Nokia 2012 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Dividends

Dividends proposed by the Board of Directors are not recorded in the financial statements until they

have been approved by the shareholders at the Annual General Meeting.

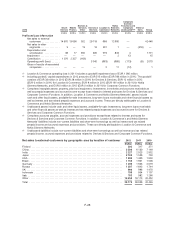

Earnings per share

Basic earnings per share is calculated by dividing the profit attributable to equity holders of the parent

by the weighted average number of shares outstanding during the year excluding shares purchased by

the Group and held as treasury shares. Diluted earnings per share is calculated by adjusting the net

profit attributable to equity holders of the parent to eliminate the interest expense of the convertible

bond and by adjusting the weighted average number of the shares outstanding with the dilutive effect

of stock options, performance shares and restricted shares outstanding during the year as well as the

assumed conversion of convertible bond.

Use of estimates and critical accounting judgments

The preparation of financial statements in conformity with IFRS requires the application of judgment by

management in selecting appropriate assumptions for calculating financial estimates, which inherently

contain some degree of uncertainty. Management bases its estimates on historical experience,

expected outcomes and various other assumptions that are believed to be reasonable under the

circumstances. The related results form a basis for making judgments about the reported carrying

values of assets and liabilities and the reported amounts of revenues and expenses that may not be

readily apparent from other sources. The Group will revise material estimates if changes occur in the

circumstances on which an estimate was based or as a result of new information or more experience.

Actual results may differ from these estimates under different assumptions or conditions.

Set forth below are areas requiring significant judgment and estimation that may have an impact on

reported results and the financial position.

Revenue recognition

Majority of the Group’s sales are recognized as revenue when the significant risks and rewards of

ownership have transferred to the buyer, continuing managerial involvement usually associated with

ownership and effective control have ceased, the amount of revenue can be measured reliably, it is

probable that economic benefits associated with the transaction will flow to the Group and the costs

incurred or to be incurred in respect of the transaction can be measured reliably. Sales could materially

change if management’s assessment of such criteria was determined to be inaccurate. The Group

enters into transactions involving multiple components consisting of any combination of hardware,

services and software. The consideration received from these transactions is allocated to each

separately identifiable component based on the relative fair value of each component. The

consideration allocated to each component is recognized as revenue when the revenue recognition

criteria for that component have been met. Determination of the fair value for each component requires

the use of estimates and judgment taking into consideration factors which may have a significant

impact on the timing and amount of revenue recognition. Examples of such factors include price when

the component is sold separately by the Group or the price when a similar component is sold

separately by the Group or a third party.

The Group makes price protection adjustments based on estimates of future price reductions and

certain agreed customer inventories at the date of the price adjustment. Potential changes in these

estimates could result in revisions to the sales in future periods.

Revenue from contracts involving solutions achieved through modification of complex telecommunications

equipment is recognized on the percentage of completion basis when the outcome of the contract can be

F-21