PNC Bank 2007 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

25 P

ARENT

C

OMPANY

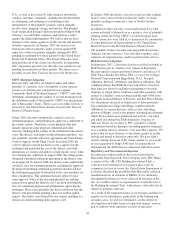

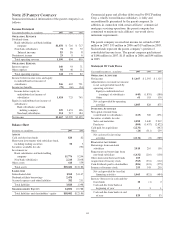

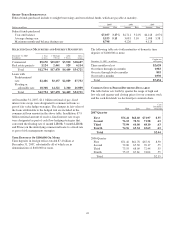

Summarized financial information of the parent company is as

follows:

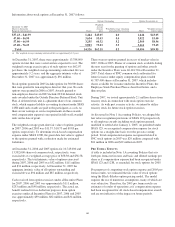

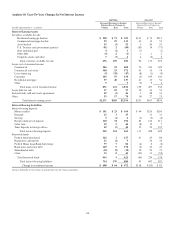

Income Statement

Year ended December 31 - in millions 2007 2006 2005

O

PERATING

R

EVENUE

Dividends from:

Bank subsidiaries and bank holding

company $1,078 $ 710 $ 717

Non-bank subsidiaries 74 69 72

Interest income 15 16 8

Noninterest income 23 96

Total operating revenue 1,190 804 803

O

PERATING

E

XPENSE

Interest expense 160 93 71

Other expense 84 46 11

Total operating expense 244 139 82

Income before income taxes and equity

in undistributed net income of

subsidiaries 946 665 721

Income tax benefits (78) (60) (24)

Income before equity in

undistributed net income of

subsidiaries 1,024 725 745

Equity in undistributed net income of

subsidiaries:

Bank subsidiaries and bank

holding company 229 1,653 396

Non-bank subsidiaries 214 217 184

Net income $1,467 $2,595 $1,325

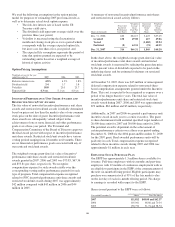

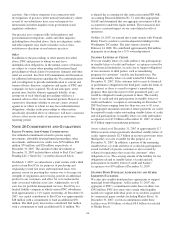

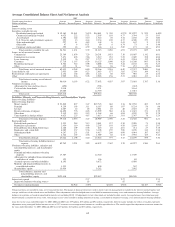

Balance Sheet

December 31 - in millions 2007 2006

A

SSETS

Cash and due from banks $20 $2

Short-term investments with subsidiary bank,

including trading securities 58 3

Securities available for sale 290

Investments in:

Bank subsidiaries and bank holding

company 15,776 9,294

Non-bank subsidiaries 2,214 2,038

Other assets 614 559

Total assets $18,682 $12,186

L

IABILITIES

Subordinated debt $968 $1,147

Nonbank affiliate borrowings 2,478

Accrued expenses and other liabilities 382 251

Total liabilities 3,828 1,398

S

HAREHOLDERS

’E

QUITY

14,854 10,788

Total liabilities and shareholders’ equity $18,682 $12,186

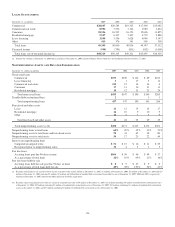

Commercial paper and all other debt issued by PNC Funding

Corp, a wholly owned finance subsidiary, is fully and

unconditionally guaranteed by the parent company. In

addition, in connection with certain affiliates’ commercial

mortgage servicing operations, the parent company has

committed to maintain such affiliates’ net worth above

minimum requirements.

The parent company received net income tax refunds of $65

million in 2007, $35 million in 2006 and $19 million in 2005.

Such refunds represent the parent company’s portion of

consolidated income taxes. The parent company paid interest

of $146 million in 2007, $113 million in 2006 and $94 million

in 2005.

