Nokia 2012 Annual Report Download - page 216

Download and view the complete annual report

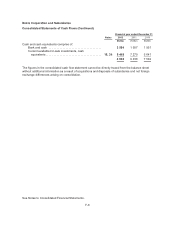

Please find page 216 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ongoing intentions: (1) Highly liquid fixed income and money-market investments that are readily

convertible to known amounts of cash with maturities at acquisition of 3 months or less, which are

classified in the balance sheet as current available-for-sale investments, cash equivalents. Due to the

high credit quality and short-term nature of these investments, there is an insignificant risk of changes

in value. (2) Similar types of investments as in category (1), but with maturities at acquisition of longer

than 3 months, are classified in the balance sheet as current available-for-sale investments, liquid

assets. (3) Investments in technology related publicly quoted equity shares, or unlisted private equity

shares and unlisted funds, are classified in the balance sheet as non-current available-for-sale

investments.

Current fixed income and money-market investments are fair valued by using quoted market rates,

discounted cash flow analyses and other appropriate valuation models at the balance sheet date.

Investments in publicly quoted equity shares are measured at fair value using exchange quoted bid

prices. Other available-for-sale investments carried at fair value include holdings in unlisted shares.

Fair value is estimated by using various factors, including, but not limited to: (1) the current market

value of similar instruments, (2) prices established from a recent arm’s length financing transaction of

the target companies, (3) analysis of market prospects and operating performance of the target

companies taking into consideration the public market of comparable companies in similar industry

sectors. The remaining available-for-sale investments, which are technology related investments in

private equity shares and unlisted funds for which the fair value cannot be measured reliably due to

non-existence of public markets or reliable valuation methods against which to value these assets, are

carried at cost less impairment.

All purchases and sales of investments are recorded on the trade date, which is the date that the

Group commits to purchase or sell the asset.

The changes in fair value of available-for-sale investments are recognized in fair value and other

reserves as part of shareholders’ equity, with the exception of interest calculated using the effective

interest method as well as foreign exchange gains and losses on monetary assets, which are

recognized directly in profit and loss. Dividends on available-for-sale equity instruments are recognized

in profit and loss when the Group’s right to receive payment is established. When the investment is

disposed of, the related accumulated changes in fair value are released from shareholders’ equity and

recognized in profit and loss. The weighted average method is used when determining the cost basis

of publicly listed equities being disposed of by the Group. FIFO (First-in First-out) method is used to

determine the cost basis of fixed income securities being disposed of by the Group.

An impairment is recorded when the carrying amount of an available-for-sale investment is greater

than the estimated fair value and there is objective evidence that the asset is impaired including, but

not limited to, counterparty default and other factors causing a reduction in value that can be

considered other than temporary. The cumulative net loss relating to that investment is removed from

equity and recognized in profit and loss. If, in a subsequent period, the fair value of the investment in a

non-equity instrument increases and the increase can be objectively related to an event occurring after

the loss was recognized, the loss is reversed, with the amount of the reversal included in profit and

loss.

Investments at fair value through profit and loss, liquid assets

Certain highly liquid financial assets are designated as Investments at fair value through profit and

loss, liquid assets, at inception. For these investments the following criteria must be met: (1) the

designation eliminates or significantly reduces the inconsistent treatment that would otherwise arise

from measuring the assets or recognizing gains or losses on a different basis; or (2) the assets are part

of a group of financial assets, which are managed and their performance evaluated on a fair value

basis, in accordance with a documented risk management or investment strategy.

F-15