Nokia 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

-

179

-

180

-

181

-

182

-

183

-

184

-

185

-

186

-

187

-

188

-

189

-

190

-

191

-

192

-

193

-

194

-

195

-

196

-

197

-

198

-

199

-

200

-

201

-

202

-

203

-

204

-

205

-

206

-

207

-

208

-

209

-

210

-

211

-

212

-

213

-

214

-

215

-

216

-

217

-

218

-

219

-

220

-

221

-

222

-

223

-

224

-

225

-

226

-

227

-

228

-

229

-

230

-

231

-

232

-

233

-

234

-

235

-

236

-

237

-

238

-

239

-

240

-

241

-

242

-

243

-

244

-

245

-

246

-

247

-

248

-

249

-

250

-

251

-

252

-

253

-

254

-

255

-

256

-

257

-

258

-

259

-

260

-

261

-

262

-

263

-

264

-

265

-

266

-

267

-

268

-

269

-

270

-

271

-

272

-

273

-

274

-

275

-

276

-

277

-

278

-

279

-

280

-

281

-

282

-

283

-

284

Table of contents

-

Page 1

-

Page 2

...due 2039 Indicate the number of outstanding shares of each of the registrant's classes of capital or common stock as of the close of the period covered by the annual report. Shares: 3 744 956 052. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the...

-

Page 3

... and Capital Resources ...Research and Development, Patents and Licenses ...Trends Information ...Off-Balance Sheet Arrangements ...Tabular Disclosure of Contractual Obligations ...DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES ...Directors and Senior Management ...Compensation ...Board Practices...

-

Page 4

... MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS ...CONTROLS AND PROCEDURES ...AUDIT COMMITTEE FINANCIAL EXPERT ...CODE OF ETHICS ...PRINCIPAL ACCOUNTANT FEES AND SERVICES ...EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES . . PURCHASES OF EQUITY SECURITIES BY THE...

-

Page 5

...access our consolidated financial statements, and other information included in our annual reports and proxy materials, at www.nokia.com. This annual report on Form 20-F is also available at www.nokia.com as well as on Citibank's website at http://citibank.ar.wilink.com (enter "Nokia" in the Company...

-

Page 6

... Mobile Phones business unit, including feature phones and devices with features such as full touch that can be categorized as smartphones, in a timely and cost efficient manner with differentiated hardware, software, localized services and applications; the success of our HERE strategy, including...

-

Page 7

... speed of innovation, product development and execution in order to bring new innovative and competitive mobile products and location-based or other services to the market in a timely manner;

7) 8)

9)

10) the success of our partnership with Microsoft in connection with the Windows Phone ecosystem...

-

Page 8

... on limited number of customers and large, multi-year contracts; 35) Nokia Siemens Networks' liquidity and its ability to meet its working capital requirements, including access to available credit under its financing arrangements and other credit lines as well as cash at hand; 36) the management of...

-

Page 9

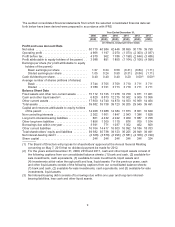

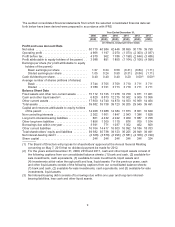

... OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS Not applicable. ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE Not applicable. ITEM 3. KEY INFORMATION 3A. Selected Financial Data The financial data set forth below at December 31, 2011 and 2012 and for each of the years in the three-year period ended...

-

Page 10

... Board of Directors will propose for shareholders' approval at the Annual General Meeting convening on May 7, 2013 that no dividend payment be made for 2012. (2) For the years ended December 31, 2009, 2010 and 2011, cash and other liquid assets consist of the following captions from our consolidated...

-

Page 11

... below sets forth actual share buy-backs by Nokia in respect of each fiscal year indicated.

Number of shares EUR millions (in total)

2008 2009 2010 2011 2012 Cash Dividends

...

157 390 000 - - - -

3 123 - - - -

On January 24, 2013, we announced that the Board of Directors will propose at the...

-

Page 12

...ADSs in the United States. See also Item 3D. "Risk Factors-Our net sales, costs and results of operations, as well as the US dollar value of our dividends and market price of our ADSs, are affected by exchange rate fluctuations, particularly between the euro, which is our reporting currency, and the...

-

Page 13

...or timely market acceptance or be preferred by ecosystem participants, mobile operators and consumers. Microsoft has recently launched the Windows 8 operating system used to power personal computers and tablets, and the related Windows Phone 8 operating system is used in the latest Nokia smartphones...

-

Page 14

... for a competitive global ecosystem in a timely manner, or at all. Applicable developer tools for the Windows Phone platform may not gain needed traction or acceptance in the market, may be introduced late, or when introduced, may not offer technologies that developers are willing to use. We may not...

-

Page 15

...higher price points. We may not be able to introduce a compelling portfolio of Nokia products with Windows Phone that include new hardware and design innovations. Additionally, we may not be able to introduce functionalities such as advanced imaging and sensor technology, location-based services and...

-

Page 16

...which are gaining significant market share in emerging markets, as well as bringing some locally relevant innovations to the market. Many mid-range to high-end feature phones increasingly offer access to the Internet and applications and provide more smartphone-like features and design, blurring the...

-

Page 17

... requiring increasing customization to meet divergent local needs and preferences. The market we address with the more affordable devices from our Mobile Phones business unit may further reduce in size if the higher-end price points become dominated by more affordable smartphones, such as Android...

-

Page 18

... of resources on the development and launches of our Nokia products with Windows Phone and the creation of a successful ecosystem for Windows Phone smartphones with Microsoft may result in less management focus and resources being provided to our Mobile Phones business unit, as well as reduced...

-

Page 19

... billion people to the Internet and information, which would negatively affect our ability to offer compelling and differentiated mobile products. Any Microsoft partnership business model to integrate our location-based assets with Microsoft's platform to generate new sources of revenue for us may...

-

Page 20

... different business models to tap into significant new sources of revenues, such as advertising and subscriptions; or generally have been able to adjust their business models and operations in an effective and timely manner to the developing smartphone and related ecosystem market requirements.

19

-

Page 21

... market easier for a number of hardware manufacturers which have chosen to join the Android ecosystem, especially at the mid-to-low range of the smartphone market. Additionally, this is increasingly reducing the addressable market and lowering the price points for Nokia feature phones. Product...

-

Page 22

... which is a community-generated open source map available to users free of charge. Aerial, satellite and other location-based imagery is also becoming increasingly available and competitors are offering locationbased products and services with the map data to both business customers and consumers in...

-

Page 23

... competitive business models for our customers. Our failure to keep momentum and increase our speed of innovation, product development and execution will impair our ability to bring new innovative and competitive mobile products and location-based or other services to the market in a timely manner...