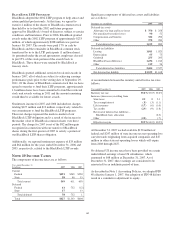

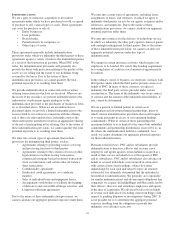

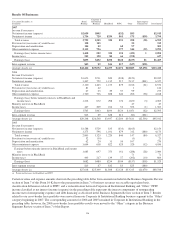

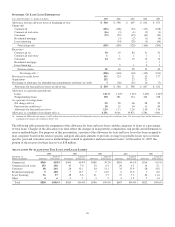

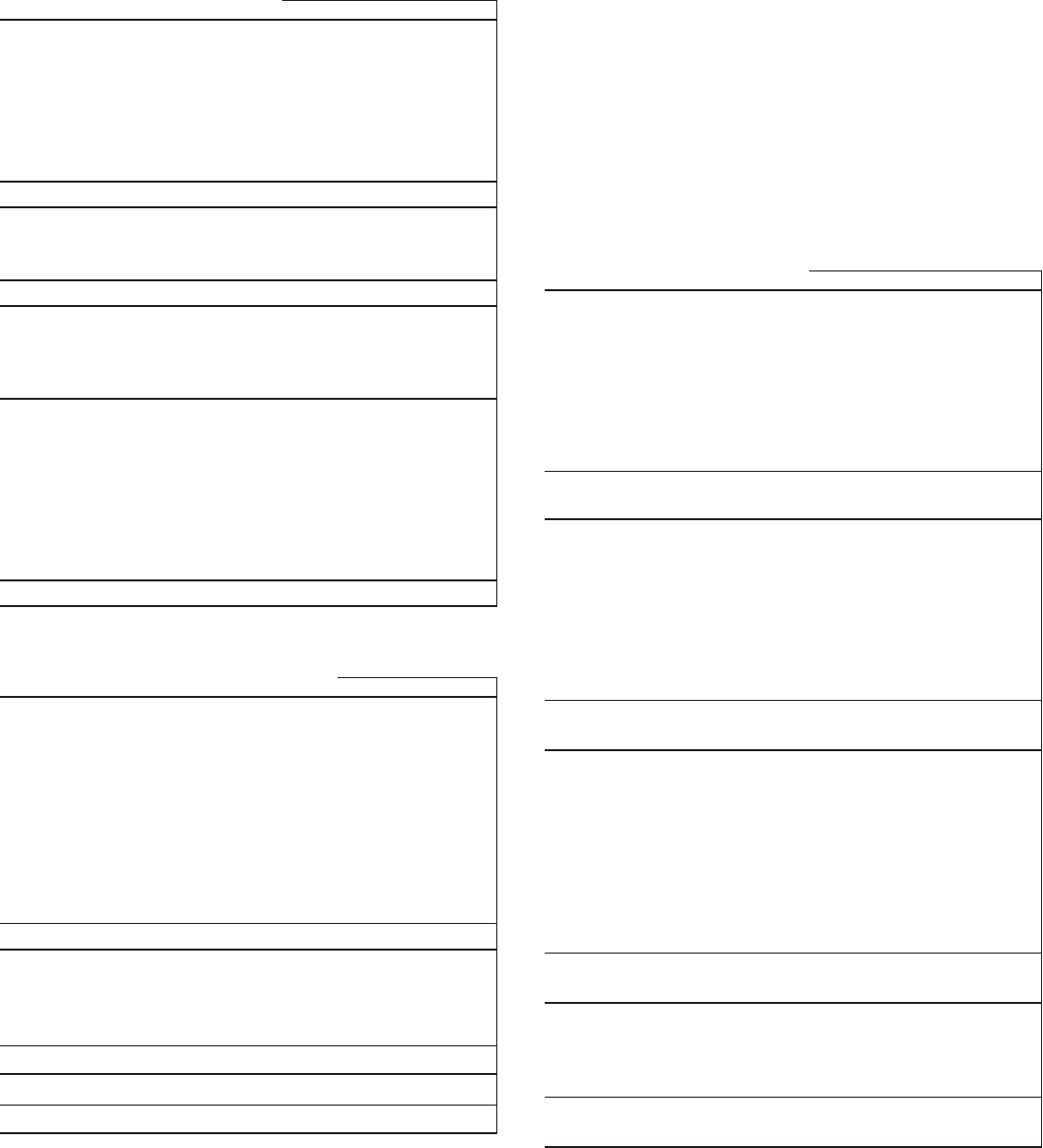

Statement Of Cash Flows

Year ended December 31 - in millions 2007 2006 2005

O

PERATING

A

CTIVITIES

Net income $ 1,467 $ 2,595 $ 1,325

Adjustments to reconcile net income

to net cash provided (used) by

operating activities:

Equity in undistributed net

(earnings) of subsidiaries (443) (1,870) (580)

Other 61 103 130

Net cash provided by operating

activities 1,085 828 875

I

NVESTING

A

CTIVITIES

Net capital returned from

(contributed to) subsidiaries (165) 300 (271)

Securities available for sale:

Sales and maturities 1,090 3,440 2,912

Purchases (800) (3,437) (2,822)

Cash paid for acquisitions (2,231) (447)

Other (26) (311) 239

Net cash used in investing

activities (2,132) (8) (389)

F

INANCING

A

CTIVITIES

Borrowings from non-bank

subsidiary 3,910 210 150

Repayments on borrowings from

non-bank subsidiary (1,432) (210) (150)

Other short-term borrowed funds 103

Acquisition of treasury stock (963) (531) (112)

Cash dividends paid to shareholders (806) (633) (575)

Issuance of treasury stock 253 343 203

Net cash provided by (used in)

financing activities 1,065 (821) (484)

Increase (decrease) in cash and due

from banks 18 (1) 2

Cash and due from banks at

beginning of year 231

Cash and due from banks at end

of year $20 $2 $3

113