PNC Bank 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

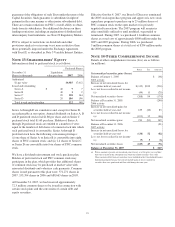

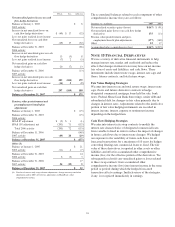

The expected weighted-average life of securities available for sale was 3 years and 6 months at December 31, 2007, 3 years and 8

months at December 31, 2006, and 4 years and 1 month at December 31, 2005.

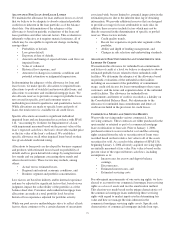

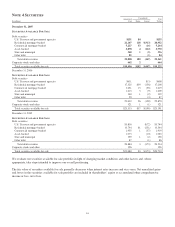

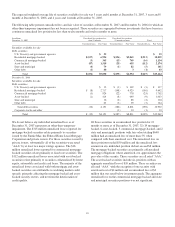

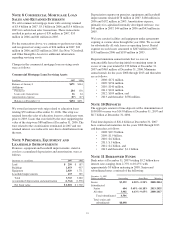

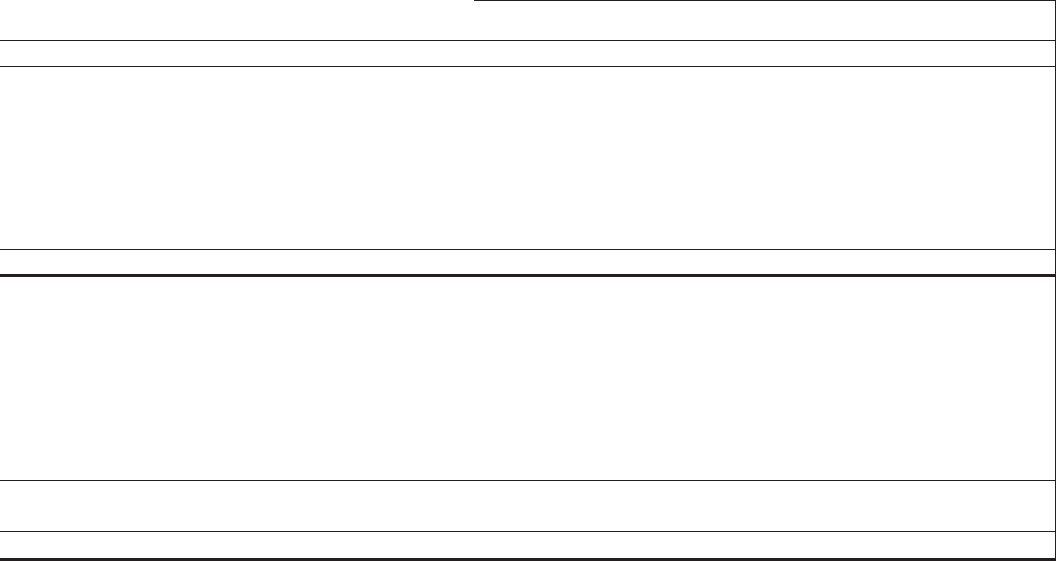

The following table presents unrealized loss and fair value of securities at December 31, 2007 and December 31, 2006 for which an

other-than-temporary impairment has not been recognized. These securities are segregated between investments that have been in a

continuous unrealized loss position for less than twelve months and twelve months or more.

In millions

December 31, 2007

Unrealized loss position less

than 12 months

Unrealized loss position

12 months or more Total

Unrealized Loss Fair Value Unrealized Loss Fair Value Unrealized Loss Fair Value

Securities available for sale

Debt securities

U.S. Treasury and government agencies $53 $ 53

Residential mortgage-backed $(157) 6,994 $(156) $5,065 $(313) 12,059

Commercial mortgage-backed (3) 365 (13) 769 (16) 1,134

Asset-backed (87) 1,519 (25) 655 (112) 2,174

State and municipal (4) 79 (1) 82 (5) 161

Other debt (1) 40 3 (1) 43

Total $(252) $9,050 $(195) $6,574 $(447) $15,624

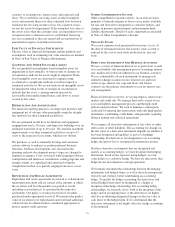

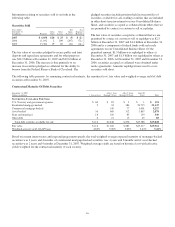

December 31, 2006

Securities available for sale

Debt securities

U.S. Treasury and government agencies $ 15 $ (3) $ 302 $ (3) $ 317

Residential mortgage-backed $ (8) 2,717 (148) 6,925 (156) 9,642

Commercial mortgage-backed (3) 924 (22) 778 (25) 1,702

Asset-backed (1) 414 (8) 649 (9) 1,063

State and municipal 16 (2) 88 (2) 104

Other debt 65 (3) 59 (3) 124

Total debt securities (12) 4,151 (186) 8,801 (198) 12,952

Corporate stocks and other (1) 10 (1) 10

Total $ (12) $4,151 $(187) $8,811 $(199) $12,962

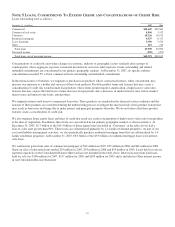

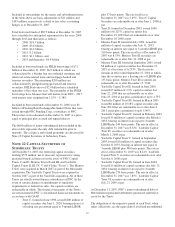

We do not believe any individual unrealized loss as of

December 31, 2007 represents an other-than-temporary

impairment. The $313 million unrealized losses reported for

mortgage-backed securities relate primarily to securities

issued by the Fannie Mae, the Federal Home Loan Mortgage

Corporation and private issuers. For those securities issued by

private issuers, substantially all of the securities were rated

“AAA” by at least two major ratings agencies. The $16

million unrealized losses reported for commercial mortgage-

backed securities relate primarily to fixed rate securities. The

$112 million unrealized losses associated with asset-backed

securities relate primarily to securities collateralized by home

equity, automobile and credit card loans. The majority of the

unrealized losses associated with both mortgage and asset-

backed securities are attributable to widening market credit

spreads, primarily affecting the mortgage-backed and asset-

backed security sectors, and not from the deterioration of

credit quality.

Of those securities in an unrealized loss position for 12

months or more as of December 31, 2007, 32 (19 mortgage-

backed, 6 asset-backed, 5 commercial mortgage-backed, and 2

state and municipal) positions with fair value totaling $640

million had an unrealized loss of more than 5% when

compared with their amortized cost. The unrealized loss on

these positions totaled $50 million and the unrealized loss

amount on any individual position did not exceed $8 million.

The mortgage-backed securities are primarily collateralized

mortgage obligations where amortized cost approximates the

par value of the security. These securities are all rated “AAA.”

The asset-backed securities include six positions with an

aggregate unrealized loss of $10 million. These securities are

all rated “AAA” with the exception of one security with

amortized cost of $4 million and an unrealized loss of $2

million that was rated below investment grade. The aggregate

unrealized loss on the commercial mortgage-backed and state

and municipal securities positions was not significant.

85