-

Page 24

... share, net sales and profitability, but may also erode our brand through consumer disappointment. Moreover, our customers and consumers expect that the services and applications provided with and in connection with our mobile products are positively differentiated from our competitors' offerings...

-

Page 25

..., retain and motivate appropriately skilled employees to implement successfully our strategies in relation to the Windows Phone platform and to work effectively and efficiently with Microsoft and the related ecosystem. New business models require access and sometimes possession of consumer data...

-

Page 26

... maintain long-term competitiveness and improve profitability discussed below under risks primarily related to Nokia Siemens Networks. These strategies also involve changing our mode of working and culture to facilitate speed and agility in innovation, product development and are aimed at increasing...

-

Page 27

...and related services. If we and the other market participants are not successful in our attempts to increase subscriber numbers, stimulate increased usage or drive upgrade and replacement sales of mobile devices and develop and increase demand for value-added services, or if mobile network operators...

-

Page 28

...retailers and network operator customers and may also result in requests for extended payment terms, credit losses, insolvencies, limited ability to respond to demand or diminished sales channels available to us. • • Cause financial difficulties for our suppliers and collaborative partners which...

-

Page 29

... and consumers as a consequence reduce their support and purchases of our mobile products, this would reduce our market share and net sales and in turn may erode our scale, brand, manufacturing and logistics, distribution and customer relations. The erosion of those strengths would impair our...

-

Page 30

... rights in a way that we cannot foresee or prevent, or private information shared with partners is leaked. The technologies or products or services supplied by the parties we work with do not meet the required quality, safety, security and other standards or customer needs. Our own quality controls...

-

Page 31

... mobile products market choose to limit or cease the supply of components to other mobile device manufacturers, including us. Further, our dependence on a limited number of suppliers that require purchases in their home country foreign currency increases our exposure to fluctuations in the exchange...

-

Page 32

... develop the best technical solutions for new products; managing the increasingly complex manufacturing process for our high-end products, particularly the software for those products; adapting our manufacturing processes for the requirements of the Windows Phone platform and the production of Nokia...

-

Page 33

...collaboration partners or other third parties where the development and manufacturing process is not fully in our control. Prior to shipment, quality issues may cause failures in ramping up the production of our products and shipping them to customers in a timely manner as well as related additional...

-

Page 34

..., certain customer feedback, information on consumer usage patterns and other personal and consumer data is collected and stored through our products, in particular with smartphones, either by the consumers or by us or our partners or subcontractors. Our developer sites may also require certain data...

-

Page 35

... than we do. If we fail to maintain or improve our market position and scale compared to our competitors across the range of our products, as well as leverage our scale to the fullest extent, or if we are unable to develop or otherwise acquire software, applications and content cost competitively in...

-

Page 36

... that the estimated long-term tax rate of Nokia will remain at current levels or that cash flows regarding taxes will be stable. Our net sales, costs and results of operations, as well as the US dollar value of our dividends and market price of our ADSs, are affected by exchange rate fluctuations...

-

Page 37

... 34 of our consolidated financial statements included in Item 18 of this annual report. Our products include increasingly complex technologies, some of which have been developed by us or licensed to us by certain third parties. As a result, evaluating the rights related to the technologies we use or...

-

Page 38

... or in companies under our control, or whenever we enter new businesses or acquire new businesses. Nokia Siemens Networks has access to certain licenses through cross-licensing arrangements with its current shareholders, Nokia and Siemens. If there are changes to Nokia Siemens Networks' corporate...

-

Page 39

... our consolidated financial statements included in Item 18 of this annual report for more detailed information on geographic location of net sales to external customers, segment assets and capital expenditures. Changes in various types of regulation, technical standards and trade policies as well as...

-

Page 40

... end users, require us to incur substantial costs, change our business practices or prevent us from offering our services. In line with changes in strategy, as well as in some cases a difficult political or business environment and an increasingly complicated trade sanctions environment, Nokia and...

-

Page 41

...will be a key driver of general sales and profitability. If Nokia Siemens Networks is not successful in implementing its services business strategy and achieving the desired outcomes in a timely manner or if the mobile broadband services market fails to develop in the manner currently anticipated by...

-

Page 42

..., as well as companies that may have stronger customer finance possibilities due to internal policies or governmental support, for example in the form of trade guarantees, allowing them to offer products and services at very low prices or with attractive financing terms. Nokia Siemens Networks also...

-

Page 43

... requirements in the mobile broadband infrastructure and related services market, our business and results of operations, particularly profitability, and financial condition may be materially adversely affected. Nokia Siemens Networks seeks to increase sales in geographic markets in which price...

-

Page 44

... as upgrades to current products and new generations of technologies, is a complex and uncertain process requiring high levels of innovation and investment, as well as accurate anticipation of technology and market trends. Nokia Siemens Networks may focus its resources on technologies that do not...

-

Page 45

..., such as penalties for contract violations. Nokia Siemens Networks' liquidity and its ability to meet its working capital requirements depend on access to available credit under its financing arrangements and other credit lines as well as cash at hand. If those sources of liquidity were to be...

-

Page 46

... the related services sectors. Nokia Siemens Networks' ability to manage its total customer finance and trade credit exposure depends on a number of factors, including its capital structure, market conditions affecting its customers, the level and terms of credit available to Nokia Siemens Networks...

-

Page 47

... and resources of Nokia Siemens Networks' and our management, which could harm our business and that of Nokia Siemens Networks. The government investigations may also harm Nokia Siemens Networks' relationships with existing customers, impair its ability to obtain new customers, business partners and...

-

Page 48

... and software development facilities, with key sites in China, Finland, Germany and the United States. History During our 148 year history, Nokia has evolved from its origins in the paper industry to become a world leader in mobile communications. Today, Nokia brings mobile products and services to...

-

Page 49

... strategy for our Devices & Services business, including our partnership with Microsoft to build a new global mobile ecosystem with Windows Phone serving as our primary smartphone platform and changes to our leadership team and operational structure, with the aim of accelerating speed of execution...

-

Page 50

... Series 40 operating system. HERE develops location-based products and services for a broad range of devices and operating systems, including our Lumia smartphones. As of January 1, 2013, HERE is the new name of our former Location & Commerce business and reportable segment. Nokia Siemens Networks...

-

Page 51

...Depositary Shares. Our principal executive office is located at Keilalahdentie 4, P.O. Box 226, FI-00045 Nokia Group, Espoo, Finland and our telephone number is +358 (0) 7 1800-8000. 4B. Business Overview In November 2012, we introduced a new brand, HERE, for our location-based products and services...

-

Page 52

... code is available as open source software, which has made entry and expansion in the smartphone market easier for a number of device manufacturers which have chosen to join the Android ecosystem. Users of Android-based devices can access and download applications from the Android application store...

