Nokia 2012 Annual Report Download - page 149

Download and view the complete annual report

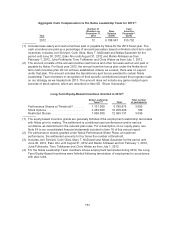

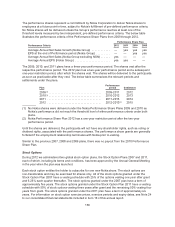

Please find page 149 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the Personnel Committee for approval. In the event the achievement criteria is not met, the actual

short-term cash incentive awarded to the executive officer can be zero. The maximum payout is only

possible with maximum performance on all measures.

For fiscal year 2012, the incentive criteria were not achieved and as a result there was no pay-out

under the short-term cash incentive plan.

For more information on the actual cash compensation paid in 2012 to our executive officers,

see “—Actual Executive Compensation for 2012—Summary Compensation Table 2012” below.

Long-Term Equity-Based Incentives

Long-term equity-based incentive awards in the form of performance shares, stock options and

restricted shares are used to align executive officers’ interests with shareholders’ interests, reward for

long-term financial performance and encourage retention, while also considering evolving regulatory

requirements and recommendations and changing economic conditions. These awards are determined

on the basis of the factors discussed above in “—Executive Compensation Philosophy, Programs and

Decision-making Process,” including a comparison of an executive officer’s overall compensation with

that of other executives in the relevant market and the impact on the competitiveness of the executive’s

compensation package in that market. Performance shares are Nokia’s main vehicle for long-term

equity-based incentives and reward the achievement of both Nokia’s long-term financial results and an

increase in share price. Performance shares vest as shares if at least one of the pre-determined

threshold performance levels, tied to Nokia’s financial performance, is achieved by the end of the

performance period. The value that the executive receives is dependent on Nokia’s share price. Stock

options are granted with the purpose of creating value for the executive officer, once vested, only if the

Nokia share price at the time of vesting is higher than the exercise price of the stock option established

at grant. This is also intended to focus executives on share price appreciation, thus aligning the

interests of the executives with those of the shareholders. Restricted shares are used primarily for

long-term retention purposes and they vest fully after the close of a pre-determined restriction period.

Any shares granted are subject to the share ownership guidelines as explained below. All of these

equity-based incentive awards are generally forfeited if the executive leaves Nokia prior to their

vesting.

Recoupment of certain equity gains

The Board of Directors has approved a policy allowing for the recoupment of equity gains realized by

Nokia Leadership Team members under Nokia equity plans in case of a financial restatement caused

by an act of fraud or intentional misconduct. This policy applies to equity grants made to Nokia

Leadership Team members after January 1, 2010.

Information on the actual equity-based incentives granted to the members of our Nokia Leadership

Team in 2012 is included in Item 6E. “Share Ownership.”

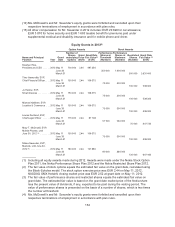

Actual Executive Compensation for 2012

Service Contracts

Stephen Elop’s service contract covers his position as President and CEO as from September 21, 2010.

As at December 31, 2012, Mr. Elop’s annual base salary, which is subject to an annual review by the

Board of Directors and confirmation by the independent members of the Board, is EUR 1 102 500. His

incentive target under the Nokia short-term cash incentive plan is 100% of annual base salary as at

December 31, 2012. In addition, Mr. Elop had a separate plan for 2011-2012, approved by the Board of

Directors. Description and outcome of this plan is below. Mr. Elop is entitled to the customary benefits in

line with our policies applicable to the top management, however, some of them are being provided on a

148