PNC Bank 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.investment company. The FASB issued a final FSP in

February 2008 which indefinitely delays the effective date of

AICPA SOP 07-1.

In May 2007, the FASB issued FASB Staff Position No.

(“FSP”) FIN 46(R) 7, “Application of FASB Interpretation

No. 46(R) to Investment Companies.” This guidance amends

paragraph 4(e) of FIN 46(R) to provide a scope exception

from the consolidation provisions for investments accounted

for at fair value in accordance with the specialized accounting

guidance of the Guide referenced above. This guidance will be

effective for PNC upon adoption of SOP 07-1.

In May 2007, the FASB issued FSP FIN 48-1, “Definition of

Settlement in FASB Interpretation (“FIN”) No. 48.” This FSP

amended FIN 48, “Accounting for Uncertainty in Income

Taxes,” to provide guidance as to the determination of

whether a tax position is deemed effectively settled for

purposes of recognizing previously unrecognized tax benefits

under FIN 48. This guidance was adopted effective January 1,

2007 in connection with our adoption of FIN 48. See Note 19

Income Taxes for additional information.

In February 2007, the FASB issued SFAS 159, “The Fair

Value Option for Financial Assets and Financial Liabilities –

Including an amendment of FASB Statement No. 115.” This

statement permits entities to choose to measure many financial

instruments and certain other items at fair value. The fair

value option may be applied on an instrument by instrument

basis with a few exceptions. The election is irrevocable and

must be applied to entire instruments and not to portions of

instruments. We adopted SFAS 159 and elected to fair value

certain loans held for sale and other financial instruments to

align the accounting treatment for these instruments with their

related hedges. The adoption did not have a material effect on

retained earnings at January 1, 2008.

The Emerging Issues Task Force (“EITF”) of the FASB issued

EITF Issue 06-4, “Accounting for Deferred Compensation and

Postretirement Benefit Aspects of Endorsement Split-Dollar

Life Insurance Arrangements,” which is effective January 1,

2008. This EITF provides guidance for an employer to

recognize a liability for future premium payments on behalf of

the employee or retiree benefits in accordance with Statement

106 or Opinion 12 based on the substantive agreement with

the employee. The adoption of this guidance did not have a

material effect on retained earnings at January 1, 2008 and is

not expected to have a material effect on our results of

operations or financial position.

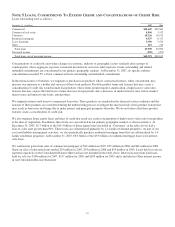

During 2006, the FASB issued the following:

• SFAS 158, “Employers’ Accounting for Defined

Benefit Pension and Other Postretirement Plans – an

amendment of FASB Statements No. 87, 88, 106, and

132(R).” This statement affects the accounting and

reporting for our qualified pension plan, our

nonqualified retirement plans, our postretirement

welfare benefit plans and our post employment

benefit plan. SFAS 158 required recognition on the

balance sheet of the over- or underfunded position of

these plans as the difference between the fair value of

plan assets and the related benefit obligations

previously recognized on the balance sheet. The

difference, net of tax, was recorded as part of

accumulated other comprehensive income or loss

(“AOCI”) within the shareholders’ equity section of

the balance sheet. This guidance also required the

recognition of any unrecognized actuarial gains and

losses and unrecognized prior service costs to AOCI,

net of tax. SFAS 158 was effective for PNC as of

December 31, 2006, with no restatement for prior

year-end reporting periods permitted. The impact of

adoption of SFAS 158 at December 31, 2006 was a

reduction of AOCI of $132 million after tax.

• SFAS 157, “Fair Value Measurements,” defines fair

value, establishes a framework for measuring fair

value, and expands disclosures about fair value

measurements. This statement applies whenever

other accounting standards require or permit assets or

liabilities to be measured at fair value; it does not

expand the use of fair value to new accounting

transactions and does not apply to pronouncements

that address share-based payment transactions. As

required, we will adopt SFAS 157 prospectively

beginning January 1, 2008. The adoption of this

standard did not have a material effect on retained

earnings at January 1, 2008.

• FIN 48 “Accounting for Uncertainty in Income Taxes

– an Interpretation of FASB Statement No. 109,”

clarifies the accounting for uncertainty in income

taxes recognized in the financial statements and sets

forth recognition, derecognition and measurement

criteria for tax positions taken or expected to be taken

in a tax filing. For PNC, this guidance was effective

for all tax positions taken or expected to be taken

beginning on January 1, 2007. See Note 19 Income

Taxes for additional information.

• FSP FAS 13-2, “Accounting for a Change or

Projected Change in the Timing of Cash Flows

Relating to Income Taxes Generated by a Leveraged

Lease Transaction,” requires a recalculation of the

timing of income recognition for a leveraged lease

under SFAS 13, “Accounting for Leases,” when a

change in the timing of income tax deductions

directly related to the leveraged lease transaction

occurs or is projected to occur. Any tax positions

taken regarding the leveraged lease transaction must

be recognized and measured in accordance with FIN

48 described above. This guidance was effective for

PNC beginning January 1, 2007 with the cumulative

effect of applying the provisions of this FSP being

recognized through an adjustment to opening retained

earnings. Any immediate or future reductions in

earnings from the change in accounting would be

79