-

Page 53

... by the Windows Phone operating system. The business unit has profit-and-loss responsibility and end-to-end accountability for the full consumer experience, including product development, product management and product marketing. Nokia's portfolio of smartphones covers price points ranging from...

-

Page 54

... Phone 8, Nokia Lumia smartphones provide several key points of differentiation versus competing smartphones running Windows Phone as well as other platforms, including Android and iOS. Our current range of Lumia products offers the following points of differentiation our industrial design. We use...

-

Page 55

... market entry and feature phones as well as affordable smartphones. The unit has profit-and-loss responsibility and end-to-end accountability for the full consumer experience, including development, management and marketing of products, services and applications. During 2012, our Mobile Phones unit...

-

Page 56

...enhance the Nokia brand and drive more sales. In our marketing, we focus on expanding awareness of the key points of differentiation in our products and services, such as the imaging capabilities of our high-end smartphones or the robust quality of our most affordable feature phones. During 2012, we...

-

Page 57

...as well as software and sales package customization

Nokia is planning to establish a new manufacturing facility near Hanoi in northern Vietnam. The targeted opening of the facility is the second half of 2013. The new manufacturing site is being established to produce our most affordable smartphones...

-

Page 58

... in the market grows, our product range becomes more diversified, our products are increasingly used together with hardware, software or service components that have been developed by third parties, we enter new businesses and the complexity of technology increases. As new features are added to our...

-

Page 59

...dominated by feature phone offerings, including those offered by Nokia. Accordingly, lower-priced smartphones are increasingly reducing the addressable market and lowering the price points for feature phones. In general, we believe product differentiation with Android is more challenging, leading to...

-

Page 60

... free or low-cost components, software and content. In addition, we compete with non-branded feature phone manufacturers, including mobile network operators, which offer mobile devices under their own brand, as well as providers of specific hardware and software layers within products and services...

-

Page 61

... user interface to make sense of location services. Nokia and Google are among companies which have been investing in this area for a number of years. Segment Overview Our HERE business, which though 2012 operated under the Location & Commerce name, develops a range of location-based products...

-

Page 62

... as well as scalable cloud services and APIs. We also license our platform to partners such as Bing Maps and Yahoo! Maps. Applications. We offer a suite of location applications, which we continue to develop for users of our products and, in some instances, for customers of competing products. These...

-

Page 63

...which is a community-generated open source map available to users free of charge. Aerial, satellite and other location-based imagery is also becoming increasingly available and competitors are offering location-based products and services with the map data to both business customers and consumers in...

-

Page 64

... towards the end of 2011, when the company adopted a new strategy (please see the section "Strategy" below). Mobile broadband provides many opportunities for Nokia Siemens Networks. The company believes the market will continue to grow as mobile operators face the challenge of increasing demand for...

-

Page 65

... pillar of its current strategy, Nokia Siemens Networks clearly stated that it wishes to make this area a competitive differentiator over time. The extreme intolerance of lapses in service of most mobile broadband subscribers and operators means that quality improvements have a direct impact on the...

-

Page 66

... purchase price accounting related items, by more than EUR 1 billion by the end of 2013, compared to the end of 2011. Organization Nokia Siemens Networks has two business units. Mobile Broadband provides radio and core network hardware and software to mobile operators throughout the world, as well...

-

Page 67

.... Sales and marketing Nokia Siemens Networks' direct sales force is active in approximately 120 countries. This helps ensure Nokia Siemens Networks is close to its customers, both physically and in cultural terms, and helps the company to develop stable customer relationships. In 2012, Nokia Siemens...

-

Page 68

... challenging European vendors. In 2012, Nokia Siemens Networks also witnessed emerging competition from Samsung Electronics, which has expanded its network infrastructure business out of its domestic Korean market with limited gains in Europe and the United States. At present, Nokia Siemens Networks...

-

Page 69

...in 2011, as a strategic market requirement the company plans to offer this financing option only to a limited number of customers and primarily to arrange and facilitate financing with the support of export credit or guarantee agencies. Seasonality-Devices & Services, HERE and Nokia Siemens Networks...

-

Page 70

Nokia Siemens Networks has made the decision in November 2011 to withdraw from the Iranian market in a controlled manner and is in the process of winding down its business activities in Iran. Nokia Siemens Networks expects to cease all revenue-generating activities relating to Iran by June 30, 2013....

-

Page 71

... accounts. Nokia Siemens Networks is in the process of closing these accounts. Government Regulation: Devices & Services, HERE and Nokia Siemens Networks Our business is subject to direct and indirect regulation in each of the countries in which we, the companies with which we work and our customers...

-

Page 72

...core business. Our strategy, including our plan to 'win in smartphones' and connect the 'next billion' to the Internet and information, aims to bring the benefits of mobile technology to people around the world. Accessibility of Nokia products. Accessibility means making products and services usable...

-

Page 73

... time and money. The open source model allows us to offer the software on a large scale, providing clients with flexibility and supporting the creation of livelihoods for systems integrators and developers. Almost 300 organizations use Nokia Data Gathering, making it one of the most used mobile...

-

Page 74

... shares and stock options. In early 2013, we also introduced an employee share purchase plan as part of the program. There are also other plans, including cash incentive plans for all employees as well as small monetary bonuses as recognition awards. Health, safety and well-being. In 2012, Nokia...

-

Page 75

... have several communications channels available to employees and others to get help in understanding and applying the Code of Conduct, or to report concerns of violations, including a "Contact the Board" channel for contacting the Board of Directors anonymously. Human rights. Improved communications...

-

Page 76

...beyond legal requirements as explained in more detail below. In 2012, we continued to focus on the materials used, energy-efficiency, take-back of used products, the overall environmental performance of our activities and the supply chain. Environmentally-leading mobile product range. Nokia has long...

-

Page 77

... Union Waste Electrical and Electronic Equipment (WEEE) Directive, but also to ensure we go above and beyond legally set requirements. Of the materials in a mobile device, 100% can be recovered and used to make new products or generate energy. Our challenge is now to engage people to make recycling...

-

Page 78

... environmental, ethical, health and safety, as well as labor practices have been integrated into Nokia sourcing's daily business operations including supplier selection and contracting, relationship development, procurement decisions and steering meetings. Sustainability key performance indicators...

-

Page 79

... legal requirements to find socially responsible means of reducing its workforce and treated those affected with dignity and respect. Where possible, Nokia Siemens Networks transferred employees to new roles inside the company to support businesses that are core to its strategy. At the end of 2012...

-

Page 80

... training on the company's human rights policy. Suppliers: All suppliers must meet Nokia Siemens Networks' global supplier requirements, which set standards for the management of ethical, environmental and social issues. This commitment is part of contractual agreements with suppliers. In 2012 Nokia...

-

Page 81

...mobile broadband sites. Renewable energy continues to form a substantial part of the energy used in Nokia Siemens Networks' own facilities-more than 38% of the used energy is from certified renewable sources. Radio waves and health. Wireless communications technologies operate well within the limits...

