PNC Bank 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

B

LACK

R

OCK

LTIP P

ROGRAMS

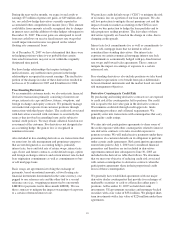

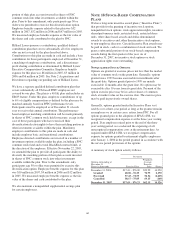

BlackRock adopted the 2002 LTIP program to help attract and

retain qualified professionals. At that time, we agreed to

transfer 4 million of the shares of BlackRock common stock

then held by us to fund the 2002 and future programs

approved by BlackRock’s board of directors, subject to certain

conditions and limitations. Prior to 2006, BlackRock granted

awards under the 2002 LTIP program of approximately $233

million, of which approximately $208 million was paid on

January 30, 2007. The awards were paid 17% in cash by

BlackRock and the remainder in BlackRock common stock

transferred by us to the LTIP participants (1 million shares).

As permitted under the award agreements, employees elected

to put 95% of the stock portion of the awards back to

BlackRock. These shares were retained by BlackRock as

treasury stock.

BlackRock granted additional restricted stock unit awards in

January 2007, all of which are subject to achieving earnings

performance goals prior to the vesting date of September 29,

2011. Of the shares of BlackRock common stock that we have

agreed to transfer to fund their LTIP programs, approximately

1.6 million shares have been committed to fund the restricted

stock unit awards vesting in 2011 and the amount remaining

would then be available for future awards.

Noninterest income for 2007 and 2006 included net charges

totaling $127 million and $12 million, respectively, related to

our commitment to fund the BlackRock LTIP programs.

These net charges represent the mark-to-market of our

BlackRock LTIP obligation and is a result of the increase in

the market value of BlackRock common shares over these

periods. The charge for 2007 is net of the $82 million gain

recognized in connection with our transfer of BlackRock

shares during the first quarter of 2007 to satisfy a portion of

our BlackRock LTIP shares obligation.

Additionally, we reported noninterest expense of $33 million

and $64 million for the years ended December 31, 2006 and

2005, respectively, related to the BlackRock LTIP awards.

