Nokia 2012 Annual Report Download - page 106

Download and view the complete annual report

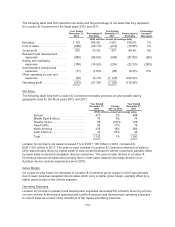

Please find page 106 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At December 31, 2012, the Group had tax losses carry forward, temporary differences and tax credits

of EUR 10 294 million (EUR 4 302 million in 2011) for which no deferred tax assets were recognized in

the consolidated financial statements due to uncertainty of utilization of these items.

We recognize tax provisions based on estimates and assumptions when, despite our belief that tax

return positions are supportable, it is more likely than not that certain positions will be challenged and

may not be fully sustained upon review by tax authorities. The Group has ongoing tax investigations in

multiple jurisdictions, including Hungary and India. If the final outcome of these matters differs from the

amounts initially recorded, differences may positively or negatively impact the current taxes and

deferred taxes in the period in which such determination is made.

Pensions

The determination of our pension benefit obligation and expense for defined benefit pension plans is

dependent on our selection of certain assumptions used by actuaries in calculating such amounts.

Those assumptions are described in Note 5 to our consolidated financial statements included in

Item 18 of this annual report and include, among others, the discount rate, expected long-term rate of

return on plan assets and annual rate of increase in future compensation levels. A portion of our plan

assets is invested in equity securities. The equity markets have experienced volatility, which has

affected the value of our pension plan assets. This volatility may make it difficult to estimate the long-

term rate of return on plan assets. Actual results that differ from our assumptions are accumulated and

amortized over future periods and therefore generally affect our recognized expense and recorded

obligation in such future periods. Our assumptions are based on actual historical experience and

external data regarding compensation and discount rate trends. While we believe that our assumptions

are appropriate, significant differences in our actual experience or significant changes in our

assumptions may materially affect our pension obligation and our future expense. The financial impact

of the pension assumptions affects mainly the Devices & Services and Nokia Siemens Networks

businesses.

Share-based Compensation

We have various types of equity-settled share-based compensation schemes for employees mainly in

Devices & Services and Location & Commerce. Employee services received, and the corresponding

increase in equity, are measured by reference to the fair value of the equity instruments as at the date of

grant, excluding the impact of any non-market vesting conditions. Fair value of stock options is

estimated by using the Black-Scholes model on the date of grant based on certain assumptions. Those

assumptions are described in Note 24 to our consolidated financial statements included in Item 18 of

this annual report and include, among others, the dividend yield, expected volatility and expected life of

stock options. The expected life of stock options is estimated by observing general option holder

behavior and actual historical terms of Nokia stock option programs, whereas the assumption of the

expected volatility has been set by reference to the implied volatility of stock options available on Nokia

shares in the open market and in light of historical patterns of volatility. These variables make estimation

of fair value of stock options difficult. Non-market vesting conditions attached to the performance shares

are included in assumptions about the number of shares that the employee will ultimately receive

relating to projections of sales and earnings per share. On a regular basis, we review the assumptions

made and revise the estimates of the number of performance shares that are expected to be settled,

where necessary. At the date of grant, the number of performance shares granted that are expected to

be settled is assumed to be two times the amount at threshold. Any subsequent revisions to the

estimates of the number of performance shares expected to be settled may increase or decrease total

compensation expense. Such increase or decrease adjusts the prior period compensation expense in

the period of the review on a cumulative basis for unvested performance shares for which compensation

expense has already been recognized in the profit and loss account, and in subsequent periods for

unvested performance shares for which the expense has not yet been recognized in the profit and loss

105