PNC Bank 2007 Annual Report Download - page 51

Download and view the complete annual report

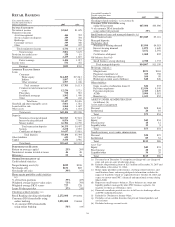

Please find page 51 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2007. The 2008 values and sensitivities shown above include

the qualified defined benefit plan maintained by Mercantile

that we integrated into the PNC plan as of December 31, 2007.

SFAS 158 was effective for PNC as of December 31, 2006.

This statement affects the accounting and reporting for our

qualified pension plan, our nonqualified retirement plans, our

postretirement welfare benefit plans, and our postemployment

benefit plans. See Note 1 Accounting Policies for further

information regarding our adoption of SFAS 158.

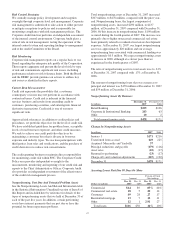

Our pension plan contribution requirements are not

particularly sensitive to actuarial assumptions. Investment

performance has the most impact on contribution requirements

and will drive the amount of permitted contributions in future

years. Also, current law, including the provisions of the

Pension Protection Act of 2006, sets limits as to both

minimum and maximum contributions to the plan. In any

event, any contributions to the plan in the near term will be at

our discretion, as we expect that the minimum required

contributions under the law will be minimal or zero for several

years.

We maintain other defined benefit plans that have a less

significant effect on financial results, including various

nonqualified supplemental retirement plans for certain

employees. See Note 17 Employee Benefit Plans in the Notes

To Consolidated Financial Statements in Item 8 of this Report

for additional information.

R

ISK

M

ANAGEMENT

We encounter risk as part of the normal course of our business

and we design risk management processes to help manage

these risks. This Risk Management section first provides an

overview of the risk measurement, control strategies, and

monitoring aspects of our corporate-level risk management

processes. Following that discussion is an analysis of the risk

management process for what we view as our primary areas of

risk: credit, operational, liquidity, and market. The discussion

of market risk is further subdivided into interest rate, trading,

and equity and other investment risk areas. Our use of

financial derivatives as part of our overall asset and liability

risk management process is also addressed within the Risk

Management section of this Item 7. In appropriate places

within this section, historical performance is also addressed.

O

VERVIEW

As a financial services organization, we take a certain amount

of risk in every business decision. For example, every time we

open an account or approve a loan for a customer, process a

payment, hire a new employee, or implement a new computer

system, we incur a certain amount of risk. As an organization,

we must balance revenue generation and profitability with the

risks associated with our business activities. Risk management

is not about eliminating risks, but about identifying and

accepting risks and then effectively managing them so as to

optimize shareholder value.

The key to effective risk management is to be proactive in

identifying, measuring, evaluating, and monitoring risk on an

ongoing basis. Risk management practices support decision-

making, improve the success rate for new initiatives, and

strengthen the market’s confidence in an organization.

Corporate-Level Risk Management Overview

We support risk management through a governance structure

involving the Board, senior management and a corporate risk

management organization.

Although our Board as a whole is responsible generally for

oversight of risk management, committees of the Board

provide oversight to specific areas of risk with respect to the

level of risk and risk management structure.

We use management level risk committees to help ensure that

business decisions are executed within our desired risk profile.

The Executive Risk Management Committee (“ERMC”),

consisting of senior management executives, provides

oversight for the establishment and implementation of new

comprehensive risk management initiatives, reviews

enterprise level risk profiles and discusses key risk issues.

The corporate risk management organization has the following

key roles:

• Facilitate the identification, assessment and

monitoring of risk across PNC,

• Provide support and oversight to the businesses, and

• Identify and implement risk management best

practices, as appropriate.

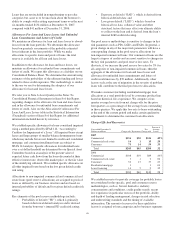

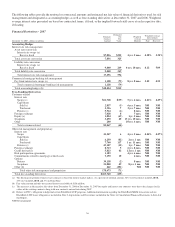

Risk Measurement

We conduct risk measurement activities specific to each area

of risk. The primary vehicle for aggregation of enterprise-wide

risk is a comprehensive risk management methodology that is

based on economic capital. This primary risk aggregation

measure is supplemented with secondary measures of risk to

arrive at an estimate of enterprise-wide risk. The economic

capital framework is a measure of potential losses above and

beyond expected losses. Potential one year losses are

capitalized to a level commensurate with a financial institution

with an A rating by the credit rating agencies. Economic

capital incorporates risk associated with potential credit losses

(Credit Risk), fluctuations of the estimated market value of

financial instruments (Market Risk), failure of people,

processes or systems (Operational Risk), and income losses

associated with declining volumes, margins and/or fees, and

the fixed cost structure of the business (Business Risk). We

estimate credit and market risks at an exposure level while we

estimate the remaining risk types at an institution or business

segment level. We routinely compare the output of our

economic capital model with industry benchmarks.

46