-

Page 82

... is a list of the location, use and capacity of major manufacturing facilities for Nokia mobile devices and Nokia Siemens Networks infrastructure equipment at December 31, 2012. In connection with the implementation of our strategy for our Devices & Services business, we have announced a number of...

-

Page 83

... social location services operations. In November 2012, we introduced HERE as the new brand for Nokia's location-based products and services. As of January 1, 2013 our Location & Commerce business and reportable segment was renamed as the HERE reportable segment. HERE focuses on the development...

-

Page 84

..., as well as designing and developing services, including applications and content, that enrich the experience people have with their mobile devices. Currently, we are addressing all key geographical markets except Japan. Devices & Services also manages our supply chain, sales channels, brand and...

-

Page 85

...-Looking Statements". Longer-term, we continue to target: • • Devices & Services net sales to grow faster than the market, and Devices & Services operating margin to be 10% or more, excluding special items and purchase price accounting related items.

Microsoft Partnership In February 2011, we...

-

Page 86

..., design and language support to the Microsoft partnership, and plan to bring Nokia products with Windows Phone to an increasing range of price points, market segments and geographies. We and Microsoft are closely collaborating on joint marketing initiatives and on a shared development roadmap...

-

Page 87

..., applications and services. As Android is available free of charge and a significant part of the source code is available as open source software, entry and expansion in the smartphone market has become easier for a number of hardware manufacturers that have chosen to leverage the Android ecosystem...

-

Page 88

...end feature phone offering from our Mobile Phones unit. We are addressing this with introductions in 2013 of smarter, competitively priced Asha full touch smartphones with more modern user experiences, including software, services and application experiences. In support of our Mobile Phones business...

-

Page 89

..., brand, quality, design, manufacturing and logistics, strategic sourcing and partnering, distribution, research and development and software user experience and intellectual property-continue to be important to our competitive position. Additionally, we plan to extend our Mobile Phones offerings...

-

Page 90

... opportunities to share the economic benefits from services and applications sales compared to other competing ecosystems, thereby improving our long-standing relationships with mobile operators around the world. Speed of Innovation, Product Development and Execution As the mobile communications...

-

Page 91

... its digital map data and location-based offerings from those of our competitors and create competitive business models for our customers. In November 2012 Nokia introduced HERE as the new brand for its location-based products and services. HERE is the first location cloud aiming to deliver maps...

-

Page 92

... expect these offerings will increase the adoption of location-based services in the mobile products market, we also expect that they may lead to additional price pressure from HERE's business customers, including device manufacturers, navigation application developers, mobile operators and personal...

-

Page 93

... Nokia Siemens Networks' 3G networks. In LTE, Nokia Siemens Networks had 77 commercial contracts at the end of 2012. Nokia Siemens Networks' net sales depend on various developments in the global mobile infrastructure and related services market, such as network operator investments, the pricing...

-

Page 94

... of products and services in the market that both meet and feed end-user demand. These continue to drive dramatic increases in data traffic and signaling through both mobile access and transport networks that carry the potential to cause network congestion and complexity. During 2012, this increase...

-

Page 95

... developing its position as one of the leaders in mobile broadband and services and improving its competitiveness and profitability. Nokia Siemens Networks continues to target to reduce its annualized operating expenses and production overheads, excluding special items and purchase price accounting...

-

Page 96

... Networks divested a number of businesses which were not in line with this strategy in 2011 and 2012. As part of our strategy announced in November 2011, Nokia Siemens Networks also articulated a regional strategy, identifying three markets, Japan, Korea and the United States, as priority countries...

-

Page 97

... from customer to customer within a particular country. During 2011 and 2012, Nokia Siemens Networks has pursued a policy of prioritizing markets such as Japan, Korea and the United States, as these markets typically offer vendors more value than other markets. In general, developed markets provide...

-

Page 98

... impact our competitive position and related price pressures through their impact on our competitors. For a discussion on the instruments used by Nokia in connection with our hedging activities, see Note 34 to our consolidated financial statements included in Item 18 of this annual report. See also...

-

Page 99

... accounting policies and related judgments and estimates used in the preparation of our consolidated financial statements. We have discussed the application of these critical accounting estimates with our Board of Directors and Audit Committee. Revenue Recognition Majority of the Group's sales...

-

Page 100

... for an upfront cash payment. The financial impact of the customer financing related assumptions mainly affects the Nokia Siemens Networks business. See also Note 34(b) to our consolidated financial statements included in Item 18 of this annual report for a further discussion of long-term loans to...

-

Page 101

... inventory was EUR 471 million at the end of 2012 (EUR 457 million at the end of 2011). The financial impact of the assumptions regarding this allowance affects mainly the cost of sales of the Devices & Services and Nokia Siemens Networks businesses. During 2012 the Group also recognized an expense...

-

Page 102

... well as the assumptions and estimates used to determine the cash inflows and outflows. Management determines the discount rates to be used based on the risk inherent in the related activity's current business model and industry comparisons. Terminal values are based on the expected life of products...

-

Page 103

... by management are based on information available, to reflect the present value of the future cash flows expected to be derived through the continuing use of the Smart Devices CGU and the Mobile Phones CGU. The recoverable amounts for the Location & Commerce CGU and the Nokia Siemens Networks CGU...

-

Page 104

... impairment testing for each year indicated are presented in the table below:

Smart Devices % 2012 2011 Cash generating units Mobile Location & Nokia Siemens Phones Commerce Networks % % % 2012 2011 2012 2011 2012 2011

Terminal growth rate ...2.3 1.9 (2.3) 1.5 1.7 3.1 0.7 Post-tax discount rate...

-

Page 105

...annual report for further information regarding "Valuation of long-lived and intangible assets and goodwill." Fair Value of Derivatives and Other Financial Instruments The fair value of financial instruments that are not traded in an active market, for example unlisted equities, are determined using...

-

Page 106

... Devices & Services and Nokia Siemens Networks businesses. Share-based Compensation We have various types of equity-settled share-based compensation schemes for employees mainly in Devices & Services and Location & Commerce. Employee services received, and the corresponding increase in equity, are...

-

Page 107

...employees of Nokia Siemens Networks, which are accounted for as cash-settled. Related employee services received, and the liability incurred, are measured at the fair value of the liability. The fair value of stock options is estimated based on the reporting date market value less the exercise price...

-

Page 108

... comparison, the 10 markets in which we generated the greatest net sales in 2011 were China, India, Brazil, Russia, Germany, Japan, the United States, the United Kingdom, Italy and Spain, together representing approximately 52% of total net sales in 2011. Gross Margin Our gross margin in 2012 was 27...

-

Page 109

...our Devices & Services business, which was partially offset by an increase in the operating performance of Nokia Siemens Networks. Our 2012 operating margin was negative 7.6% compared to negative 2.8% in 2011. Our operating loss in 2012 included purchase price accounting items, restructuring charges...

