PNC Bank 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

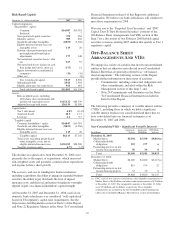

income. Noninterest income represented 57% of total

revenue for 2007.

• Overall asset quality remained strong, reflecting our

commitment to maintain a moderate risk profile.

While nonperforming assets increased in 2007

compared with 2006, the coverage ratio of the

allowance for loan and lease losses to nonperforming

loans was 190% and the allowance for loan and lease

losses to total loans increased to 1.21% at

December 31, 2007.

• PNC continued to be well capitalized and maintained

a strong liquidity position.

• At December 31, 2007, our investment in BlackRock

was $4.1 billion and, based upon the closing price of

BlackRock’s common stock on that date, we had an

additional $5.3 billion of pretax value that was not

recognized.

B

ALANCE

S

HEET

H

IGHLIGHTS

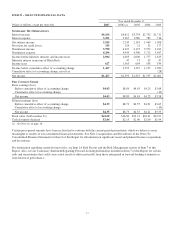

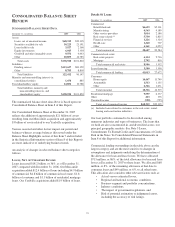

Total assets were $138.9 billion at December 31, 2007

compared with $101.8 billion at December 31, 2006. The

increase compared with December 31, 2006 was primarily due

to the addition of approximately $21 billion of assets related

to the Mercantile acquisition, growth in loans and higher

securities available for sale.

Total average assets were $123.4 billion for 2007 compared

with $95.0 billion for 2006. This increase reflected a $20.3

billion increase in average interest-earning assets and an

increase in average other noninterest-earning assets. An

increase of $12.9 billion in loans and a $5.2 billion increase in

securities available for sale were the primary factors for the

increase in average interest-earning assets.

The increase in average other noninterest-earning assets for

2007 reflected our equity investment in BlackRock, which

averaged $3.8 billion for 2007 and which had been

consolidated for the first nine months of 2006, and an increase

in average goodwill of $3.6 billion primarily related to the

Mercantile and Yardville acquisitions.

Average total loans were $62.5 billion for 2007 and $49.6 billion

for 2006. The increase in average total loans included the effect

of the Mercantile acquisition for 10 months of 2007 and higher

commercial loans. The increase in average total loans included

growth in commercial loans of $5.3 billion and growth in

commercial real estate loans of $4.5 billion. Loans represented

64% of average interest-earning assets for both 2007 and 2006.

Average securities available for sale totaled $26.5 billion for

2007 and $21.3 billion for 2006. The 10-month impact of

Mercantile contributed to the increase in average securities for

the 2007 period, along with overall balance sheet growth.

Securities available for sale comprised 27% of average

interest-earning assets for both 2007 and 2006.

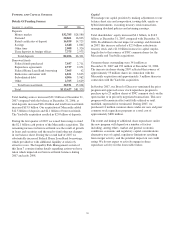

Average total deposits were $76.8 billion for 2007, an increase

of $13.5 billion over 2006. Average deposits grew from the

prior year primarily as a result of an increase in money

market, noninterest-bearing demand deposits and retail

certificates of deposit. These increases reflected the 10-month

impact of the Mercantile acquisition and growth in deposits in

Corporate & Institutional Banking.

Average total deposits represented 62% of average total assets

for 2007 and 67% for 2006. Average transaction deposits were

$50.7 billion for 2007 compared with $42.3 billion for 2006.

Average borrowed funds were $23.0 billion for 2007 and

$15.0 billion for 2006. Increases of $3.2 billion in bank notes

and senior debt, $2.5 billion in federal funds purchased and

$1.5 billion in Federal Home Loan bank borrowings drove the

increase in average borrowed funds compared with 2006.

Shareholders’ equity totaled $14.9 billion at December 31,

2007, compared with $10.8 billion at December 31, 2006. The

increase resulted primarily from the Mercantile and Yardville

acquisitions. See the Consolidated Balance Sheet Review

section of this Item 7 for additional information.

L

INE OF

B

USINESS

H

IGHLIGHTS

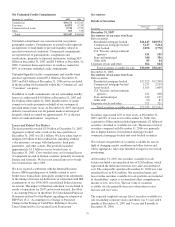

We refer you to Item 1 of this Report under the captions

Business Overview and Review of Lines of Business for an

overview of our business segments and to the Business

Segments Review section of this Item 7 for a Results Of

Businesses – Summary table and further analysis of business

segment results for 2007 and 2006, including presentation

differences from Note 26. Total business segment earnings

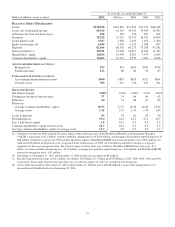

were $1.7 billion for 2007 and $1.5 billion for 2006.

We provide a reconciliation of total business segment earnings

to total PNC consolidated net income as reported on a GAAP

basis in Note 26 Segment Reporting in the Notes To

Consolidated Financial Statements in Item 8 of this Report.

Retail Banking

Retail Banking’s 2007 earnings increased $128 million, to

$893 million, up 17% compared with 2006. The increase in

earnings over the prior year was driven by acquisitions and

strong fee income and customer growth, partially offset by

increases in the provision for credit losses and continued

investments in the business.

Corporate & Institutional Banking

Corporate & Institutional Banking earned $432 million in

2007 compared with $454 million in 2006. While total

revenue increased more than noninterest expense, earnings

declined due to an increase in the provision for credit losses.

Market-related declines in commercial mortgage- backed

securities (“CMBS”) securitization activities and

non-customer-related trading revenue resulted in a year-over-

year reduction in noninterest income.

20