PNC Bank 2007 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM

13 – CERTAIN RELATIONSHIPS AND RELATED

TRANSACTIONS, AND DIRECTOR INDEPENDENCE

The information required by this item is included under the

captions “Transactions Involving Directors And Executive

Officers” and “Corporate Governance At PNC – Director

Independence” in our Proxy Statement to be filed for the

annual meeting of shareholders to be held on April 22, 2008

and is incorporated herein by reference.

ITEM

14 – PRINCIPAL ACCOUNTING FEES AND

SERVICES

The information required by this item is included under the

caption “Independent Auditors” in our Proxy Statement to be

filed for the annual meeting of shareholders to be held on

April 22, 2008 and is incorporated herein by reference.

PART IV

ITEM

15 –

EXHIBITS

,

FINANCIAL STATEMENT

SCHEDULES

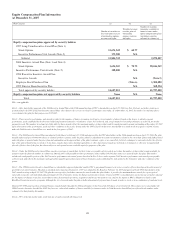

FINANCIAL STATEMENTS, FINANCIAL

STATEMENT SCHEDULES

Our consolidated financial statements required in response to

this Item are incorporated by reference from Item 8 of this

Report.

The report of our former independent registered public

accounting firm follows:

REPORT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

To the Board of Directors and Shareholders of

The PNC Financial Services Group, Inc.

Pittsburgh, Pennsylvania

We have audited the accompanying consolidated balance

sheet of The PNC Financial Services Group, Inc. and

subsidiaries (the “Company”) as of December 31, 2006, and

the related consolidated statements of income, shareholders’

equity, and cash flows for each of the two years in the period

ended December 31, 2006. These financial statements are the

responsibility of the Company’s management. Our

responsibility is to express an opinion on these financial

statements based on our audits.

We conducted our audits in accordance with the standards of

the Public Company Accounting Oversight Board

(United States). Those standards require that we plan and

perform the audit to obtain reasonable assurance about

whether the financial statements are free of material

misstatement. An audit includes examining, on a test basis,

evidence supporting the amounts and disclosures in the

financial statements. An audit also includes assessing the

accounting principles used and significant estimates made by

management, as well as evaluating the overall financial

statement presentation. We believe that our audits provide a

reasonable basis for our opinion.

In our opinion, such consolidated financial statements present

fairly, in all material respects, the financial position of The

PNC Financial Services Group, Inc. and subsidiaries as of

December 31, 2006, and the results of their operations and

their cash flows for each of the two years in the period ended

December 31, 2006, in conformity with accounting principles

generally accepted in the United States of America.

As discussed in Note 1 to the consolidated financial

statements, the Company adopted Statement of Financial

Accounting Standard No. 158, “Employers’ Accounting for

Defined Benefit Pension and Other Postretirement Plans – an

amendment of FASB Statements No. 87, 88, 106, and 132(R)”

as of December 31, 2006.

As discussed in Note 1 to the consolidated financial

statements, the accompanying consolidated statement of cash

flows for the year ended December 31, 2006 has been restated.

As a result of the transaction discussed in Note 2 to the

consolidated financial statements, the Company no longer

consolidates BlackRock, Inc. (“BlackRock”). Beginning

September 30, 2006, the Company recognized its investment

in BlackRock using the equity method of accounting.

/s/ Deloitte & Touche LLP

Pittsburgh, Pennsylvania

March 1, 2007 (February 4, 2008 as to the effects of the

restatement discussed in Note 1)

Audited consolidated financial statements of BlackRock, Inc.

(“BlackRock”) for the years ended December 31, 2007 and

December 31, 2006 are incorporated herein by reference to

Item 15(a)(1) of BlackRock’s 2007 Annual Report on

Form 10-K (Commission File Number 001-33099).

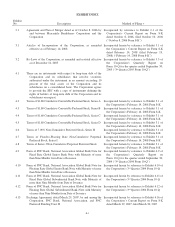

EXHIBITS

Our exhibits listed on the Exhibit Index on pages E-1 through

E-6 of this Form 10-K are filed with this Report or are

incorporated herein by reference.

126