-

Page 110

...geographical distribution as well as new product launches, but were negatively affected in the third quarter 2012 by product transitions. In the fourth quarter 2012, Smart Devices net sales grew sequentially as we started shipping new Lumia devices, although volumes were adversely affected by supply...

-

Page 111

... aggressive price competition and the lack of affordable full touch devices. Towards the end of the second quarter 2012 Mobile Phones introduced affordable Asha full touch smartphones and sold 15.8 million units in the second half 2012. Our overall Devices & Services net sales in 2012 benefited from...

-

Page 112

...items and purchase price accounting related items, by the end of 2013. In June, 2012, we announced additional restructuring measures to those announced in 2011, including targeted investments in key growth areas, operational changes, divestment of non-core assets and significantly increased our cost...

-

Page 113

... and Mobile Phones. Smart Devices The following table sets forth selective line items for Smart Devices for the fiscal years 2012 and 2011.

Year Ended December 31, 2012 Change 2011 to 2012 Year Ended December 31, 2011

Net sales (EUR millions)(1) ...Smart Devices volume (millions units) ...Smart...

-

Page 114

...in our Mobile Phones gross margin in 2012 was primarily due to a higher proportion of sales of lower gross margin devices as well as the net negative impact related to foreign currency fluctuations. Location & Commerce As of January 1, 2013 our Location & Commerce business and reportable segment was...

-

Page 115

...licenses to vehicle customers, partially offset by lower sales to personal navigation devices customers. The year-on-year decline in Location & Commerce internal net sales was primarily due to lower sales related to the large decline in our Symbian device volumes experienced since 2010. Gross Margin...

-

Page 116

Location & Commerce sales and marketing expenses decreased 28% primarily driven by a focus on cost controls and lower marketing spending. Location & Commerce administrative and general expenses increased 13% primarily driven by higher use of services provided by shared support functions. In 2012, ...

-

Page 117

...the services business with the focused strategy. Operating Expenses Nokia Siemens Networks' research and development expenses decreased 6% year-on-year in 2012 primarily due to structural cost saving actions and overall research and development efficiency. Nokia Siemens Networks' sales and marketing...

-

Page 118

... mobile products market continued to see volume growth in 2011, our net sales and profitability were negatively affected by the increasing momentum of competing smartphone platforms relative to our Symbian smartphones in all regions as we embarked on our platform transition to Windows Phone, as well...

-

Page 119

..., the 10 markets in which we generated the greatest net sales in 2010 were China, India, Germany, Russia, the United States, Brazil, the United Kingdom, Spain, Italy and Indonesia, together representing approximately 52% of total net sales in 2010. Gross Margin Our gross margin in 2011 was 29...

-

Page 120

...related to hedging our cash balances, as well as higher costs related to Nokia Siemens Networks' financing. Our net debt to equity ratio was negative 40% at December 31, 2011, compared with a net debt to equity ratio of negative 43% at December 31, 2010. See Item 5B. "Liquidity and Capital Resources...

-

Page 121

... selective line items and the percentage of net sales that they represent for Devices & Services for the fiscal years 2011 and 2010.

Year Ended December 31, 2011 Year Ended Percentage of December 31, Percentage of Net Sales 2010 Net Sales (EUR millions, except percentage data) Percentage Increase...

-

Page 122

... 2011. Devices & Services net sales increased sequentially in the fourth quarter 2011, supported by broader product renewal in both Mobile Phones, for example dual SIM devices, and Smart Devices as well as overall industry seasonality. Our overall Devices & Services net sales in 2011 benefited...

-

Page 123

... product development to bring new innovations to the market faster and at lower price-points, consistent with the Mobile Phones "Internet for the next billion" strategy. This increase was partially offset by a focus on priority projects and cost controls. Devices & Services research and development...

-

Page 124

....6 million units in 2010. The year-on-year decrease in our Smart Device volumes in 2011 was driven by the strong momentum of competing smartphone platforms relative to our higher priced Symbian devices, particularly in Europe and Asia Pacific, as well as pricing tactics by certain of our competitors...

-

Page 125

... the market, and pressure from a variety of price aggressive competitors, which adversely affected our Mobile Phones volumes. During 2011, Mobile Phones volumes were also negatively affected by our reduced portfolio of higher priced feature phones, as well as by distributors and operators purchasing...

-

Page 126

... of 2011, a negative impact from foreign currency hedging and the appreciation of the euro against certain currencies, which were partially offset by a product mix shift towards higher margin feature phones. Location & Commerce As of January 1, 2013 our Location & Commerce business and reportable...

-

Page 127

... on cost controls, partially offset by increased depreciation costs related to closure of offices. Operating Margin Location & Commerce operating loss increased to EUR 1 526 million in 2011, compared with a loss of EUR 663 million in 2010. Location & Commerce operating margin in 2011 was negative...

-

Page 128

...selective line items and the percentage of net sales that they represent for Nokia Siemens Networks for the fiscal years 2011 and 2010.

Year Ended December 31, 2011 Year Ended Percentage of December 31, Percentage of Net Sales 2010 Net Sales (EUR millions, except percentage data) Percentage Increase...

-

Page 129

... 2011, Nokia Siemens Networks announced its current strategy to focus on mobile broadband and services and the launch of an extensive global restructuring program. 5B. Liquidity and Capital Resource At December 31, 2012, our cash and other liquid assets (bank and cash; available-for-sale investments...

-

Page 130

... further information regarding our long-term liabilities, see Note 16 to our consolidated financial statements included in Item 18 of this annual report. Our ratio of net interestbearing debt, defined as short-term and long-term debt less cash and other liquid assets, to equity, defined as capital...

-

Page 131

... in 2012 resulted primarily from site consolidation and increased efficiency. Principal capital expenditures during the three years included production lines, test equipment and computer hardware used primarily in research and development, office and manufacturing facilities as well as services and...

-

Page 132

... long-term loans to network operators. See Note 34(b) to our consolidated financial statements included in Item 18 of this annual report for further information relating to our committed and outstanding customer financing. We continue to make arrangements with financial institutions and investors...

-

Page 133

... consolidated financial statements included in Item 18 of this annual report for further information regarding commitments and contingencies. 5C. Research and Development, Patents and Licenses Success in the mobile communications industry requires continuous introduction of new products and services...

-

Page 134

... Companies Act and our Articles of Association, the control and management of Nokia is divided among the shareholders at a general meeting, the Board of Directors (or the "Board"), the President and CEO, and the Nokia Leadership Team chaired by the President and CEO. Board of Directors The current...

-

Page 135

... of New York University). Various executive and managerial positions in Baby Care, Feminine Care, and Beauty Care units of The Procter & Gamble Company since 1980 in the United States, Germany and Japan. Member of the Board of Directors of Agency for Science, Technology & Research (A*STAR). Strategy...

