PNC Bank 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

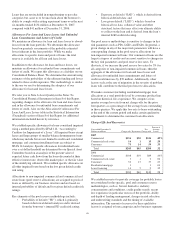

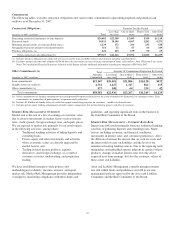

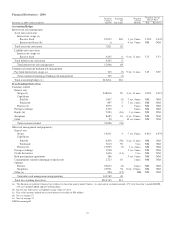

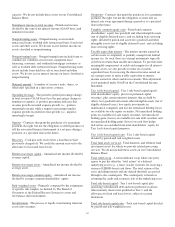

Sensitivity results and market interest rate benchmarks for the

fourth quarters of 2007 and 2006 follow:

Interest Sensitivity Analysis Fourth

Quarter

2007

Fourth

Quarter

2006

Net Interest Income Sensitivity Simulation

Effect on net interest income in first year

from gradual interest rate change over

following 12 months of:

100 basis point increase (2.8)% (2.6)%

100 basis point decrease 2.9% 2.5%

Effect on net interest income in second year

from gradual interest rate change over

the preceding 12 months of:

100 basis point increase (6.4)% (5.5)%

100 basis point decrease 4.4% 3.7%

Duration of Equity Model

Base case duration of equity (in years): 2.1 1.5

Key Period-End Interest Rates

One month LIBOR 4.60% 5.32%

Three-year swap 3.91% 5.10%

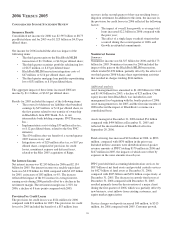

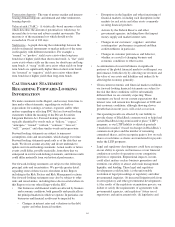

In addition to measuring the effect on net interest income

assuming parallel changes in current interest rates, we

routinely simulate the effects of a number of nonparallel

interest rate environments. The following Net Interest Income

Sensitivity To Alternative Rate Scenarios table reflects the

percentage change in net interest income over the next two

12-month periods assuming (i) the PNC Economist’s most

likely rate forecast, (ii) implied market forward rates, and

(iii) a Two-Ten Inversion (a 200 basis point inversion between

two-year and ten-year rates superimposed on current base

rates) scenario. We are inherently sensitive to a flatter or

inverted yield curve.

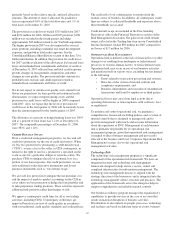

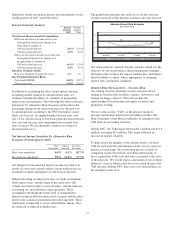

Net Interest Income Sensitivity To Alternative Rate

Scenarios (Fourth Quarter 2007)

PNC

Economist

Market

Forward

Two-Ten

Inversion

First year sensitivity 6.4% 6.1% (8.7)%

Second year sensitivity 9.5% 11.0% (7.7)%

All changes in forecasted net interest income are relative to

results in a base rate scenario where current market rates are

assumed to remain unchanged over the forecast horizon.

When forecasting net interest income, we make assumptions

about interest rates and the shape of the yield curve, the

volume and characteristics of new business, and the behavior

of existing on- and off-balance sheet positions. These

assumptions determine the future level of simulated net

interest income in the base interest rate scenario and the other

interest rate scenarios presented in the following table. These

simulations assume that as assets and liabilities mature, they

are replaced or repriced at market rates.