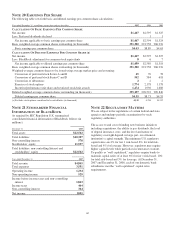

N

OTE

19 I

NCOME

T

AXES

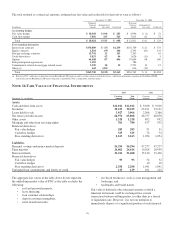

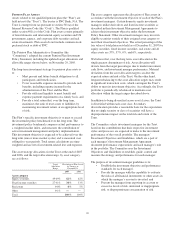

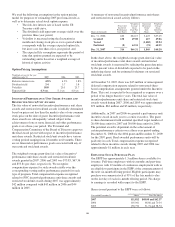

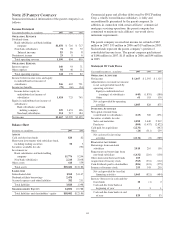

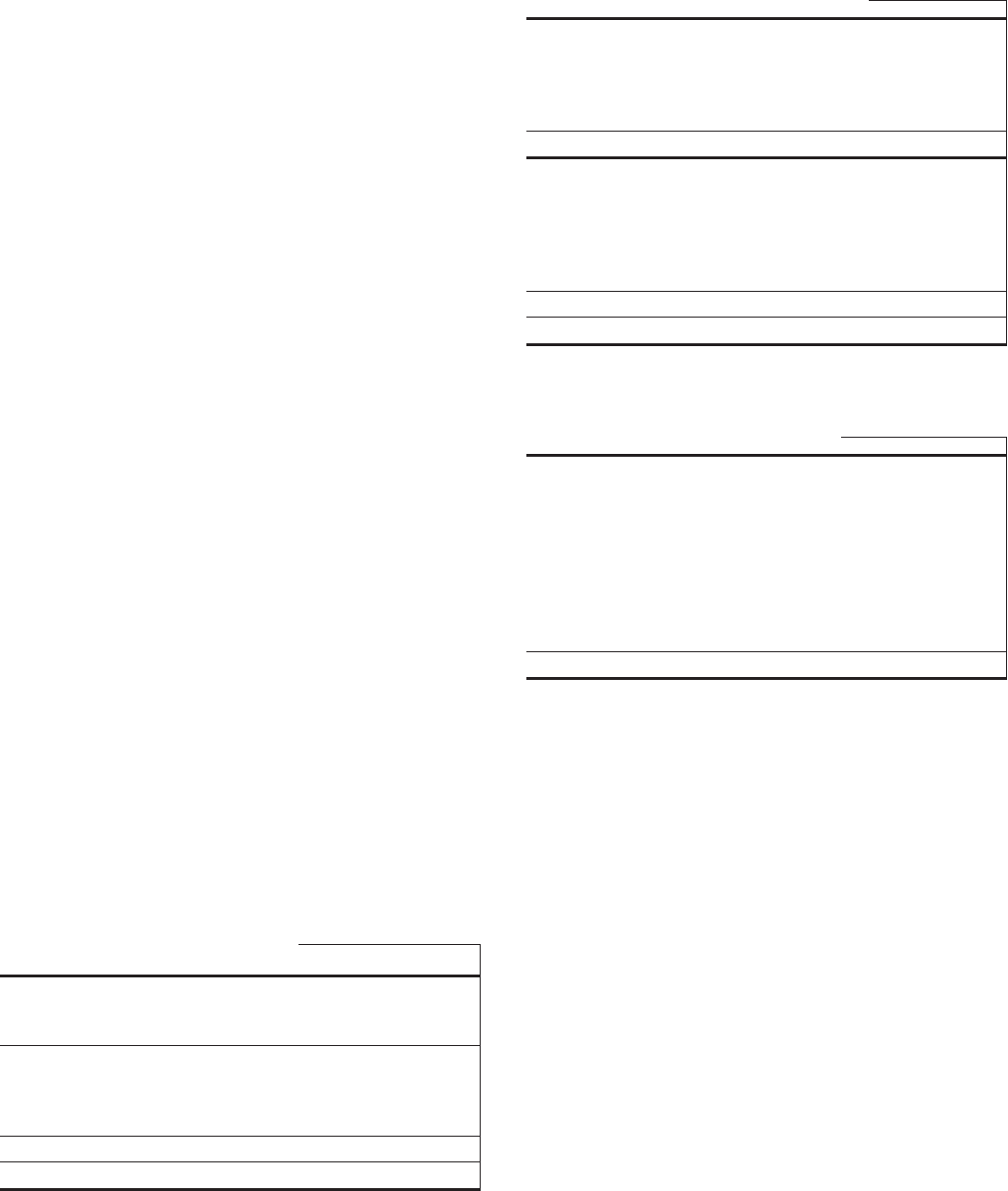

The components of income taxes are as follows:

Year ended December 31

In millions 2007 2006 2005

Current

Federal $491 $565 $550

State 58 46 53

Total current 549 611 603

Deferred

Federal 61 752 (12)

State 17 13

Total deferred 78 752 1

Total $627 $1,363 $604

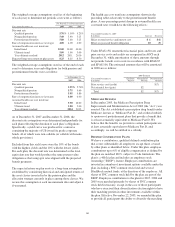

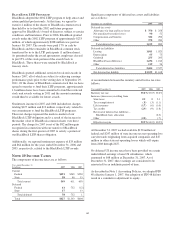

Significant components of deferred tax assets and liabilities

are as follows:

December 31 - in millions 2007 2006

Deferred tax assets

Allowance for loan and lease losses $ 370 $ 258

Net unrealized securities losses 90 52

Compensation and benefits 322 296

Other 370 283

Total deferred tax assets 1,152 889

Deferred tax liabilities

Leasing 1,011 1,025

Depreciation 65 75

Goodwill 255 205

BlackRock basis difference 1,234 1,166

Other 119 56

Total deferred tax liabilities 2,684 2,527

Net deferred tax liability $1,532 $1,638

A reconciliation between the statutory and effective tax rates

follows:

Year ended December 31 2007 2006 2005

Statutory tax rate 35.0%35.0% 35.0%

Increases (decreases) resulting from

State taxes 2.3 .8 2.1

Tax-exempt interest (.8) (.3) (1.1)

Life insurance (1.7) (.6) (1.0)

Tax credits (2.9) (.9) (1.8)

Reversal of deferred tax liabilities –

BlackRock basis allocation (2.3)

Other (2.0) (.7)

Effective tax rate 29.9% 34.0% 30.2%

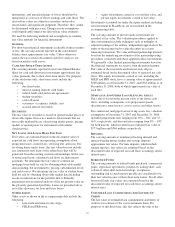

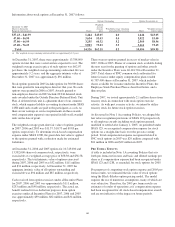

At December 31, 2007 we had available $130 million of

federal and $247 million of state income tax net operating loss

carryforwards originating from acquired companies and $47

million in other state net operating losses which will expire

from 2008 through 2027.

No deferred US income taxes have been provided on certain

undistributed earnings of non-US subsidiaries, which

amounted to $48 million at December 31, 2007. As of

December 31, 2007, these earnings are considered to be

reinvested for an indefinite period of time.

As described in Note 1 Accounting Policies, we adopted FIN

48 effective January 1, 2007. Our adoption of FIN 48 did not

result in a cumulative adjustment to equity.

105