-

Page 136

... positions at ABB Group Limited from 1987, including Executive Vice President, Head of Automation Technology Products Division and Member of Group Executive Committee 2000-2002, Senior Vice President, Business Area Automation Power Products 1998-2000, Vice President, Business Unit Drives Products...

-

Page 137

...nieurs, Paris). Director of Shared Services of L'Oréal Group 2010-2011. Chief Financial Officer, Executive Vice President in charge of strategy of PSA Peugeot Citroën 2007-2009. COO, Intellectual Property and Licensing Business Unit of Thomson 2006-2007. Vice President Corporate Planning at Saint...

-

Page 138

...a one-year term from the Annual General Meeting 2013 until the close of the Annual General Meeting 2014. The Committee will propose that the number of Board members be ten and that the following current Nokia Board members be re-elected as members of the Nokia Board of Directors for a term until the...

-

Page 139

... our Articles of Association, the Nokia Leadership Team is responsible for the operative management of the Company. The Chairman and members of the Nokia Leadership Team are appointed by the Board of Directors. Only the Chairman of the Nokia Leadership Team, the President and Chief Executive Officer...

-

Page 140

... 2010-2011. Senior Vice President, Smartphones Product Management, Nokia 2009. Vice President, Live Category, Nokia 2008-2009. Senior Vice President, Marketing, Mobile Phones, Nokia 2006-2007. Vice President, Marketing, North America, Mobile Phones, Nokia 2003-2005. Marketing, sales and management...

-

Page 141

... Telephone Business Unit, Nokia 2000-2002. Vice President, Corporate Planning and Business Development 1997-2000. Managerial positions at Hewlett-Packard Company 1986-1997. Henry Tirri, b. 1956 Executive Vice President, Chief Technology Officer. Nokia Leadership Team member since 2011. Joined Nokia...

-

Page 142

... Business Development Manager and Controller, Customer Services, Nokia Cellular Systems 1994-1995. Project Manager, Nokia Telecom AB (Sweden) 1993-1994. Member of the Board of Directors of Nokia Siemens Networks B.V. Member of the Board of Directors of The Federation of Finnish Technology Industries...

-

Page 143

... executive officers and describes our compensation policies and actual compensation for the Nokia Leadership Team as well as our use of equity-based incentives. Board of Directors The following table sets forth the annual remuneration of the members of the Board of Directors for service on the Board...

-

Page 144

... of the President and CEO is described below in "-Executive Compensation-Actual Executive Compensation for 2012-Summary Compensation Table 2012". The remuneration of the Board of Directors is set annually by our Annual General Meeting by a resolution of a simple majority of the shareholders' votes...

-

Page 145

... of the Annual General Meeting in 2012 during fiscal year 2011. For their compensation in 2011 see Note 31 to our consolidated financial statements included in Item 18 of this annual report. (4) Represents the fee paid to Marjorie Scardino for service as Vice Chairman of the Board. (5) Stephen Elop...

-

Page 146

... 2011. Specifically, our programs are designed to incorporate specific measures that align directly with the execution of our strategy; deliver an appropriate amount of performance-related variable compensation for the achievement of strategic goals and financial targets in both the short- and long...

-

Page 147

... implemented in 2012. Components of Executive Compensation Our compensation program for executive officers includes annual cash compensation in the form of a base salary and short-term cash incentives as well as long-term equity-based incentive awards in the form of performance shares, stock options...

-

Page 148

... Team are eligible for the additional Total Shareholder Return element. For Stephen Elop, Total Shareholder Return was measured in the one-time special CEO incentive program approved by the Board of Directors for the two-year period 2011-2012. Annual incentive cash bonus under the Nokia short-term...

-

Page 149

... "Share Ownership." Actual Executive Compensation for 2012 Service Contracts Stephen Elop's service contract covers his position as President and CEO as from September 21, 2010. As at December 31, 2012, Mr. Elop's annual base salary, which is subject to an annual review by the Board of Directors and...

-

Page 150

... Board of Directors decided in March 2011 that in order to align Mr. Elop's compensation to increased shareholder value and to link a meaningful portion of his compensation directly to the performance of Nokia's share price over the period of 2011-2012, his compensation structure for 2011 and 2012...

-

Page 151

..." and "Compensation-Executive Compensation-Equity Grants in 2012." Pension Arrangements for the Members of the Nokia Leadership Team The members of the Nokia Leadership Team participate in the local retirement programs applicable to employees in the country where they reside. Executives in Finland...

-

Page 152

... relevant plan rules. For a description of our equity plans, see Note 24 to our consolidated financial statements included in Item 18 of this annual report. (2) For performance shares granted under Nokia Performance Share Plans, at maximum performance, the settlement amounts to four times the number...

-

Page 153

... Michael Halbherr, EVP, Location & Commerce ...2012 Louise Pentland, EVP, Chief Legal Officer(8) ...2012 Mary T. McDowell, EVP, Mobile Phones until June 30, 2012(8)(14) ...2012 2011 2010 Niklas Savander, EVP, Markets until June 30, 2012(14) ...2012 2011 2010 570 690 57 750 539 300 106 575 550 000...

-

Page 154

... and for mobile phone and driver. (8) Salaries, benefits and perquisites for Ms. Harlow, Ms. Pentland and Ms. McDowell were paid and denominated in GBP and USD. Amounts were converted using year-end 2012 USD/EUR exchange rate of 1.28 and GBP/EUR rate of 0.80. For year 2011 disclosure, amounts...

-

Page 155

... Share Plan 2012 and the Nokia Restricted Share Plan 2012. (2) The fair value of stock options equals the estimated fair value on the grant date, calculated using the Black-Scholes model. The stock option exercise price was EUR 2.44 on May 11, 2012. NASDAQ OMX Helsinki closing market price...

-

Page 156

... Board of Directors. For a more detailed description of all of our equity-based incentive plans, see Note 24 to our consolidated financial statements included in Item 18 of this annual report. Performance Shares During 2012, we administered four global performance share plans, the Performance Share...

-

Page 157

...vesting four years from grant. The stock options granted under the 2011 plan have a term of approximately six years. For information on stock option exercise prices, exercise periods and expiry dates, see Note 24 to our consolidated financial statements included in Item 18 of this annual report. 156

-

Page 158

... the Board of Directors approved also the implementation of a new Employee Share Purchase Plan. Similarly to the earlier broad-based equity incentive programs, the Equity Program 2013 is designed to support the participants' focus and alignment with the company's strategy and targets. Nokia's use of...

-

Page 159

... Annual General Meeting in 2011. For more information about the Stock Option Plan 2011 see "Equity-Based Incentive Programs - Stock Options" above. Restricted Shares Restricted shares under the Restricted Share Plan 2013 approved by the Board of Directors are used as described above on a selective...