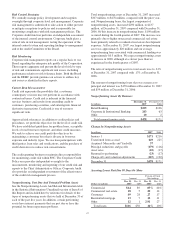

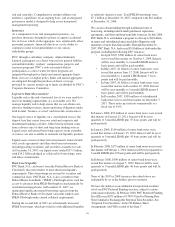

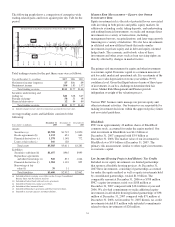

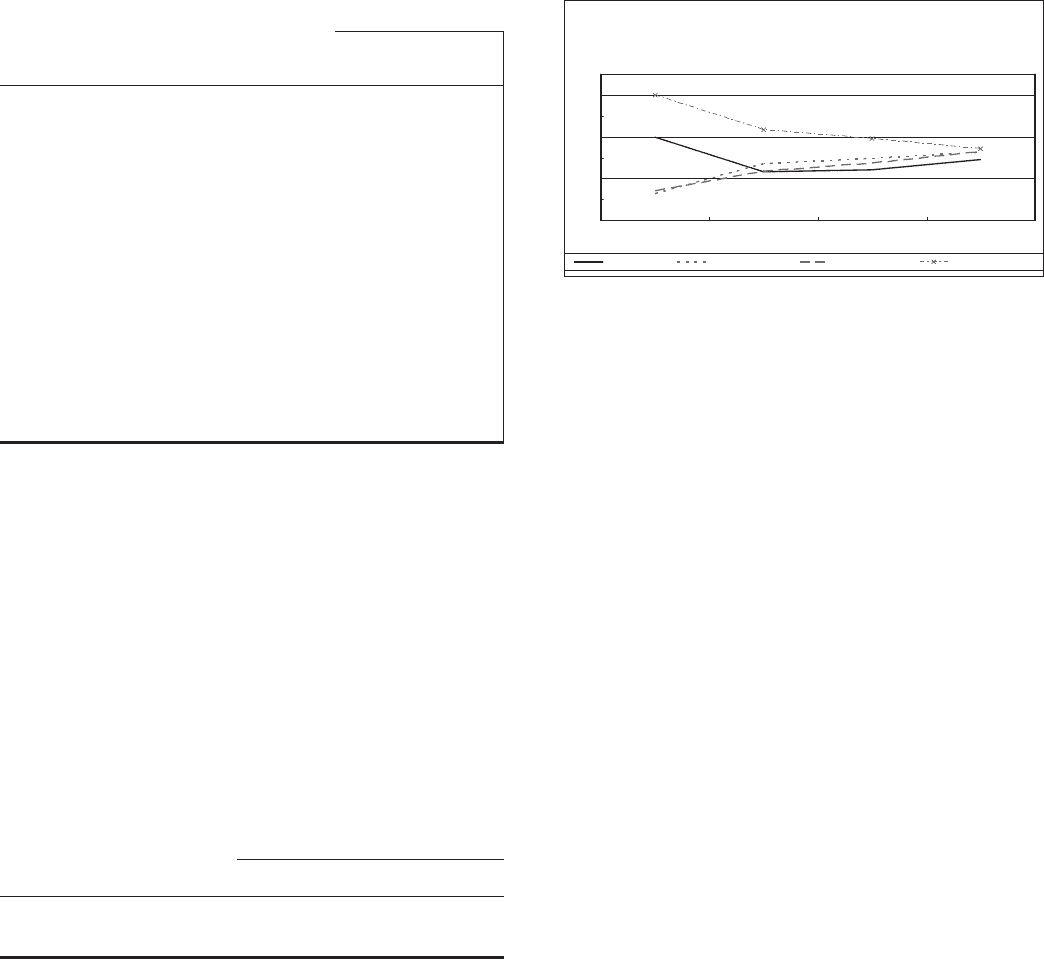

The graph below presents the yield curves for the base rate

scenario and each of the alternate scenarios one year forward.

Alternate Interest Rate Scenarios

One Year Forward

3.0

4.0

5.0

6.0

1M LIBOR 2Y Swap 3Y Swap 5Y Swap

Base Rates PNC Economist Market Forward Two-Ten Inversion

Our risk position is currently liability sensitive which was the

objective of our recent balance sheet management strategies.

We believe that we have the deposit funding base and balance

sheet flexibility to adjust, where appropriate, to changing

interest rates and market conditions.

M

ARKET

R

ISK

M

ANAGEMENT

–T

RADING

R

ISK

Our trading activities primarily include customer-driven

trading in fixed income securities, equities, derivatives, and

foreign exchange contracts. They also include the

underwriting of fixed income and equity securities and

proprietary trading.

We use value-at-risk (“VaR”) as the primary means to

measure and monitor market risk in trading activities. The

Risk Committee of the Board establishes an enterprise-wide

VaR limit on our trading activities.

During 2007, our VaR ranged between $6.1 million and $12.8

million, averaging $8.5 million. This range reflected an

increase in market volatility.

To help ensure the integrity of the models used to calculate

VaR for each portfolio and enterprise-wide, we use a process

known as backtesting. The backtesting process consists of

comparing actual observations of trading-related gains or

losses against the VaR levels that were calculated at the close

of the prior day. We would expect a maximum of two to three

instances a year in which actual losses exceeded the prior day

VaR measure. During 2007, there were two such instances at

the enterprise-wide level.

53