PNC Bank 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A

LLOWANCE

F

OR

L

OAN

A

ND

L

EASE

L

OSSES

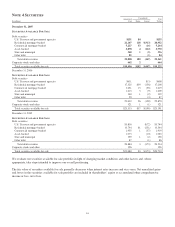

We maintain the allowance for loan and lease losses at a level

that we believe to be adequate to absorb estimated probable

credit losses inherent in the loan portfolio as of the balance

sheet date. Our determination of the adequacy of the

allowance is based on periodic evaluations of the loan and

lease portfolios and other relevant factors. This evaluation is

inherently subjective as it requires material estimates, all of

which may be susceptible to significant change, including,

among others:

• Probability of default,

• Loss given default,

• Exposure at date of default,

• Amounts and timing of expected future cash flows on

impaired loans,

• Value of collateral,

• Historical loss exposure, and

• Amounts for changes in economic conditions and

potential estimation or judgmental imprecision.

In determining the adequacy of the allowance for loan and

lease losses, we make specific allocations to impaired loans,

allocations to pools of watchlist and non-watchlist loans, and

allocations to consumer and residential mortgage loans. We

also allocate reserves to provide coverage for probable losses

not covered in specific, pool and consumer reserve

methodologies related to qualitative and quantitative factors.

While allocations are made to specific loans and pools of

loans, the total reserve is available for all credit losses.

Specific allocations are made to significant individual

impaired loans and are determined in accordance with SFAS

114, “Accounting by Creditors for Impairment of a Loan,”

with impairment measured based on the present value of the

loan’s expected cash flows, the loan’s observable market price

or the fair value of the loan’s collateral. We establish a

specific allowance on all other impaired loans based on their

loss given default credit risk rating.

Allocations to loan pools are developed by business segment

and products with estimated losses based on probability of

default and loss given default risk ratings by using historical

loss trends and our judgment concerning those trends and

other relevant factors. These factors may include, among

others:

• Actual versus estimated losses,

• Regional and national economic conditions, and

• Business segment and portfolio concentrations.

Loss factors are based on industry and/or internal experience

and may be adjusted for significant factors that, based on our

judgment, impact the collectibility of the portfolio as of the

balance sheet date. Consumer and residential mortgage loan

allocations are made at a total portfolio level based on

historical loss experience adjusted for portfolio activity.

While our pool reserve methodologies strive to reflect all risk

factors, there continues to be a certain element of uncertainty

associated with, but not limited to, potential imprecision in the

estimation process due to the inherent time lag of obtaining

information. We provide additional reserves that are designed

to provide coverage for losses attributable to such risks. In

addition, these reserves include factors which may not be

directly measured in the determination of specific or pooled

reserves. These factors include:

• Credit quality trends,

• Recent loss experience in particular segments of the

portfolio,

• Ability and depth of lending management, and

• Changes in risk selection and underwriting standards.

A

LLOWANCE

F

OR

U

NFUNDED

L

OAN

C

OMMITMENTS

A

ND

L

ETTERS

O

F

C

REDIT

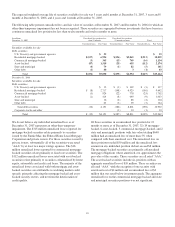

We maintain the allowance for unfunded loan commitments

and letters of credit at a level we believe is adequate to absorb

estimated probable losses related to these unfunded credit

facilities. We determine the adequacy of the allowance based

on periodic evaluations of the unfunded credit facilities

including an assessment of the probability of commitment

usage, credit risk factors for loans outstanding to these same

customers, and the terms and expiration dates of the unfunded

credit facilities. The allowance for unfunded loan

commitments and letters of credit is recorded as a liability on

the Consolidated Balance Sheet. Net adjustments to the

allowance for unfunded loan commitments and letters of

credit are included in the provision for credit losses.

C

OMMERCIAL

M

ORTGAGE

S

ERVICING

R

IGHTS

We provide servicing under various commercial, loan

servicing contracts. These contracts are either purchased in the

open market or retained as part of a commercial mortgage

loan securitization or loan sale. Prior to January 1, 2006,

purchased contracts were recorded at cost and the servicing

rights retained from the sale or securitization of loans were

recorded based on their relative fair value to all of the assets

securitized or sold. As a result of the adoption of SFAS 156,

beginning January 1, 2006 all newly acquired servicing rights

are initially measured at fair value. Fair value is based on the

present value of the expected future cash flows, including

assumptions as to:

• Interest rates for escrow and deposit balance

earnings,

• Discount rates,

• Estimated interest rates, and

• Estimated servicing costs.

For subsequent measurements of our servicing rights, we have

elected to account for our commercial mortgage loan servicing

rights as a class of assets and use the amortization method.

This election was made based on the unique characteristics of

the commercial mortgage loans underlying these servicing

rights with regard to market inputs used in determining fair

value and how we manage the risks inherent in the

commercial mortgage servicing rights assets. Specific risk

characteristics of commercial mortgages include loan type,

75