-

Page 160

...Nokia Equity Program 2013 (i.e. performance shares, stock options, restricted shares as well as matching share awards under the Employee Share Purchase Plan) in 2013 are set forth in the table below.

Plan type Planned Maximum Number of Shares Available for Grants under the Equity Program 2013

Stock...

-

Page 161

... legal compliance and the management of risks related to Nokia's operations. In doing so, the Board may set annual ranges and/or individual limits for capital expenditures, investments and divestitures and financial commitments not to be exceeded without Board approval. Nokia has a Risk Policy...

-

Page 162

...under both Finnish standards and the rules of the New York Stock Exchange due to his position as CEO of Eucalyptus Systems, Inc., which has a business relationship with and receives revenue from Nokia Siemens Networks. The executive member of the Board, President and CEO Stephen Elop, was determined...

-

Page 163

...-Actual Executive Compensation for 2012-Service Contracts." Committees of the Board of Directors The Audit Committee consists of a minimum of three members of the Board who meet all applicable independence, financial literacy and other requirements of Finnish law and the rules of the stock exchanges...

-

Page 164

... consists of a minimum of three members of the Board who meet all applicable independence requirements of Finnish law and the rules of the stock exchanges where Nokia shares are listed, i.e. NASDAQ OMX Helsinki and the New York Stock Exchange. Since May 3, 2012, the Personnel Committee has consisted...

-

Page 165

...-Executive Compensation." The Corporate Governance and Nomination Committee consists of three to five members of the Board who meet all applicable independence requirements of Finnish law and the rules of the stock exchanges where Nokia shares are listed, i.e. NASDAQ OMX Helsinki and the New York...

-

Page 166

... Board of Directors in 2012." The Nokia Leadership Team members receive equity-based compensation in the form of performance shares, stock options and restricted shares. For a description of our equity-based compensation programs for employees and executives, see Item 6B. "Compensation-Equity-Based...

-

Page 167

... Stock options or other equity awards that are deemed as being beneficially owned under the applicable SEC rules are not included. For the number of shares or ADSs received as director compensation, see Note 31 to our consolidated financial statements included in Item 18 of this annual report. Share...

-

Page 168

... number of shares and total voting rights of the company, excluding shares held by Nokia Group. (3) The percentage is calculated in relation to the total outstanding equity incentives per instrument. (4) No Nokia shares were delivered under Nokia Performance Share Plan 2010, which vested in 2012...

-

Page 169

... Nokia Stock Option Plans 2007 and 2011. For a description of our stock option plans, please see Note 24 to our consolidated financial statements in Item 18 of this annual report.

Total Intrinsic Value of Exercise Stock Options, Price Number of Stock December 28, 2012 per (1) Options (EUR)(2) Share...

-

Page 170

... (2) The intrinsic value of the stock options is based on the difference between the exercise price of the options and the closing market price of Nokia shares on NASDAQ OMX Helsinki as at December 28, 2012 of EUR 2.93. (3) For any gains realized upon exercise of stock options for the members of the...

-

Page 171

...Aho. The information related to stock options held for each former executive is as of the date of resignation from the Nokia Leadership Team and is presented in the table below.

Stock Option Category Total Intrinsic Value of Exercise Number of Stock Stock Options Price Options(1) (EUR)(8) Share (EUR...

-

Page 172

...-time special CEO incentive program. For a description of our performance share and restricted share plans, please see Note 24 to the consolidated financial statements in Item 18 of this annual report.

Performance Shares Restricted Shares Number of Number of Performance Performance Intrinsic Value...

-

Page 173

...made under these plans, the restriction period will end for the 2009 plan on January 1, 2013; for the 2010 plan on January 1, 2014; for the 2011 plan on January 1, 2015; and for the 2012 plan on July 1, 2016. (8) The intrinsic value is based on the closing market price of a Nokia share on NASDAQ OMX...

-

Page 174

... Mr. Savander's and Mr. Aho's stock option grants were forfeited and cancelled upon their respective terminations of employment in accordance with the plan rules. (12) The intrinsic value is based on the closing market price of a Nokia share on NASDAQ OMX Helsinki as at June 29, 2012 of EUR 1.62 in...

-

Page 175

... certain information relating to stock option exercises and share deliveries upon settlement during the year 2012 for our Nokia Leadership Team members.

Stock Options Awards(1) Number of Value Shares Realized on Acquired on Exercise Exercise (EUR) Performance Shares Awards(2) Number of Value Shares...

-

Page 176

... goals of our long-term equity-based incentive program is to focus executives on promoting the long-term value sustainability of the company and on building value for shareholders on a longterm basis. In addition to granting stock options, performance shares and restricted shares, we also encourage...

-

Page 177

... under common control with Nokia or associates of Nokia. See Note 31 to our consolidated financial statements included in Item 18 of this annual report. 7C. Interests of Experts and Counsel Not applicable. ITEM 8. FINANCIAL INFORMATION

8A. Consolidated Statements and Other Financial Information 8A1...

-

Page 178

... and sale in the United States. We believe that the allegations of IDT described above are without merit and we intend to pursue all available defenses and legal options in this matter. IPCom From December 2007 onwards, IPCom filed actions against Nokia and members of the Nokia Leadership Team in...

-

Page 179

... a new patent license agreement. The agreement resulted in settlement of all existing patent litigation between the companies and withdrawal of pending actions in the US, UK and Canada related to the arbitration tribunal decision. The financial structure of the license agreement includes a one-time...

-

Page 180

... two of its executives as defendants. In summary the complaint alleged that from October 26, 2011 to April 10, 2012, false positive statements were made about Nokia's financial outlook and growth prospects in relation to the conversion to a Windows Phone-based operating system for smartphones. After...

-

Page 181

...v. Nokia was filed in the United States District Court for the Southern District of New York. The complaint named Nokia Corporation, certain Nokia Corporation Board members, Fidelity Management Trust Co., The Nokia Retirement Savings & Investment Plan Committee and the Plan Administrator, as well as...

-

Page 182

... and Article 53 EEA Agreement) by entering into a worldwide conspiracy to raise and/or stabilize the prices of CRTs, among other anticompetitive conduct, from no later than March 1995 to around November 2007. During the Cartel Period, Nokia, through its subsidiary Nokia Display Products Oy, engaged...

-

Page 183

... business and results of operations. ITEM 9. THE OFFER AND LISTING

9A. Offer and Listing Details Our capital consists of shares traded on NASDAQ OMX Helsinki under the symbol "NOK1V." American Depositary Shares, or ADSs, each representing one of our shares, are traded on the New York Stock Exchange...

-

Page 184

... 3.54

9B. Plan of Distribution Not applicable. 9C. Markets The principal trading markets for the shares are the New York Stock Exchange, in the form of ADSs, and NASDAQ OMX Helsinki, in the form of shares. Nokia also maintained a listing at the Frankfurt Stock Exchange in the year 2012 but decided...

