Nokia 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Distribution of Earnings

We distribute retained earnings, if any, within the limits set by the Finnish Companies Act. We make

and calculate the distribution, if any, either in the form of cash dividends, share buy-backs, or in some

other form or a combination of these. There is no specific formula by which the amount of a distribution

is determined, although some limits set by law are discussed below. The timing and amount of future

distributions of retained earnings, if any, will depend on our future results and financial condition.

Under the Finnish Companies Act, we may distribute retained earnings on our shares only upon a

shareholders’ resolution and subject to limited exceptions in the amount proposed by our Board of

Directors. The amount of any distribution is limited to the amount of distributable earnings of the parent

company pursuant to the last accounts approved by our shareholders, taking into account the material

changes in the financial situation of the company after the end of the last financial period and a

statutory requirement that the distribution of earnings must not result in insolvency of the company.

Subject to exceptions relating to the right of minority shareholders to request for a certain minimum

distribution, the distribution may not exceed the amount proposed by the Board of Directors.

Share Buy-backs

Under the Finnish Companies Act, Nokia Corporation may repurchase its own shares pursuant to

either a shareholders’ resolution or an authorization to the Board of Directors approved by the

company’s shareholders. The authorization may amount to a maximum of 10% of all the shares of the

company and its maximum duration is 18 months. The Board of Directors has been regularly

authorized by our shareholders at the Annual General Meetings to repurchase Nokia’s own shares,

and during the past three years the authorization covered 360 million shares in 2010, 2011 and 2012.

The amount authorized each year has been at or slightly under the maximum limit provided by the

Finnish Companies Act. Nokia has not repurchased any of its own shares since September 2008.

On January 24, 2013, we announced that the Board of Directors will propose that the Annual General

Meeting convening on May 7, 2013 authorize the Board to resolve to repurchase a maximum of 370 million

Nokia shares. The proposed maximum number of shares that may be repurchased corresponds to less

than 10% of all the shares of the company. The shares may be repurchased in order to develop the capital

structure of the company, finance or carry out acquisitions or other arrangements, settle the company’s

equity-based incentive plans, be transferred for other purposes, or be cancelled. The shares may be

repurchased either through a tender offer made to all shareholders on equal terms, or in marketplaces by

repurchasing the shares in another proportion than that of the current shareholders. The authorization

would be effective until June 30, 2014 and terminate the current authorization for repurchasing of the

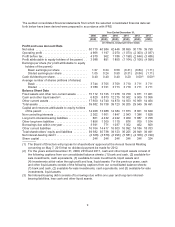

company’s shares resolved at the Annual General Meeting on May 3, 2012. The table below sets forth

actual share buy-backs by Nokia in respect of each fiscal year indicated.

Number of shares

EUR millions

(in total)

2008 ............................... 157390000 3123

2009 ............................... — —

2010 ............................... — —

2011 ............................... — —

2012 ............................... — —

Cash Dividends

On January 24, 2013, we announced that the Board of Directors will propose at the Annual General

Meeting convening on May 7, 2013 that no dividend payment be made for 2012.

The table below sets forth the amounts of total cash dividends per share and per ADS paid in respect

of each fiscal year indicated. For the purposes of showing the US dollar amounts per ADS for 2008

10