Nokia 2012 Annual Report Download - page 150

Download and view the complete annual report

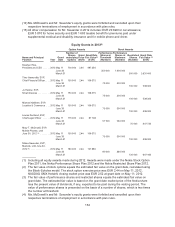

Please find page 150 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.tax-assisted basis. Mr. Elop is also eligible to participate in Nokia’s long-term equity-based compensation

programs according to Nokia policies and guidelines and as determined by the Board of Directors.

In case of termination by Nokia for reasons other than cause, Mr. Elop is entitled to a severance

payment of up to 18 months of compensation (both annual base salary and target incentive) and his

equity will be forfeited as determined in the applicable equity plan rules, with the exception of the equity

out of the Nokia Equity Program 2010, which will vest in an accelerated manner (the performance

period of Nokia Performance Share Plan 2010 ended in 2012 and no shares were delivered in

accordance with its terms). In case of termination by Mr. Elop, the notice period is six months and he is

entitled to a payment for such notice period (both annual base salary and target incentive for six

months) and all his equity will be forfeited. In the event of a change of control of Nokia, Mr. Elop may

terminate his employment upon a material reduction of his duties and responsibilities, upon which he

will be entitled to a compensation of 18 months (both annual base salary and target incentive), and his

unvested equity will vest in an accelerated manner. In case of termination by Nokia for cause, Mr. Elop

is entitled to no additional compensation and all his equity will be forfeited. In case of termination by

Mr. Elop for cause, he is entitled to a severance payment equivalent to 18 months of notice (both

annual base salary and target incentive), and his unvested equity will vest in an accelerated manner.

Mr. Elop is subject to a 12-month non-competition obligation after termination of the contract. Unless

the contract is terminated by Nokia for cause, Mr. Elop may be entitled to compensation during the

non-competition period or a part of it. Such compensation amounts to the annual base salary and

target incentive for the respective period during which no severance payment is paid.

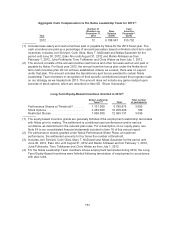

The Board of Directors decided in March 2011 that in order to align Mr. Elop’s compensation to

increased shareholder value and to link a meaningful portion of his compensation directly to the

performance of Nokia’s share price over the period of 2011-2012, his compensation structure for 2011

and 2012 would be modified. To participate in this program, Mr. Elop invested a portion of his short-

term cash incentive opportunity and a portion of the value of his expected annual equity grants into the

program as follows:

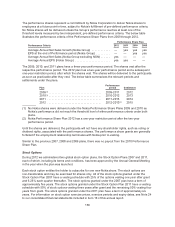

• His target short-term cash incentive level was reduced from 150% to 100% and

• His equity grants were reduced to a level below the competitive market value.

In consideration, Mr. Elop had the opportunity to earn a number of Nokia shares at the end of 2012

based on two independent criteria, with half of the opportunity tied to each criterion:

(1) Total Shareholder Return (TSR) relative to a peer group of companies over the two-year

period from December 31, 2010 until December 31, 2012: Minimum payout would require

performance at the 50th percentile of the peer group and the maximum payout would occur if

the rank is among the top three of the peer group. The peer group consists of a number of

relevant companies in the high technology/mobility, telecommunications and Internet services

industries.

(2) Nokia’s absolute share price at the end of 2012: Minimum payout if the Nokia share price was

EUR 9, with maximum payout if the Nokia share price was EUR 17.

Nokia share price under both criteria was calculated as a 20-day trade volume weighted average share

price on the NASDAQ OMX Helsinki. If the minimum level for one of the criterion had been met, a total

of 125 000 Nokia ordinary shares would have been delivered to Mr. Elop. At maximum level for both

criteria, a total of 750 000 Nokia ordinary shares would have been delivered to him. Shares earned

under this plan during 2011-2012 would have been subject to an additional one-year vesting period

until the first quarter 2014, at which point the earned and vested shares would have been delivered to

Mr. Elop.

149