Nokia 2012 Annual Report Download - page 154

Download and view the complete annual report

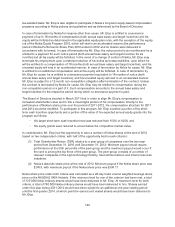

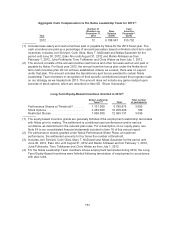

Please find page 154 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(4) The change in pension value represents the proportionate change in the liability related to the

individual executives. These executives are covered by the Finnish State employees’ pension act

(“TyEL”) that provides for a retirement benefit based on years of service and earnings according to

the prescribed statutory system. The TyEL system is a partly funded and a partly pooled “pay as

you go” system. Effective March 1, 2008, Nokia transferred its TyEL pension liability and assets to

an external Finnish insurance company and no longer carries the liability on its financial

statements. The figures shown represent only the change in liability for the funded portion. The

method used to derive the actuarial IFRS valuation is based upon available salary information at

the respective year end. Actuarial assumptions including salary increases and inflation have been

determined to arrive at the valuation at the respective year end.

(5) The amounts shown in the total compensation column do not represent the amount actually

payable or paid for the respective fiscal years, as they also include the theoretical pension value

and the theoretical grant date fair value of the stock awards and option awards, and not the actual

value received by the executive.

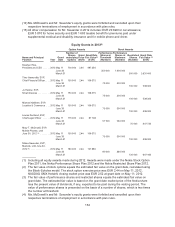

(6) All other compensation for Mr. Elop in 2012 includes: EUR 39 152 for housing; EUR 10 692 for

participation in a health assessment and leadership performance program; EUR 15 454 for home

security; and EUR 4 097 taxable benefit for premiums paid under supplemental medical and

disability insurance and for mobile phone and driver.

(7) All other compensation for Mr. Ihamuotila in 2012 includes: EUR 11 220 for car allowance; EUR

15 069 service year award; EUR 10 692 for participation in a health assessment and leadership

performance program; EUR 1 285 for home security and EUR 1 880 taxable benefit for premiums

paid under supplemental medical and disability insurance and for mobile phone and driver.

(8) Salaries, benefits and perquisites for Ms. Harlow, Ms. Pentland and Ms. McDowell were paid and

denominated in GBP and USD. Amounts were converted using year-end 2012 USD/EUR

exchange rate of 1.28 and GBP/EUR rate of 0.80. For year 2011 disclosure, amounts were

converted using year-end 2011 USD/EUR and GBP/EUR exchange rate of 1.35 and 0.86,

respectively. For year 2010 disclosure, amounts were converted using year-end 2010 USD/EUR

exchange rate of 1.32.

(9) Ms. McDowell and Ms. Pentland participated in Nokia’s U.S Retirement Savings and Investment

Plan. Under this 401(k) plan, participants elect to make voluntary pre-tax contributions that are

100% matched by Nokia up to 8% of eligible earnings. 25% of the employer’s match vests for the

participants during each of the first four years of their employment. Participants earning in excess

of the Internal Revenue Service (IRS) eligible earning limits may participate in the Nokia

Restoration and Deferral Plan, which allows employees to defer up to 50% of their salary and

100% of their short-term cash incentive. Contributions to the Restoration and Deferral Plan are

matched 100% up to 8% of eligible earnings, less contributions made to the 401(k) plan. The

Company’s contributions to the plan are included under “All Other Compensation Column” and

noted hereafter.

(10) All other compensation for Ms. Harlow in 2012 includes: EUR 48 252 company contributions to the

UK Pension Plan; EUR 9 709 for car and fuel and EUR 771 for health insurance and home

security.

(11) All other compensation for Mr. Halbherr in 2012 includes: EUR 48 966 company contributions to

the German Pension Plan and EUR 12 511 for car, fuel, account maintenance and health

insurance.

(12) All other compensation for Ms. Pentland in 2012 includes: EUR 10 692 for participation in a health

assessment and leadership performance program; EUR 9 787 company contributions to the

401(k) Plan and EUR 2 282 provided under Nokia’s international assignment policy in the UK.

(13) All other compensation for Ms. McDowell in 2012 includes: EUR 112 024 provided under Nokia’s

international assignment policy in the UK; EUR 10 866 for car allowance; EUR 77 927 for accrued

and unused holiday and payment provided under Nokia’s international assignment policy in the UK

and EUR 64 749 company contributions to the 401(k) and Executive Salary Deferral Plan.

153