Nokia 2012 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

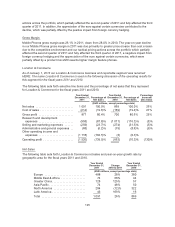

Operating Expenses

Nokia Siemens Networks’ research and development expenses increased 2% to EUR 2 185 million,

compared to EUR 2 137 million in 2010. The increase was primarily due to the addition of research and

development operations relating to the acquired Motorola Solutions’ networks assets as well as

investments in strategic initiatives.

Nokia Siemens Networks’ selling and marketing expenses, as well as administrative and general

expenses, were virtually flat year-on-year in 2011, as the increase from the acquired Motorola

Solutions networks assets was offset by ongoing cost control initiatives.

Operating Margin

Nokia Siemens Networks’ operating loss in 2011 was EUR 300 million, compared with an operating

loss of EUR 686 million in 2010. Nokia Siemens Networks’ operating margin in 2011 was negative

2.1%, compared with negative 5.4% in 2010 primarily because of higher net sales, which were offset

by higher operating expenses.

Strategy and Restructuring Program

On November 23, 2011, Nokia Siemens Networks announced its current strategy to focus on mobile

broadband and services and the launch of an extensive global restructuring program.

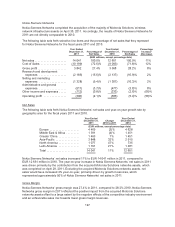

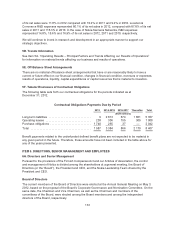

5B. Liquidity and Capital Resource

At December 31, 2012, our cash and other liquid assets (bank and cash; available-for-sale

investments, cash equivalents; available-for-sale investments, liquid assets; and investments at fair

value through profit and loss, liquid assets) decreased to EUR 9 909 million, compared with EUR 10

902 million at December 31, 2011, primarily due to cash outflows related to restructuring, the payment

of the dividend and cash outflows related to the net financial expenses and taxes as well as capital

expenditures. This was partially offset by positive overall net cash from operating activities, excluding

cash outflows related to restructuring, net financial expenses and taxes, as well as cash flows related

to the receipt of quarterly platform support payments from Microsoft (which commenced in the fourth

quarter 2011), proceeds from the sale of fixed assets and proceeds from the issuance of a convertible

bond. At December 31, 2010, cash and other liquid assets totaled EUR 12 275 million.

At December 31, 2012, cash and cash equivalents (bank and cash and available-for-sale investments,

cash equivalent) decreased to EUR 8 952 million, compared with EUR 9 236 million at December 31,

2011. We hold our cash and cash equivalents predominantly in euro. Cash and cash equivalents

totaled EUR 7 592 million at December 31, 2010.

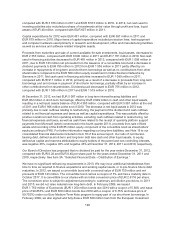

Net cash used in operating activities was EUR 354 million in 2012, compared with net cash from

operating activities of EUR 1 137 million in 2011 and EUR 4 774 million in 2010. In 2012, net cash from

operating activities decreased to net cash used in operating activities primarily due to a decrease in

profitability and cash outflows relating to restructuring. In 2011, net cash from operating activities

decreased primarily due to a decrease in profitability and an increase in net working capital partially

offset by an increase in cash inflows of IPR royalty income, the receipt of a platform support payment

from Microsoft in the fourth quarter of 2011 and an increase in other financial income. Net cash from

investing activities was EUR 562 million in 2012, compared with EUR 1 499 million in 2011 and a

usage of EUR 2 421 million in 2010. Net cash from acquisitions of businesses, net of acquired cash,

was EUR 13 million, compared to net cash used in acquisitions of businesses, net of acquired cash, of

EUR 817 million in 2011 and EUR 110 million in 2010. Cash flow from investing activities in 2012

included purchases of current available-for-sale investments, liquid assets of EUR 1 668 million,

128