Nokia 2012 Annual Report Download - page 237

Download and view the complete annual report

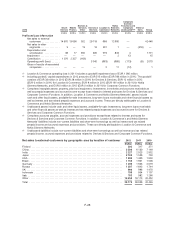

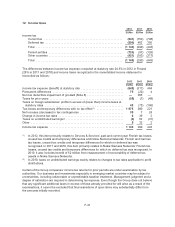

Please find page 237 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The discount rates applied in the impairment testing for each CGU have been determined

independently of capital structure reflecting current assessments of the time value of money and

relevant market risk premiums. Risk premiums included in the determination of the discount rate reflect

risks and uncertainties for which the future cash flow estimates have not been adjusted.

The recoverable amount of the Location & Commerce CGU exceeds its carrying amount by a small

margin in the fourth quarter 2012. The related valuation is deemed most sensitive to the changes in

both discount and long-term growth rates. A discount rate increase in excess of 0.5 percentage point or

long-term growth decline in excess of 1 percentage point would result in impairment loss in the

Location & Commerce CGU. Management’s estimates of the overall automotive volumes and market

share, customer adoption of the new location-based platform and related service offerings, projected

device sales volumes and fair value of the services sold within the Group as well as continued focus on

cost efficiency are the main drivers for the Location & Commerce net cash flow projections. The

Group’s cash flow forecasts reflect the current strategic views that license fee based models will

remain important in both near and long term. Management expects that license fee based models

which are augmented with software and services and monetized via license fees, transactions fees and

advertising, will grow in the future as more customers demand complete, end-to-end location solutions.

Actual short and long-term performance could vary from management’s forecasts and impact future

estimates of recoverable value. Since the recoverable amount exceeds the carrying amount only by a

small margin, any material adverse changes such as market deterioration or changes in the

competitive landscape could impact management’s estimates of the main drivers and result in

impairment loss.

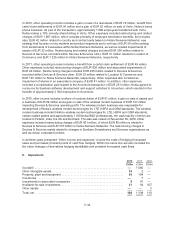

In the fourth quarter of 2011, the Group conducted annual impairment testing for the Location &

Commerce CGU to assess if events or changes in circumstances indicated that the carrying amount of

the Location & Commerce CGU was not recoverable. As a result, the Group recorded an impairment

loss of EUR 1 090 million to reduce the carrying amount of the Location & Commerce CGU to its

recoverable amount. The impairment loss was allocated in its entirety to the carrying amount of

goodwill in the balance sheet of the Location & Commerce CGU. This impairment loss is presented as

impairment of goodwill in the 2011 consolidated income statement. As a result of the impairment loss,

the amount of goodwill allocated to the Location & Commerce CGU was reduced to EUR 3 274 million

at December 31, 2011.

The impairment charge was result of an evaluation of the projected financial performance and net cash

flows of the Location & Commerce CGU. The main drivers for management’s net cash flow projections

included license fees related to digital map data, fair value of the services sold within the Group and

estimated average revenue per user with regard to mobile media advertising. The average revenue per

user was estimated based on peer market data for mobile advertising revenue. Projected device sales

volumes impacted the overall forecasted intercompany and advertising revenues. This took into

consideration the market dynamics in digital map data and related location-based content markets,

including the Group’s long-term view at the time of 2011 impairment testing, that the market will move

from fee-based models towards advertising-based models especially in some more mature markets. It

also reflected recent results and related competitive factors in local search and advertising markets

resulting in lower estimated growth prospects from location-based assets integrated with different

advertising platforms. After consideration of all relevant factors, the Group reduced the net sales

projections for the Location & Commerce CGU which, in turn, reduced projected profitability and cash

flows.

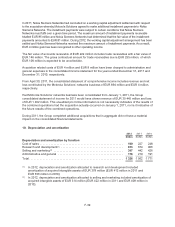

The Group’s goodwill impairment testing did not result in impairment charges for the years ended

December 31, 2012 or 2010. An impairment loss was recorded with respect to the Group’s Location &

Commerce CGU in 2011, as noted above. No further impairment charges were recorded with respect

to the other CGUs in 2011.

F-36