Nokia 2012 Annual Report Download - page 158

Download and view the complete annual report

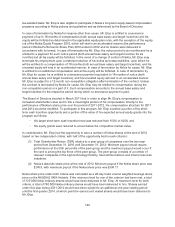

Please find page 158 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The exercise price of the stock options is determined at the time of grant, on a quarterly basis, in

accordance with a pre-agreed schedule after the release of Nokia’s periodic financial results. The

exercise prices are based on the trade volume weighted average price of a Nokia share on NASDAQ

OMX Helsinki during the trading days of the first whole week of the second month of the respective

calendar quarter (i.e., February, May, August or November). With respect to the 2011 Stock Option

Plan, should an ex-dividend date take place during that week, the exercise price shall be determined

based on the following week’s trade volume weighted average price of the Nokia share on NASDAQ

OMX Helsinki. Exercise prices are determined on a one-week weighted average to mitigate any

day-specific fluctuations in Nokia’s share price. The determination of exercise price is defined in the

terms and conditions of the stock option plans, which were approved by the shareholders at the Annual

General Meetings 2007 and 2011. The Board of Directors does not have the right to change how the

exercise price is determined.

Shares will be eligible for dividend for the financial year in which the share subscription takes place.

Other shareholder rights will commence on the date on which the subscribed shares are entered in the

Trade Register. The stock option grants are generally forfeited if the employment relationship

terminates with Nokia.

Restricted Shares

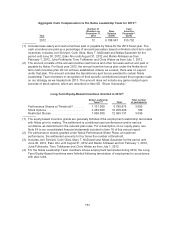

During 2012, we administered four global restricted share plans, the Restricted Share Plans 2009,

2010, 2011 and 2012, each of which, including its terms and conditions, has been approved by the

Board of Directors.

Restricted shares are used on a selective basis to ensure retention and recruitment of individuals with

functional mastery and other employees deemed critical to Nokia’s future success.

All of our restricted share plans have a restriction period of three years after grant. Until the shares are

delivered, the participants will not have any shareholder rights, such as voting or dividend rights,

associated with the restricted shares. The restricted share grants are generally forfeited if the

employment relationship terminates with Nokia prior to vesting.

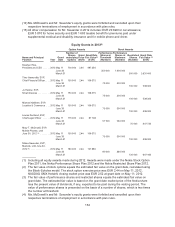

Nokia Equity-Based Incentive Program 2013

On January 24, 2013, the Board of Directors approved the scope and design of the Nokia Equity

Program 2013. The Equity Program 2013 mirrors the 2012 Program in terms of performance shares,

stock options and restricted shares. In addition to these instruments, the Board of Directors approved

also the implementation of a new Employee Share Purchase Plan. Similarly to the earlier broad-based

equity incentive programs, the Equity Program 2013 is designed to support the participants’ focus and

alignment with the company’s strategy and targets. Nokia’s use of the performance-based plan in

conjunction with the restricted share plan as the main long-term incentive vehicles is planned to

effectively contribute to the long-term value creation and sustainability of the company and to align the

interests of the employees with those of the shareholders. It is also designed to ensure that the overall

equity-based compensation is based on performance, while also ensuring the recruitment and

retention of talent vital to the future success of Nokia. In addition, the new Employee Share Purchase

Plan is introduced to encourage employee share ownership, commitment and engagement.

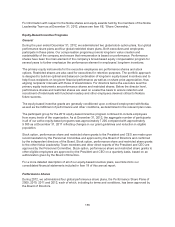

The primary equity instruments for the executive employees are performance shares and stock

options. Restricted shares are also used for executives for retention purposes. For directors below the

executive level, the primary equity instruments are performance shares and restricted shares. Below

the director level, performance shares and restricted shares are used on a selective basis to ensure

retention and recruitment of individuals with functional mastery and other employees deemed critical to

Nokia’s future success. These equity-based incentive awards are generally forfeited if the employee

157