Nokia 2012 Annual Report Download - page 281

Download and view the complete annual report

Please find page 281 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nokia has not guaranteed any of the Nokia Siemens Networks borrowings and thus these are non-

recourse to Nokia. All Nokia Siemens Networks Finance B.V. borrowings above are guaranteed by

Nokia Siemens Networks Oy and/or Nokia Siemens Networks BV.

In October 2012, Nokia issued a EUR 750 million convertible bond that matures in October 2017. The

bond includes a voluntary conversion option starting from December 2012 until maturity. Based on initial

conversion price, voluntary conversion of the entire bond would result in the issue of 287 million shares.

In December 2011, Nokia Siemens Networks entered into a EUR 1 255 million committed forward

starting credit facility effective from the forward start date of June 1, 2012. By April 2012 the committed

facility had been increased to EUR 1 500 million. The facility replaced EUR 2 000 million revolving

credit facility from 2009 that matured in June 2012. EUR 1 500 million committed facility comprised in

two equal parts, EUR 750 million revolving credit facility maturing in June 2015 and EUR 750 million

term loan maturing in June 2013. In December 2012, EUR 150 million of the term loan was prepaid

and the maturity of the remaining EUR 600 million term loan was extended to March 2014.

Of the Nokia Siemens Networks’ EUR Finnish Pension Loan, EUR EIB R&D Loan and EUR Nordic

Investment Bank Loan EUR 44 million, EUR 100 million and EUR 45 million respectively are included

in current maturities as of 31 December, 2012.

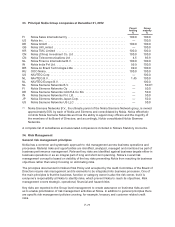

The following table below is an undiscounted cash flow analysis for both financial liabilities and

financial assets that are presented on the balance sheet, and off-balance sheet instruments such as

loan commitments according to their remaining contractual maturity. Line-by-line reconciliation with the

balance sheet is not possible.

At 31 December 2012

Total

amount

Due within

3 months

Due between

3 and

12 months

Due between

1 and

3 years

Due between

3 and

5 years

Due beyond

5 years

EURm EURm EURm EURm EURm EURm

Non-current financial assets

Long-term loans receivable ........... 217 1 2 46 37 131

Current financial assets

Current portion of long-term loans

receivable ....................... 40 12 28 — — —

Short-term loans receivable .......... 1 1 — — — —

Investments at fair value through profit

and loss ......................... 493 1 5 11 260 216

Available-for-sale investment ......... 6008 5782 119 82 25 —

Cash ............................. 3504 3504 — — — —

Cash flows related to derivative financial

assets net settled:

Derivative contracts - receipts ..... 240 78 (30) 86 25 81

Cash flows related to derivative financial

assets gross settled:

Derivative contracts - receipts ..... 13864 10299 3072 41 41 411

Derivative contracts - payments . . . (13 596) (10 212) (2 959) (17) (17) (391)

Accounts receivable(1) ............... 4579 3952 615 12 — —

Non-current financial liabilities

Long-term liabilities ................. (6642) (111) (163) (2 933) (1 123) (2 312)

Current financial liabilities

Current portion of long-term loans ..... (216) (83) (133) — — —

Short-term liabilities ................. (262) (207) (55) — — —

Cash flows related to derivative financial

liabilities net settled:

Derivative contracts - payments . . . (99) (2) (3) (7) (7) (80)

Cash flows related to derivative financial

liabilities gross settled:

Derivative contracts - receipts ..... 7966 6964 889 113 — —

Derivative contracts - payments . . . (8 016) (6 999) (903) (114) — —

Accounts payable .................. (4394) (4 241) (136) (17) — —

Contingent financial assets and liabilities

Loan commitments given, undrawn(2) . . (34) (28) (6) — — —

Loan commitments obtained,

undrawn(3) ....................... 2261 46 (11) 727 1 499 —

F-80