Nokia 2012 Annual Report Download - page 273

Download and view the complete annual report

Please find page 273 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284

|

|

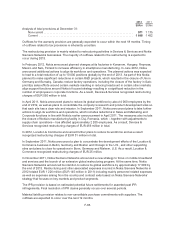

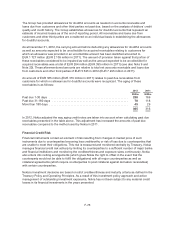

Financial risks

The objective for Treasury activities in Nokia is to guarantee sufficient funding for the Group at all

times, and to identify, evaluate and manage financial risks. Treasury activities support this aim by

mitigating the adverse effects caused by fluctuations in the financial markets on the profitability of the

underlying businesses and by managing the capital structure of the Group by prudently balancing the

levels of liquid assets and financial borrowings.

Treasury activities are governed by the Treasury Policy approved by the CEO, that provides principles

for overall financial risk management and determines the allocation of responsibilities for financial risk

management in Nokia. Standard Operating Procedures approved by the CFO cover specific areas

such as foreign exchange risk, interest rate risk, credit and liquidity risk as well as use of derivative

financial instruments in managing these risks. Nokia is risk averse in its Treasury activities.

Financial risks are divided into (a) market risk (covering foreign exchange risk, interest risk and equity

price risk), (b) credit risk (covering business related credit risk and financial credit risk) and (c) liquidity

risk.

(a) Market Risk

Methodology for assessing market risk exposures: Value-at-Risk

Nokia uses the Value-at-Risk (VaR) methodology to assess the Group exposures to foreign exchange

(FX), interest rate, and equity risks. The VaR gives estimates of potential fair value losses in market

risk sensitive instruments as a result of adverse changes in specified market factors, at a specified

confidence level over a defined holding period.

In Nokia, the FX VaR is calculated with the Monte Carlo method which simulates random values for

exchange rates in which the Group has exposures and takes the non-linear price function of certain

FX derivative instruments into account. The variance-covariance methodology is used to assess and

measure the interest rate risk and equity price risk.

The VaR is determined by using volatilities and correlations of rates and prices estimated from a

one-year sample of historical market data, at 95% confidence level, using a one-month holding period.

To put more weight on recent market conditions, an exponentially weighted moving average is

performed on the data with an appropriate decay factor.

This model implies that within a one-month period, the potential loss will not exceed the VaR estimate

in 95% of possible outcomes. In the remaining 5% of possible outcomes, the potential loss will be at

minimum equal to the VaR figure, and on average substantially higher.

The VaR methodology relies on a number of assumptions, such as a) risks are measured under

average market conditions, assuming that market risk factors follow normal distributions; b) future

movements in market risk factors follow estimated historical movements; c) the assessed exposures

do not change during the holding period. Thus it is possible that, for any given month, the potential

losses at 95% confidence level are different and could be substantially higher than the estimated VaR.

Foreign exchange risk

Nokia operates globally and is exposed to transactional and translational foreign exchange risks.

Transaction risk arises from foreign currency denominated assets and liabilities together with foreign

currency denominated future cash flows. Transaction exposures are managed in the context of various

functional currencies of foreign Group companies.

F-72