PNC Bank 2007 Annual Report Download - page 97

Download and view the complete annual report

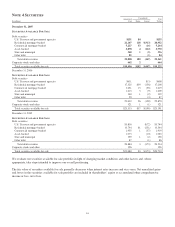

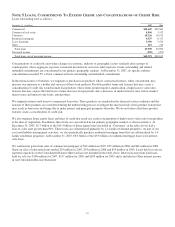

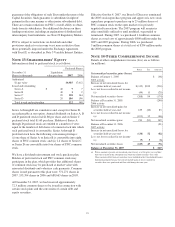

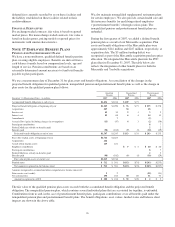

Please find page 97 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Included in outstandings for the senior and subordinated notes

in the table above are basis adjustments of $21 million and

$103 million, respectively, related to fair value accounting

hedges as of December 31, 2007.

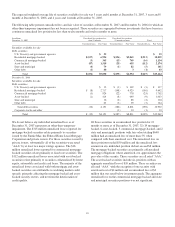

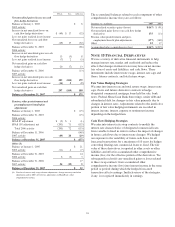

Total borrowed funds of $30.9 billion at December 31, 2007

have scheduled or anticipated repayments for the years 2008

through 2013 and thereafter as follows:

• 2008: $18.3 billion,

• 2009: $3.6 billion,

• 2010: $3.3 billion,

• 2011: $.2 billion,

• 2012: $1.1 billion, and

• 2013 and thereafter: $4.4 billion.

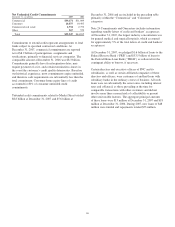

Included in borrowed funds are FHLB borrowings of $7.1

billion at December 31, 2007, $6.9 billion of which are

collateralized by a blanket lien on residential mortgage and

other real estate-related loans and mortgage-backed and

treasury securities. The remaining $200 million are

collateralized by pledged mortgage-backed and treasury

securities. FHLB advances of $2.0 billion have scheduled

maturities of less than one year. The remainder of the FHLB

borrowings have balances that will mature from 2009 – 2017,

with interest rates ranging from 1.25% – 5.38%.

Included in borrowed funds at December 31, 2006 were $1

billion of Floating Rate Exchangeable Senior Notes that were

issued through PNC Funding Corp, a subsidiary of PNC.

These notes were redeemed on December 21, 2007 at a price

equal to principal plus accrued and unpaid interest.

The $604 million of junior subordinated debt included in the

above table represents the only debt redeemable prior to

maturity. The call price and related premiums are discussed in

Note 12 Capital Securities of Subsidiary Trusts.

N

OTE

12 C

APITAL

S

ECURITIES OF

S

UBSIDIARY

T

RUSTS

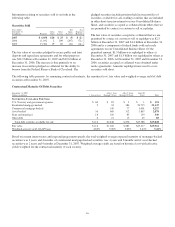

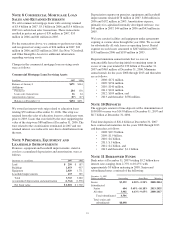

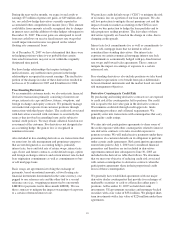

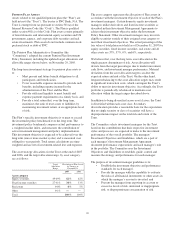

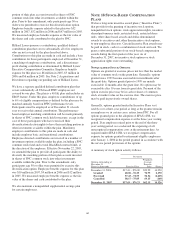

At December 31, 2007, the following capital securities

totaling $572 million, net of discount, represent non-voting

preferred beneficial interests in the assets of PNC Capital

Trusts C and D, Monroe Trusts II and III, and Yardville

Capital Trusts II, III, IV, V and VI (the “Trusts”). The Monroe

Trusts were acquired in March 2007 as part of the Mercantile

acquisition. The Yardville Capital Trusts were acquired in

October 2007 as part of the Yardville acquisition. All of these

Trusts are wholly owned finance subsidiaries of PNC. In the

event of certain changes or amendments to regulatory

requirements or federal tax rules, the capital securities are

redeemable in whole. The financial statements of the Trusts

are not included in PNC’s consolidated financial statements in

accordance with GAAP.

• Trust C, formed in June 1998, issued $200 million of

capital securities due June 1, 2028, bearing interest at

a floating rate per annum equal to 3-month LIBOR

plus 57 basis points. The rate in effect at

December 31, 2007 was 5.69%. Trust C Capital

Securities are redeemable on or after June 1, 2008 at

par.

• Trust D, formed in December 2003, issued $300

million of 6.125% capital securities due

December 15, 2033 that are redeemable on or after

December 18, 2008 at par.

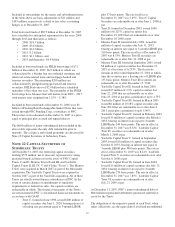

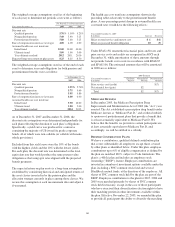

• Monroe Trust II, formed in July 2003, issued $4

million of capital securities due July 31, 2033,

bearing an interest rate equal to 3-month LIBOR plus

310 basis points. The rate in effect at December 31,

2007 was 8.33%. Monroe Trust II securities are

redeemable on or after July 31, 2008 at par.

• Monroe Trust III, formed in September 2005, issued

$8 million of capital securities due December 15,

2035 at a fixed rate of 6.253%. The fixed rate

remains in effect until September 15, 2010 at which

time the securities pay a floating rate of LIBOR plus

155 basis points. Monroe Trust III securities are

redeemable on or after December 15, 2010.

• Yardville Capital Trust II, formed in June 2000

issued $15 million of 9.5% capital securities due

June 22, 2030 that are redeemable on or after

June 23, 2010 at par plus a premium of up to 4.75%.

• Yardville Capital Trust III, formed in March 2001

issued $6 million of 10.18% capital securities due

June 2031 that are redeemable on or after June 8,

2011 at par plus a premium of up to 5.09%.

• Yardville Capital Trust IV, formed in February 2003

issued $15 million of capital securities due March 1,

2033, bearing an interest rate equal to 3-month

LIBOR plus 340 basis points. The rate in effect at

December 31, 2007 was 8.52%. Yardville Capital

Trust IV securities are redeemable on or after

March 1, 2008 at par.

• Yardville Capital Trust V, formed in September

2003, issued $10 million of capital securities due

October 8, 2033, bearing an interest rate equal to

3-month LIBOR plus 300 basis points. The rate in

effect at December 31, 2007 was 8.24%. Yardville

Capital Trust V securities are redeemable on or after

October 8, 2008 at par.

• Yardville Capital Trust VI, formed in June 2004,

issued $15 million of capital securities due July 23,

2034, bearing an interest rate equal to 3-month

LIBOR plus 270 basis points. The rate in effect at

December 31, 2007 was 7.85%. Yardville Capital

Trust VI securities are redeemable on or after

July 23, 2009 at par.

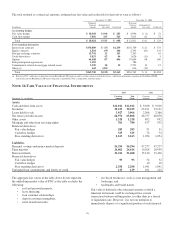

At December 31, 2007, PNC’s junior subordinated debt of

$604 million represented debentures purchased and held as

assets by the Trusts.

The obligations of the respective parent of each Trust, when

taken collectively, are the equivalent of a full and unconditional

92