PNC Bank 2007 Annual Report Download - page 77

Download and view the complete annual report

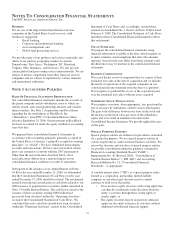

Please find page 77 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.not necessarily represent amounts that we will ultimately

realize through distribution, sale or liquidation of the

investments. The valuation procedures applied to direct

investments include techniques such as multiples of adjusted

earnings of the entities, independent appraisals of the entity or

the pricing used to value the entity in a recent financing

transaction. We value affiliated partnership interests based on

the underlying investments of the partnership using

procedures consistent with those applied to direct investments.

We generally value limited partnership investments based on

the financial statements we receive from the general partner.

We include all private equity investments on the Consolidated

Balance Sheet in the caption equity investments. Changes in

the fair value of these assets are recognized in noninterest

income.

We consolidate private equity investments when we are the

general partner in a limited partnership and have determined

that we have control of the partnership. The portion we do not

own is reflected in the caption minority and noncontrolling

interests in consolidated entities on the Consolidated Balance

Sheet.

Equity Securities and Partnership Interests

We account for equity investments other than BlackRock and

private equity investments under one of the following

methods:

• Marketable equity securities are recorded on a trade-

date basis and are accounted for based on the

securities’ quoted market prices from a national

securities exchange. Dividend income on these

securities is recognized in net interest income. Those

purchased with the intention of recognizing short-

term profits are classified as trading and included in

other short-term investments. Both realized and

unrealized gains and losses on trading securities are

included in noninterest income. Marketable equity

securities not classified as trading are designated as

securities available for sale with unrealized gains and

losses, net of income taxes, reflected in accumulated

other comprehensive income (loss). Any unrealized

losses that we have determined to be other-than-

temporary on securities classified as available for

sale are recognized in current period earnings.

• For investments in limited partnerships, limited

liability companies and other investments that are not

required to be consolidated, we use either the cost

method or the equity method of accounting. We use

the cost method for investments in which we are not

considered to have influence over the operations of

the investee and when cost appropriately reflects our

economic interest in the underlying investment. We

use the equity method for all other general and

limited partner ownership interests and limited

liability company investments. Under the cost

method, there is no change to the cost basis unless

there is an other-than-temporary decline in value. If

the decline is determined to be other than temporary,

we write down the cost basis of the investment to a

new cost basis that represents realizable value. The

amount of the write-down is accounted for as a loss

included in noninterest income. Distributions

received from income on cost method investments

are included in interest income or noninterest income

depending on the type of investment. Under the

equity method, we record our equity ownership share

of net income or loss of the investee in noninterest

income. Investments described above are included in

the caption equity investments on the Consolidated

Balance Sheet.

Debt Securities

Debt securities are recorded on a trade-date basis. We classify

debt securities as held to maturity and carry them at amortized

cost if we have the positive intent and ability to hold the

securities to maturity. Debt securities that we purchase for

short-term appreciation or other trading purposes are carried at

market value and classified as short-term investments.

Realized and unrealized gains and losses on trading securities

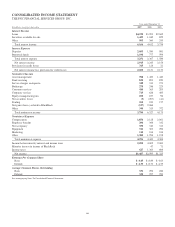

are included in noninterest income. Interest income related to

trading securities totaled $116 million in 2007, $62 million in

2006 and $60 million in 2005 and is included in Other interest

income in the Consolidated Income Statement.

Debt securities not classified as held to maturity or trading are

designated as securities available for sale and carried at

market value with unrealized gains and losses, net of income

taxes, reflected in accumulated other comprehensive income

(loss). We review all debt securities that are in an unrealized

loss position for other-than-temporary impairment on a

quarterly basis. Declines in the market value of available for

sale debt securities that are deemed other-than-temporary are

recognized as a securities loss included in noninterest income

in the period in which the determination is made.

We include all interest on debt securities, including

amortization of premiums and accretion of discounts using the

interest method, in net interest income. We compute gains and

losses realized on the sale of debt securities available for sale

on a specific security basis and include them in noninterest

income.

LOANS AND

L

EASES

Except as described below, loans held for investment are

stated at the principal amounts outstanding, net of unearned

income, unamortized deferred fees and costs on originated

loans, and premiums or discounts on loans purchased. Interest

on performing loans is accrued based on the principal amount

outstanding and recorded in interest income as earned using

the interest method. Loan origination fees, direct loan

origination costs, and loan premiums and discounts are

deferred and amortized to net interest income, over periods

not exceeding the contractual life of the loan.

72