PNC Bank 2007 Annual Report Download - page 117

Download and view the complete annual report

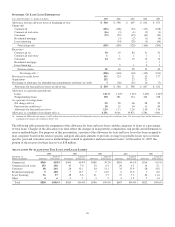

Please find page 117 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In connection with the lending of securities facilitated by

PFPC as an intermediary on behalf of certain of its clients, we

provide indemnification to those clients against the failure of

the borrowers to return the securities. The market value of the

securities lent is fully secured on a daily basis; therefore, the

exposure to us is limited to temporary shortfalls in the

collateral as a result of short-term fluctuations in trading

prices of the loaned securities. At December 31, 2007, the

total maximum potential exposure as a result of these

indemnity obligations was $10.4 billion, although the

collateral at the time exceeded that amount.

V

ISA

I

NDEMNIFICATION

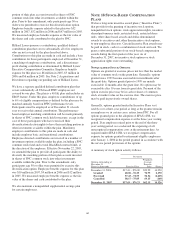

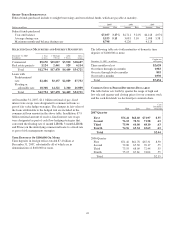

Our payment services business issues and acquires credit and

debit card transactions through Visa U.S.A. Inc. card

association or its affiliates (“Visa”). In October 2007, Visa

completed a restructuring and issued shares of Visa Inc.

common stock to its financial institution members in

contemplation of its initial public offering (“IPO”) currently

anticipated in the first quarter of 2008 (the “Visa

Reorganization”). As part of the Visa Reorganization, we

received our proportionate share of a class of Visa Inc.

common stock allocated to the U.S. members. Visa expects

that a portion of these shares will be redeemed for cash out of

the proceeds of the IPO. The U.S. members are obligated to

indemnify Visa for judgments and settlements related to

specified litigation. Visa will set aside a portion of the

proceeds from the IPO in an escrow account for the benefit of

the U.S. member financial institutions to fund the expenses of

the litigation as well as the members’ proportionate share of

any judgments or settlements that may arise out of the

litigation. Prior to the IPO, the U.S. members are obligated to

indemnify Visa with respect to this litigation. In accordance

with GAAP, we recorded a liability and operating expense

totaling $82 million before taxes in the fourth quarter of 2007

representing our estimate of the fair value of our

indemnification obligation for potential losses arising from

this litigation. Our estimate was subjective, based on publicly

available information and other information made available to

all of the affected Visa members. It did not reflect any direct

knowledge of the relative strengths and weaknesses of the

litigation still pending or the status of any ongoing settlement

discussions. We believe that the IPO will be completed and

cash will be available through the escrow to satisfy litigation

settlements. In addition, based on estimates provided by Visa

regarding its planned IPO, we believe that our ownership

interest in Visa has a value significantly in excess of our

indemnification liability. Our Visa shares will not generally be

transferable until they can be converted into shares of the

publicly traded class of stock, which cannot happen until the

later of three years after the IPO or settlement of all of the

specified litigation.

R

ECOURSE

A

GREEMENT WITH

F

EDERAL

N

ATIONAL

M

ORTGAGE

A

SSOCIATION

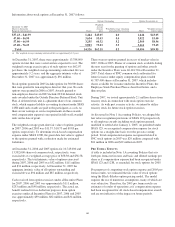

In connection with our July 2007 acquisition of ARCS, we are

authorized to originate, underwrite, close and service

commercial mortgage loans and then sell them to Fannie Mae

under Fannie Mae’s DUS program.

Under this program, we assume up to one-third of the risk of

loss on unpaid principal balances. At December 31, 2007, the

maximum liability was $3.5 billion. Accordingly, we maintain

a reserve for such potential losses which approximates the fair

value of this liability. At December 31, 2007, the unpaid

principal balance outstanding of loans sold by ARCS as a

participant in this program was $11.6 billion. The fair value of

the guarantee, in the form of reserves for losses under this

program, totaled $39 million as of December 31, 2007 and is

included in Other liabilities on our Consolidated Balance

Sheet. If payment is required under this program, we would

not have an interest in the collateral underlying the mortgage

loans on which losses occurred. The serviced loans are not

included on our Consolidated Balance Sheet.

O

THER

G

UARANTEES

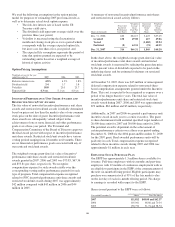

We write caps and floors for customers, risk management and

proprietary trading purposes. At December 31, 2007, the fair

value of the written caps and floors liability on our

Consolidated Balance Sheet was $87 million. Our ultimate

obligation under written options is based on future market

conditions and is only quantifiable at settlement. We manage

our market risk exposure from customer positions through

transactions with third-party dealers.

We also enter into credit default swaps under which we buy

loss protection from or sell loss protection to a counterparty

for the occurrence of a credit event of a reference entity. The

fair value of the contracts sold on our Consolidated Balance

Sheet was a net liability of $51 million at December 31, 2007.

The maximum amount we would be required to pay under the

credit default swaps in which we sold protection, assuming all

reference obligations experience a credit event at a total loss,

without recoveries, was $1.9 billion at December 31, 2007.

We have entered into various contingent performance

guarantees through credit risk participation arrangements with

terms ranging from less than one year to 10 years. We will be

required to make payments under these guarantees if a

customer defaults on its obligation to perform under certain

credit agreements with third parties. Our exposure under these

agreements was approximately $572 million at December 31,

2007.

C

ONTINGENT

P

AYMENTS

I

N

C

ONNECTION

W

ITH

C

ERTAIN

A

CQUISITIONS

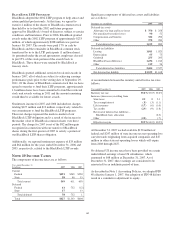

A number of the acquisition agreements to which we are a

party and under which we have purchased various types of

assets, including the purchase of entire businesses, partial

interests in companies, or other types of assets, require us to

make additional payments in future years if certain

predetermined goals are achieved or not achieved within a

specific time period. Due to the nature of the contract

provisions, we cannot quantify our total exposure that may

result from these agreements.

112