Nokia 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284

|

|

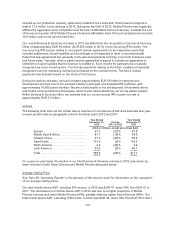

ramped up our production capacity, particularly related to the Lumia 920. Smart Devices shipped a

total of 13.4 million Lumia devices in 2012. During the first half of 2012, Mobile Phones was negatively

affected by aggressive price competition and the lack of affordable full touch devices. Towards the end

of the second quarter 2012 Mobile Phones introduced affordable Asha full touch smartphones and sold

15.8 million units in the second half 2012.

Our overall Devices & Services net sales in 2012 benefited from the recognition in Devices & Services

Other of approximately EUR 50 million (EUR 450 million in 2011) of non-recurring IPR income. The

non-recurring IPR income relates to new patent license agreements for the respective years that

included settlements of past royalties and accordingly is not expected to have a recurring benefit.

Patent license agreements are generally multi-year arrangements and may cover both licensee’s past

and future sales. Typically, when a patent license agreement is signed it includes an agreement or

settlement on past royalties that the licensor is entitled to. Such income for past periods is typically

recognized as a non-recurring item. The license payments relating to the future royalties are typically

recognized over the remaining contract period based on the contract terms. The future license

payments may fluctuate based on the terms of the license.

During the last two decades, we have invested approximately EUR 50 billion in research and

development and built one of the wireless industry’s strongest and broadest IPR portfolios, with

approximately 10 000 patent families. We are a world leader in the development of handheld device

and mobile communications technologies, which is also demonstrated by our strong patent position.

Within Devices & Services Other, we estimate that our current annual IPR income run-rate is

approximately EUR 0.5 billion.

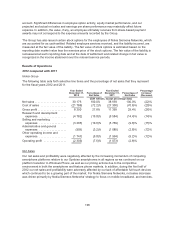

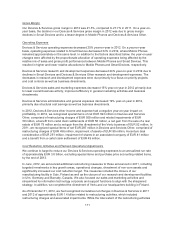

Volume

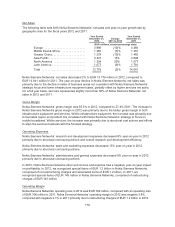

The following chart sets out the mobile device volumes for our Devices & Services business and year-

on-year growth rates by geographic area for the fiscal years 2012 and 2011.

Year Ended

December 31,

2012

Change

2011 to 2012

Year Ended

December 31,

2011

(Units in millions, except percentage data)

Europe ........................... 67.3 (23)% 87.8

Middle East & Africa ................ 81.7 (14)% 94.6

Greater China ...................... 27.5 (58)% 65.8

Asia-Pacific ........................ 113.5 (5)% 118.9

North America ..................... 2.2 (44)% 3.9

Latin America ...................... 43.4 (6)% 46.1

Total ............................. 335.6 (20)% 417.1

On a year-on-year basis, the decline in our total Devices & Services volumes in 2012 was driven by

lower volumes in both Smart Devices and Mobile Phones discussed below.

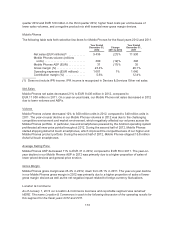

Average Selling Price

See “Item 5A. Operating Results” or the glossary of this annual report for information on the calculation

of our average selling prices.

Our total mobile device ASP, including IPR income, in 2012 was EUR 47, down 18% from EUR 57 in

2011. The decrease in our mobile device ASP in 2012 was due to a higher proportion of Mobile

Phones volumes and lower Mobile Phones ASPs, partially offset by higher Smart Devices ASPs. Our

total mobile device ASP, excluding IPR income, in 2012 was EUR 45, down 18% from EUR 55 in 2011.

110