Nokia 2012 Annual Report Download - page 235

Download and view the complete annual report

Please find page 235 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

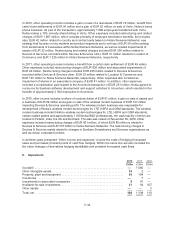

In 2012, other operating income includes a gain on sale of a real estate of EUR 79 million, benefit from

cartel claim settlements of EUR 56 million and a gain of EUR 52 million on sale of Vertu, Nokia’s luxury

phone business. As part of the transaction, approximately 1 000 employees transferred with Vertu.

Nokia retains a 10% minority shareholding in Vertu. Other expenses included restructuring and related

charges of EUR 1 807 million, which consists primarily of employee termination benefits, but includes

also, EUR 42 million related to country and contract exits based on Nokia Siemens Networks’ new

strategy that focuses on key markets and product segments and a net loss of EUR 50 million arising

from divestments of businesses within Nokia Siemens Networks, as well as related impairments of

assets of EUR 32 million. Restructuring and related charges included EUR 550 million related to

Devices & Services, recorded within Devices & Services other, EUR 31 million related to Location &

Commerce and EUR 1 226 million to Nokia Siemens Networks, respectively.

In 2011, other operating income includes a benefit from a cartel claim settlement of EUR 49 million.

Other expenses included restructuring charges of EUR 626 million and associated impairments of

EUR 90 million. Restructuring charges included EUR 456 million related to Devices & Services,

recorded within Devices & Services other. EUR 25 million related to Location & Commerce and

EUR 145 million to Nokia Siemens Networks, respectively. Other expenses also included an

impairment of shares in an associated company of EUR 41 million. In addition, other expenses

included a consideration paid related to the Accenture transaction of EUR 251 million. Nokia agreed to

oursource its Symbian software development and support activities to Accenture, which resulted in the

transfer of approximately 2 300 employees to Accenture.

In 2010, other income includes a refund of customs duties of EUR 61 million, a gain on sale of assets and

a business of EUR 29 million and a gain on sale of the wireless modem business of EUR 147 million

impacting Devices & Services operating profit. The wireless modem business was responsible for

development of Nokia’s wireless modem technologies for LTE, HSPA and GSM standards. The wireless

modem business included Nokia’s wireless modem technologies for LTE, HSPA and GSM standards,

certain related patens and approximately 1 100 Nokia R&D professionals, the vast majority of whom are

located in Finland, India, the UK and Denmark. The sale was closed on November 30, 2010. Other

expenses included restructuring charges of EUR 401 million, of which EUR 85 million is related to

Devices & Services and EUR 316 million to Nokia Siemens Networks. The restructuring charges in

Devices & Services mainly related to changes in Symbian Smartphones and Services organizations as

well as certain corporate functions.

In all three years presented “Other income and expenses” include the costs of hedging forecasted

sales and purchases (forward points of cash flow hedges). Within the same line are also included the

fair value changes of derivatives hedging identifiable and probable forecasted cash flows.

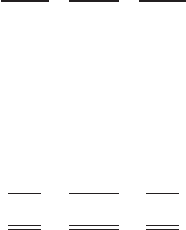

8. Impairment

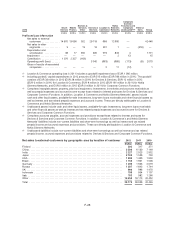

2012 2011 2010

EURm EURm EURm

Goodwill ........................................................... —1 090 —

Other intangible assets ............................................... 16 2—

Property, plant and equipment ......................................... 54 104 —

Inventories ......................................................... —7—

Investments in associated companies ................................... 841 —

Available-for-sale investments ......................................... 31 94 107

Other assets ....................................................... ——3

Total, net .......................................................... 109 1 338 110

F-34