Nokia 2012 Annual Report Download - page 105

Download and view the complete annual report

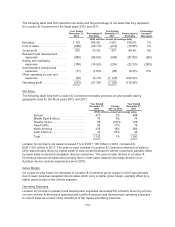

Please find page 105 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Group and estimated average revenue per user with regard to mobile media advertising. The average

revenue per user was estimated based on peer market data for mobile advertising revenue. Projected

device sales volumes impacted the overall forecasted intercompany and advertising revenues. This

took into consideration the market dynamics in digital map data and related location-based content

markets, including the Group’s long-term view at the time of the 2011 annual impairment testing, that

the market will move from fee-based models towards advertising-based models especially in some

more mature markets. It also reflected recently announced results and related competitive factors in

local search and advertising market resulting in lower estimated growth prospects from location-based

assets integrated with different advertising platforms. After consideration of all relevant factors, the

Group reduced the net sales projections for the Location & Commerce CGU which, in turn, reduced

projected profitability and cash flows.

The Group’s goodwill impairment testing did not result in impairment charges for the years ended

December 31, 2012 or 2010. An impairment loss was recorded with respect to the Group’s Location &

Commerce CGU in 2011, as discussed above. No further impairment charges were recorded with

respect to the other CGUs in 2011.

See Note 8 to our consolidated financial statements included in Item 18 of this annual report for further

information regarding “Valuation of long-lived and intangible assets and goodwill.”

Fair Value of Derivatives and Other Financial Instruments

The fair value of financial instruments that are not traded in an active market, for example unlisted

equities, are determined using valuation techniques. We use judgment to select an appropriate

valuation methodology and underlying assumptions based principally on existing market conditions. If

quoted market prices are not available for unlisted shares, fair value is estimated by using various

factors, including, but not limited to: (1) the current market value of similar instruments, (2) prices

established from a recent arm’s length financing transaction of the target companies, (3) analysis of

market prospects and operating performance of the target companies taking into consideration of

public market comparable companies in similar industry sectors. Changes in these assumptions may

cause the Group to recognize impairments or losses in the future periods. During 2012 the Group

received distributions of EUR 49 million (EUR 45 million in 2011) included in other financial income

from a private fund held as non-current available-for-sale. Due to a reduction in estimated future cash

flows the Group also recognized an impairment loss of EUR 7 million (EUR 38 million in 2011) for the

fund included in other financial expenses.

Income Taxes

The Group is subject to income taxes both in Finland and in numerous other jurisdictions. Significant

judgment is required in determining income tax expense, tax provisions, deferred tax assets and

liabilities recognized in the consolidated financial statements. We recognize deferred tax assets to the

extent that it is probable that sufficient taxable income will be available in the future against which the

temporary differences, tax losses and unused tax credits can be utilized. We have considered future

taxable income and tax planning strategies in making this assessment. Deferred tax assets are

assessed for realizability each reporting period, and when circumstances indicate that it is no longer

probable that deferred tax assets will be utilized, they are adjusted as necessary. In 2012 Nokia taxes

continued to be unfavorably affected by Nokia Siemens Networks taxes as no tax benefits are

recognized for certain Nokia Siemens Networks deferred tax items. Additionally Nokia taxes were

adversely affected by allowances related to Devices & Services’ Finnish deferred tax assets and

discontinuation of recognizing tax benefits for Devices & Services’ Finnish deferred tax items due to

uncertainty of utilization of these items.

104