Nokia 2012 Annual Report Download - page 236

Download and view the complete annual report

Please find page 236 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

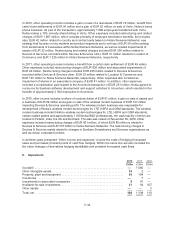

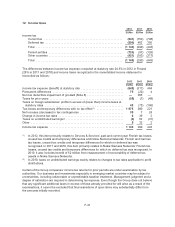

Goodwill

Goodwill is allocated to the Group’s cash-generating units (CGU) for the purpose of impairment testing.

The allocation is made to those cash-generating units that are expected to benefit from the synergies

of the business combination in which the goodwill arose. The Group has allocated goodwill to the cash-

generating units, which correspond to the Group’s reportable segments at each of the respective years’

impairment testing date, as presented in the table below:

2012 2011

EURm EURm

Smart Devices ............................................................ 899 862

Mobile Phones ............................................................ 530 502

Location & Commerce ...................................................... 3 270 3 274

Nokia Siemens Networks ................................................... 183 173

Total .................................................................... 4 882 4 811

The recoverable amounts for the Smart Devices CGU and the Mobile Phones CGU are based on value

in use calculations. A discounted cash flow calculation was used to estimate the value in use for both

CGUs. Cash flow projections determined by management are based on information available, to reflect

the present value of the future cash flows expected to be derived through the continuing use of the

Smart Devices CGU and the Mobile Phones CGU.

The recoverable amounts for the Location & Commerce CGU and the Nokia Siemens Networks CGU

are based on fair value less costs to sell. A discounted cash flow calculation was used to estimate the

fair value less costs to sell for both CGUs. The cash flow projections employed in the discounted cash

flow calculation have been determined by management based on the information available, to reflect

the amount that an entity could obtain from separate disposal of each of the Location & Commerce

CGU and the Nokia Siemens Networks CGU, in an arm’s length transaction between knowledgeable,

willing parties, after deducting the estimated costs of disposal.

The cash flow projections employed in the value in use and the fair value less costs to sell calculations

are based on detailed financial plans approved by management, covering a three-year planning horizon.

Cash flows in subsequent periods reflect a realistic pattern of slowing growth that declines towards an

estimated terminal growth rate utilized in the terminal period. The terminal growth rate utilized does not

exceed long-term average growth rates for the industry and economies in which the CGU operates. All

cash flow projections are consistent with external sources of information, wherever available.

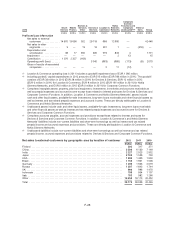

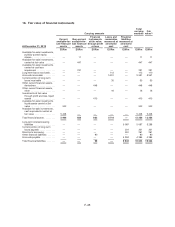

The key assumptions applied in the 2012 impairment testing analysis for each CGU are presented in

the table below:

Cash-generating unit

Smart

Devices

%

Mobile

Phones

%

Location &

Commerce

%

Nokia Siemens

Networks

%

2012 2011 2012 2011 2012 2011 2012 2011

Terminal growth rate ....................... 2.3 1.9 (2.3) 1.5 1.7 3.1 0.7 1.0

Post-tax discount rate ...................... 10.5 9.0 10.5 9.0 9.9 9.7 10.3 10.4

Pre-tax discount rate ....................... 12.8 12.2 15.5 13.1 12.8 13.1 14.2 13.8

Both value in use of Smart Devices CGU and Mobile Phones CGU and fair value less costs to sell for

Location & Commerce CGU and Nokia Siemens Networks CGU are determined on a pre-tax value

basis using pre-tax valuation assumptions including pre-tax cash flows and pre-tax discount rate. As

market-based rates of return for the Group’s CGUs are available only on a post-tax basis, the pre-tax

discount rates are derived by adjusting the post-tax discount rates to reflect the specific amount and

timing of future tax cash flows.

F-35