Nokia 2012 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.filed a complaint with the ITC based upon the same four patents and sought to ban Nokia from

importing certain Lumia smartphones into the United States. The ITC action was instituted by the ITC

on January 13, 2012 and a target date for completion was July 18, 2013.

Before any of the cases reached final judgment, Nokia and Digitude resolved all patent litigation

between the companies, including withdrawal by Digitude of its complaint in the ITC and its action

pending in the District of Delaware. The structure of the settlement is that Digitude entered into a

Patent Purchase Agreement with third-party RPX whereby the asserted patents were sold to RPX, and

Digitude entered into a release agreement directly with Nokia. Nokia has a Membership and License

Agreement between itself and RPX which covered the asserted patents.

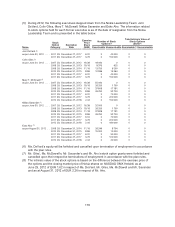

Securities Litigation & ERISA

On February 5, 2010 a lawsuit was initiated by a municipal retirement fund in the United States District

Court for the Southern District of New York on behalf of itself, and was seeking class action status on

behalf of purchasers of American Depository Shares or ADS’s, of Nokia between January 24, 2008

and September 5, 2008 inclusive, to pursue remedies under the Securities and Exchange Act of 1934

(the “Exchange Act”). An amended complaint was filed in the same lawsuit on August 23, 2010 by a

different municipal retirement fund that was appointed lead plaintiff. The complaint generally alleged

that certain officers and executives of Nokia Corporation violated the Exchange Act when they

allegedly failed to disclose materially adverse facts about the Company’s business in a timely manner,

including allegations of failures to disclose product launch delays, intense price competition, loss of

market share to competitors and changing worldwide market conditions, all of which were adverse to

the Company. After extensive proceedings, the case was dismissed by the Court on December 12,

2012. No appeal was taken and the dismissal became final on January 12, 2013.

On May 3, 2012 a class action complaint entitled Chmielinski v. Nokia Corporation was filed in the

United States District Court for the Southern District of New York naming Nokia Corporation and two of

its executives as defendants. In summary the complaint alleged that from October 26, 2011 to April 10,

2012, false positive statements were made about Nokia’s financial outlook and growth prospects in

relation to the conversion to a Windows Phone-based operating system for smartphones. After

investigation, the plaintiffs agreed to dismiss the case against all defendants without any compensation

being paid to any plaintiff or their counsel by any defendant. On December 12, 2012 the complaint was

withdrawn and dismissed.

On April 19, 2010 and April 21, 2010, two individuals filed separate putative class action lawsuits

against Nokia Inc. and the directors and officers of Nokia Inc., and certain other employees and

representatives of the company, claiming to represent all persons who were participants in or

beneficiaries of the Nokia Retirement Savings and Investment Plan (the “Plan”) who participated in the

Plan between January 1, 2008 and the present and whose accounts included investments in Nokia

shares. The plaintiffs allege that the defendants failed to comply with their statutory and fiduciary duties

when they failed to remove Nokia shares as a plan investment option. The cases were consolidated

and an amended consolidated complaint was filed on September 15, 2010. The amended complaint

alleges that the named individuals knew of the matters alleged in the securities case referenced above,

that the matters significantly increased the risk of Nokia shares ownership, and as a result of that

knowledge, the named defendants should have removed Nokia shares as a Plan investment option.

The plaintiff’s claims were dismissed in their entirety on September 5, 2011. On September 13, 2012

the Court denied Plaintiffs’ motion for leave to amend their complaint a second time and entered

judgment in favor of Nokia. On October 23, 2012 the plaintiffs filed an appeal of the District Court’s

order granting judgment in favor of Nokia. A decision on the Appeal is expected in 2013. We believe

that the allegations are without merit, and we will continue to defend ourselves against this action.

179