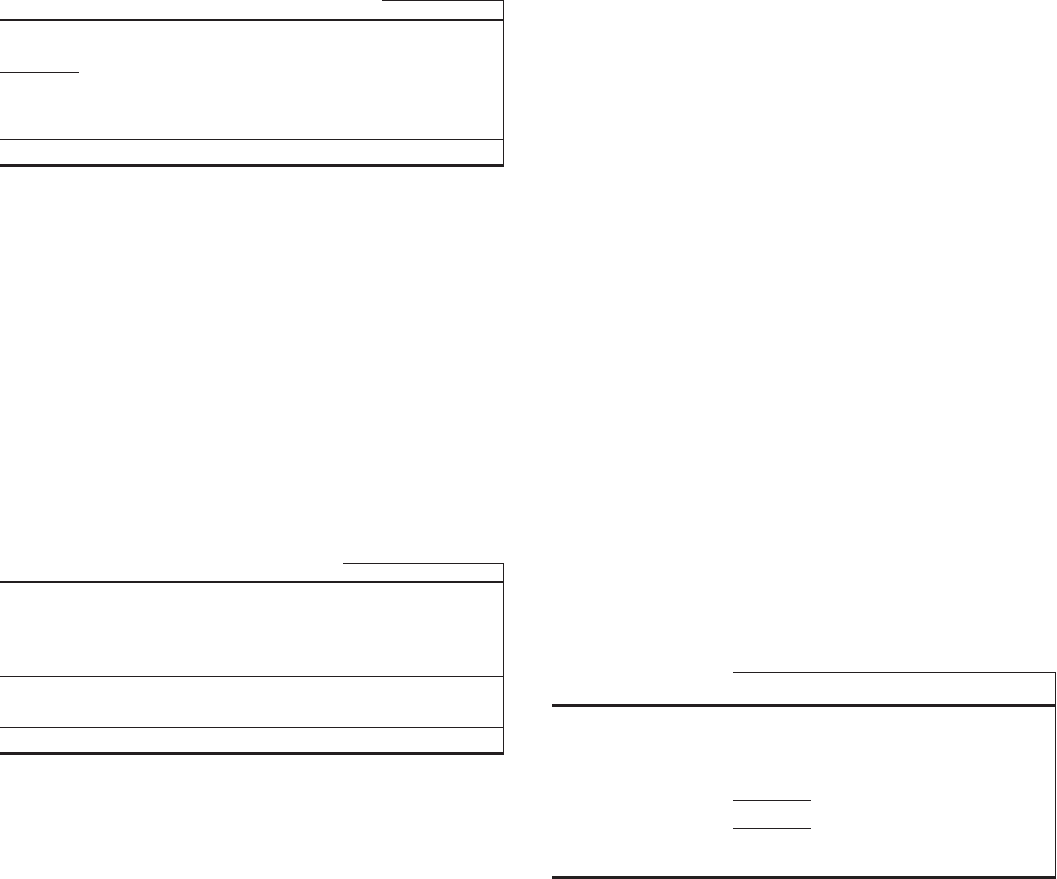

December 31 - in millions 2007 2006

Land $ 250 $ 187

Buildings 1,053 937

Equipment 2,029 1,771

Leasehold improvements 433 385

Total 3,765 3,280

Accumulated depreciation and amortization (1,764) (1,578)

Net book value $ 2,001 $ 1,702

Depreciation expense on premises, equipment and leasehold

improvements totaled $178 million in 2007, $180 million in

2006 and $192 million in 2005. Amortization expense,

primarily for capitalized internally developed software, was

$40 million in 2007, $44 million in 2006 and $43 million in

2005.

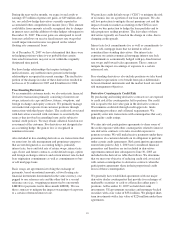

We lease certain facilities and equipment under agreements

expiring at various dates through the year 2066. We account

for substantially all such leases as operating leases. Rental

expense on such leases amounted to $207 million in 2007,

$193 million in 2006 and $189 million in 2005.

Required minimum annual rentals that we owe on

noncancelable leases having initial or remaining terms in

excess of one year totaled $1.239 billion at December 31,

2007 and $965 million at December 31, 2006. Minimum

annual rentals for the years 2008 through 2013 and thereafter

are as follows:

• 2008: $172 million,

• 2009: $156 million,

• 2010: $140 million,

• 2011: $124 million,

• 2012: $109 million, and

• 2013 and thereafter: $538 million.

N

OTE

10 D

EPOSITS

The aggregate amount of time deposits with a denomination of

$100,000 or more was $14.8 billion at December 31, 2007 and

$8.7 billion at December 31, 2006.

Total time deposits of $26.4 billion at December 31, 2007

have contractual maturities for the years 2008 through 2013

and thereafter as follows:

• 2008: $22.5 billion,

• 2009: $1.9 billion,

• 2010: $.6 billion,

• 2011: $.1 billion,

• 2012: $.2 billion, and

• 2013 and thereafter: $1.1 billion.

N

OTE

11 B

ORROWED

F

UNDS

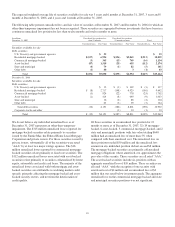

Bank notes at December 31, 2007 totaling $3.2 billion have

interest rates ranging from 2.75% to 10.25% with

approximately $3 billion maturing in 2008. Senior and

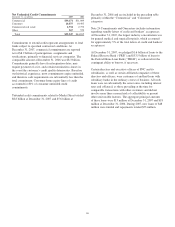

subordinated notes consisted of the following:

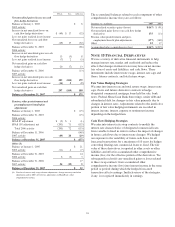

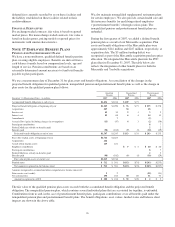

December 31, 2007

Dollars in millions Outstanding Stated Rate Maturity

Senior $3,592 4.20%–5.50% 2008-2014

Subordinated

Junior 604 5.69%–10.18% 2013-2035

All other 3,902 4.63%–9.65% 2008-2017

Total subordinated 4,506

Total senior and

subordinated $8,098

91