Nokia 2012 Annual Report Download - page 145

Download and view the complete annual report

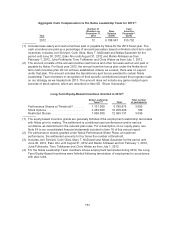

Please find page 145 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(3) Jorma Ollila, Bengt Holmström and Per Karlsson served on the Board until the close of the Annual

General Meeting in 2012. They were not paid any fees during fiscal year 2012, but received their

compensation for the term until the close of the Annual General Meeting in 2012 during fiscal year

2011. For their compensation in 2011 see Note 31 to our consolidated financial statements

included in Item 18 of this annual report.

(4) Represents the fee paid to Marjorie Scardino for service as Vice Chairman of the Board.

(5) Stephen Elop did not receive remuneration for his service as a member of the Board. This table

does not include remuneration paid to Mr. Elop for his service as the President and CEO. For the

compensation paid for his service as the President and CEO, see “—Executive Compensation—

Actual Executive Compensation for 2012—Summary Compensation Table 2012” below.

(6) Represents the fees paid to Henning Kagermann, consisting of a fee of EUR 130 000 for service

as a member of the Board and EUR 25 000 for service as the Chairman of the Personnel

Committee.

(7) Represents the fees paid to Jouko Karvinen, consisting of a fee of EUR 130 000 for service as a

member of the Board and EUR 25 000 for service as the Chairman of the Audit Committee.

(8) Represents the fees paid to Isabel Marey-Semper, consisting of a fee of EUR 130 000 for service

as a member of the Board and EUR 10 000 for service as a member of the Audit Committee.

(9) Represents the fees paid to Elizabeth Nelson, consisting of a fee of EUR 130 000 for service as a

member of the Board and EUR 10 000 for service as a member of the Audit Committee.

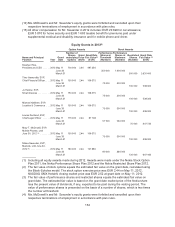

Proposal by the Corporate Governance and Nomination Committee for Remuneration to the

Board of Directors in 2013

On January 24, 2013, the Corporate Governance and Nomination Committee of the Board announced

its proposal to the Annual General Meeting convening on May 7, 2013 regarding the remuneration to

the Board of Directors in 2013. The Committee will propose that the annual fee payable to the Board

members elected at the same meeting for a term until the close of the Annual General Meeting in

2014, remain at the same level as it has been for the past five years and be as follows: EUR 440 000

for the Chairman, EUR 150 000 for the Vice Chairman and EUR 130 000 for each member (excluding

the President and CEO of Nokia if elected to the Nokia Board); for the Chairman of the Audit

Committee and the Chairman of the Personnel Committee an additional annual fee of EUR 25 000,

and for each member of the Audit Committee an additional annual fee of EUR 10 000.

The guiding principle of the Committee’s proposal is to align the interests of the directors with those of

the shareholders by remunerating directors primarily with Nokia shares that must be retained for the

duration of the Board membership. Therefore, the Committee will propose that, as in the past,

approximately 40 per cent of the remuneration be paid in Nokia shares purchased from the market,

which shares shall be retained until the end of a director’s Board membership in line with the Nokia

policy (except for those shares needed to offset any costs relating to the acquisition of the shares,

including taxes). The rest of the remuneration would be payable in cash, most of which is typically used

to cover taxes arising out of the remuneration.

Executive Compensation

The sections below describe in more detail, our executive compensation philosophy, the design of our

programs and the factors that are considered during the decision-making process. One of the

underlying principles of our philosophy and our program design is that a significant portion of

executive’s compensation is at-risk pay tied to the performance of the company and aligned with the

value delivered to shareholders. Of the total compensation package for the President and CEO, 84% is

at-risk pay tied to performance. The amount of pay at risk for the other members of the Nokia

Leadership Team ranges from 71% to 80%. Our programs are designed so this portion of at-risk pay is

earned and delivered when results warrant. While significant strides have been made in the execution

of our strategy, the transition has taken longer than anticipated in terms of results relative to the

144