PNC Bank 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 V

ERSUS

2005

C

ONSOLIDATED

I

NCOME

S

TATEMENT

R

EVIEW

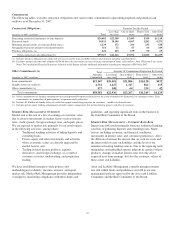

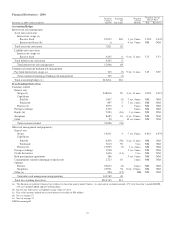

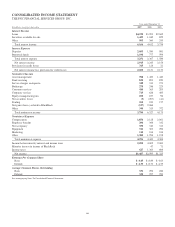

Summary Results

Consolidated net income for 2006 was $2.595 billion or $8.73

per diluted share and for 2005 was $1.325 billion or $4.55 per

diluted share.

Net income for 2006 included the after-tax impact of the

following items:

• The third quarter gain on the BlackRock/MLIM

transaction of $1.3 billion, or $4.36 per diluted share;

• The third quarter securities portfolio rebalancing loss

of $127 million, or $.43 per diluted share;

• BlackRock/MLIM transaction integration costs of

$47 million, or $.16 per diluted share, and

• The third quarter mortgage loan portfolio repositioning

loss of $31 million, or $.10 per diluted share.

The aggregate impact of these items increased 2006 net

income by $1.1 billion, or $3.67 per diluted share.

Results for 2005 included the impact of the following items:

• The reversal of deferred tax liabilities that benefited

earnings by $45 million, or $.16 per diluted share, in

the first quarter related to our transfer of ownership

in BlackRock from PNC Bank, N.A. to our

intermediate bank holding company, PNC Bancorp,

Inc.;

• Implementation costs totaling $35 million after-tax,

or $.12 per diluted share, related to the One PNC

initiative;

• The $34 million after-tax benefit of a second quarter

2005 loan recovery; and

• Integration costs of $20 million after-tax, or $.07 per

diluted share, comprised of provision for credit

losses, noninterest expense and deferred taxes,

related to the May 2005 acquisition of Riggs.

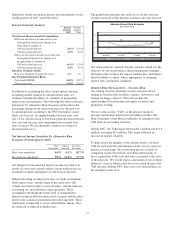

Net Interest Income

Net interest income was $2.245 billion for 2006 and $2.154

billion for 2005. Net interest income on a taxable-equivalent

basis was $2.270 billion for 2006 compared with $2.187 billion

for 2005, an increase of $83 million, or 4%. The increase

reflected the impact of the 6% increase in average interest-

earning assets during 2006 partially offset by a decline in the

net interest margin. The net interest margin was 2.92% for

2006, a decline of 8 basis points compared with 2005.

Provision For Credit Losses

The provision for credit losses was $124 million for 2006

compared with $21 million for 2005. The provision for credit

losses for 2005 included the benefit of a $53 million loan

recovery in the second quarter of that year resulting from a

litigation settlement. In addition to this item, the increase in

the provision for credit losses in 2006 reflected the following

factors:

• The impact of overall loan growth, as average total

loans increased $2.2 billion in 2006 compared with

the prior year;

• The effect of a single large overdraft situation that

occurred during the second quarter of 2006, and

• Growth in unfunded commitments.

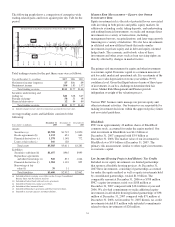

Noninterest Income

Summary

Noninterest income was $6.327 billion for 2006 and $4.173

billion for 2005. Noninterest income for 2006 included the

impact of the gain on the BlackRock/MLIM transaction,

which totaled $2.078 billion, partially offset by the effects of

our third quarter 2006 balance sheet repositioning activities

that resulted in charges totaling $244 million.

Additional analysis

Asset management fees amounted to $1.420 billion for 2006

and $1.443 billion for 2005, a decline of $23 million. Our

equity income from BlackRock was included in asset

management fees beginning with the fourth quarter of 2006.

Asset management fees for 2005 and the first nine months of

2006 reflected the impact of BlackRock’s revenue on a

consolidated basis.

Assets managed at December 31, 2006 totaled $54 billion

compared with $494 billion at December 31, 2005 and

reflected the deconsolidation of BlackRock effective

September 29, 2006.

Fund servicing fees increased $23 million in 2006, to $893

million, compared with $870 million in the prior year.

Included in these amounts were distribution/out-of-pocket

revenue amounts at PFPC totaling $170 million in 2006 and

$147 million in 2005, the impacts of which were offset by

expenses in the same amounts in each year.

PFPC provided fund accounting/administration services for

$837 billion of net fund assets and provided custody services

for $427 billion of fund assets at December 31, 2006,

compared with $835 billion and $476 billion, respectively, at

December 31, 2005. The decrease in custody fund assets at

December 31, 2006 compared with December 31, 2005

resulted primarily from the deconversion of a major client

during the first quarter of 2006, which was partially offset by

new business, asset inflows from existing customers, and

equity market appreciation.

Service charges on deposits increased $40 million, to $313

million, for 2006 compared with 2005. Customer growth,

58