Nokia 2012 Annual Report Download - page 261

Download and view the complete annual report

Please find page 261 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other equity plans for employees

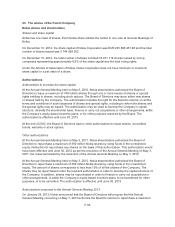

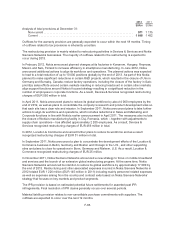

In addition to the global equity plans described above, Nokia has equity plans for Nokia acquired

businesses or employees in the United States and Canada under which participants can receive Nokia

ADSs or ordinary shares. These equity plans do not result in an increase in the fund for invested non-

restricted equity of Nokia.

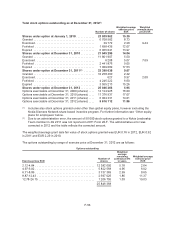

On the basis of these plans, the Group had 0.1 million stock options outstanding on December 31,

2012. The weighted average exercise price is USD 11.39.

In connection with the July 10, 2008 acquisition of NAVTEQ, the Group assumed NAVTEQ’s 2001

Stock Incentive Plan (“NAVTEQ Plan”). All unvested NAVTEQ restricted stock units under the

NAVTEQ Plan were converted to an equivalent number of restricted stock units entitling their holders

to Nokia shares. The maximum number of Nokia shares to be delivered to NAVTEQ employees during

the years 2008-2012 was approximately 3 million, all of which have been delivered by December 31,

2012. The Group does not intend to make further awards under the NAVTEQ Plan.

The Group also has an Employee Share Purchase Plan in the United States, which permits all full-time

Nokia employees located in the United States to acquire Nokia ADSs at a 15% discount. The purchase

of the ADSs is funded through monthly payroll deductions from the salary of the participants, and the

ADSs are purchased on a monthly basis. As of December 31, 2012, approximately 1 750 000 ADSs

had been purchased under this plan during 2012, and there were a total of approximately

1 230 participants in the plan. The plan will be ramped-down during 2013 as a new global Employee

Share Purchase Plan will be implemented as described below.

During 2011-2012, Nokia had a one-time special CEO incentive program designed to align the CEO’s

compensation to increased shareholder value and to link a meaningful portion of CEO’s compensation

directly to the performance of Nokia’s share price over the period of 2011-2012. Mr. Elop had the

opportunity to earn 125 000 – 750 000 Nokia shares at the end of 2012 based on two independent

criteria: Total Shareholder Return (TSR) relative to a peer group of companies over the two-year period

and Nokia’s absolute share price at the end of 2012. As the minimum performance for neither of the

two performance criterion was reached, no share delivery took place. The number of shares earned

and to be settled may be adjusted by the Board of Directors under certain exceptional circumstances

up until June 30, 2013, should the results significantly change.

On January 24, 2013 Nokia introduced an Employee Share Purchase Plan, which is planned to be

offered in 27 countries to all Nokia employees (excluding Nokia Siemens Networks’ employees). Under

the Plan, the eligible Nokia employees can elect to make monthly contributions from their salary to

purchase Nokia shares. The contribution per employee cannot exceed EUR 1 200 per year. The share

purchases will be made at market value on pre-determined dates on a monthly basis during a 12-month

savings period. Nokia will offer one matching share for every two purchased shares the employee still

holds after the last monthly purchase has been made in June 2014. In addition, 20 free shares will be

delivered to employees who make the first three consecutive monthly share purchases. The participation

in the plan is voluntary to the employees.

Nokia Siemens Networks established a share-based incentive program in 2012 under which options for

Nokia Siemens Networks B.V. shares are granted to selected Nokia Siemens Networks’ employees.

The options generally become exercisable on the fourth anniversary of the grant date or, if earlier, on

the occurrence of certain corporate transactions, such as initial public offering (“IPO”). The exercise

price of the options is based on a per share value on grant as determined for the purposes of the

incentive program. The options will be cash-settled at exercise unless an IPO has taken place, at

which point they would be converted into equity-settled options. If an IPO has not taken place by the

sixth anniversary of the grant date, Nokia Siemens Networks will cash out any remaining options. If an

IPO has taken place, equity options remain exercisable until the tenth anniversary of the grant date.

F-60