-

Page 185

... the development, manufacture, marketing and sales of mobile devices, other electronic products and telecommunications systems and equipment as well as related mobile, Internet and network infrastructure services and other consumer and enterprise services. Nokia may also create, acquire and license...

-

Page 186

... proportion of voting rights or number of shares to reach, exceed or fall below the above mentioned limits. Upon receiving such notice, the company shall disclose it by a stock exchange release without undue delay. Purchase Obligation Our Articles of Association require a shareholder that holds one...

-

Page 187

...the prices paid for the security in public trading during the preceding three months weighted by the volume of trade. Under the Finnish Companies Act (2006/624), as amended, a shareholder whose holding exceeds nine-tenths of the total number of shares or voting rights in Nokia has both the right and...

-

Page 188

...) 10% or more of the share capital or voting stock of Nokia, persons who acquired their ADSs pursuant to the exercise of employee stock options or otherwise as compensation, or persons whose functional currency is not the US dollar, who may be subject to special rules that are not discussed herein...

-

Page 189

...that are shareholders in a PFIC generally will be required to file an annual report disclosing the ownership of such shares and certain other information as yet to be determined. US Holders should consult their own tax advisors regarding the application of the PFIC rules (including the new reporting...

-

Page 190

...birth or business ID (if applicable) and address in the country of residence. US and Finnish Tax on Sale or Other Disposition A US Holder generally will recognize taxable capital gain or loss on the sale or other disposition of ADSs in an amount equal to the difference between the US dollar value of...

-

Page 191

... Revenue Service and furnishing any required information. 10F. Dividends and Paying Agents Not applicable. 10G. Statement by Experts Not applicable. 10H. Documents on Display The documents referred to in this annual report can be read at the Securities and Exchange Commission's public reference...

-

Page 192

...this annual report for information on market risk. ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES 12D. American Depositary Shares 12D.3 Depositary Fees and Charges Our American Depositary Shares, or ADSs, each representing one of our shares, are traded on the New York Stock Exchange...

-

Page 193

... our consolidated financial statements for the year ended December 31, 2012, has issued an attestation report on the effectiveness of the company's internal control over financial reporting under Auditing Standard No. 5 of the Public Company Accounting Oversight Board (United States of America...

-

Page 194

... 303A.02 of the New York Stock Exchange's Listed Company Manual. ITEM 16B. CODE OF ETHICS We have adopted a code of ethics that applies to our Chief Executive Officer, President, Chief Financial Officer and Corporate Controller. This code of ethics is available on our website, www.nokia.com at the...

-

Page 195

... accounting, data security, investigations and reviews of licensing arrangements with customers, other consulting services and occasional training or reference materials and services. Audit Committee Pre-Approval Policies and Procedures The Audit Committee of our Board of Directors is responsible...

-

Page 196

... the United States, commonly use such shares. The Restricted Share Plans also promote employee share ownership, and are used in conjunction with the Performance Share and Stock Option Plans. ITEM 16H. MINE SAFETY DISCLOSURE Not applicable. PART III ITEM 17. FINANCIAL STATEMENTS Not applicable. ITEM...

-

Page 197

... Articles of Association of Nokia Corporation. See Note 28 to our consolidated financial statements included in Item 18 of this annual report for information on how earnings per share information was calculated. List of significant subsidiaries. Certification of Stephen Elop, Chief Executive Officer...

-

Page 198

... related bodies have agreed to cooperate on the production of globally applicable technical specifications for a third generation mobile system. Access network: A telecommunications network between a local exchange and the subscriber station. ADSL (asymmetric digital subscriber line): A technology...

-

Page 199

... former Location & Commerce business and reportable segment and also the brand for the location-based products and services we build for a broad range of devices and operating systems, including our Lumia smartphones. HSPA (High-Speed Packet Access): A wideband code division multiple access feature...

-

Page 200

... receiver. Open source: Refers to a program in which the source code is available to the general public for use and modification from its original design free of charge. Operating system (OS): Software that controls the basic operation of a computer or a mobile device, such as managing the processor...

-

Page 201

... use the Windows Phone platform. We are contributing our expertise on hardware, design and language support, and plan to bring Windows Phone to a broad range of price points, market segments and geographies. WiMAX (Worldwide Interoperability for Microwave Access): A technology of wireless networks...

-

Page 202

... of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was...

-

Page 203

Nokia Corporation and Subsidiaries Consolidated Income Statements

Notes Financial year ended December 31 2012 2011 2010 EURm EURm EURm

Net sales ...Cost of sales ...Gross profit ...Research and development expenses ...Selling and marketing expenses ...Administrative and general expenses ......

-

Page 204

... Consolidated Statements of Comprehensive Income

Notes Financial year ended December 31 2012 2011 2010 EURm EURm EURm

(Loss) profit ...Other comprehensive income (expense) Items that may be reclassified subsequently to profit or loss Translation differences ...Net investment hedges ...Cash...

-

Page 205

... for doubtful accounts (2012: EUR 248 million, 2011: EUR 284 million) ...Prepaid expenses and accrued income ...Current portion of long-term loans receivable ...Other financial assets ...Investments at fair value through profit and loss, liquid assets ...Available-for-sale investments, liquid...

-

Page 206

... and Subsidiaries Consolidated Statements of Cash Flows

Financial year ended December 31 2012 2011 2010 EURm EURm EURm

Notes

Cash flow from operating activities (Loss) profit attributable to equity holders of the parent ...Adjustments, total ...Change in net working capital ...Cash generated from...

-

Page 207

Nokia Corporation and Subsidiaries Consolidated Statements of Cash Flows (Continued)

Notes Financial year ended December 31 2012 2011 2010 EURm EURm EURm

Cash and cash equivalents comprise of: Bank and cash ...Current available-for-sale investments, cash equivalents ...

3 504 16, 34 5 448 8 952

1 ...

-

Page 208

Nokia Corporation and Subsidiaries Consolidated Statements of Changes in Shareholders' Equity

Reserve for Before Number of Share Fair value invested nonNonshares Share issue Treasury Translation and other non-restrict. Retained controlling controlling (000's) capital premium shares differences ...

-

Page 209

Nokia Corporation and Subsidiaries Consolidated Statements of Changes in Shareholders' Equity (Continued)

Reserve for Before Number of Share Fair value invested nonNonshares Share issue Treasury Translation and other non-restrict. Retained controlling controlling (000's) capital premium shares ...

-

Page 210

... to the consolidated financial statements also conform to Finnish accounting legislation. Nokia's Board of Directors authorized the financial statements for 2012 for issuance and filing on March 7, 2013. As of April 1, 2011, the Group's operational structure featured two new operating and reportable...

-

Page 211

... and financial policies of the entity through agreement or the Group has the power to appoint or remove the majority of the members of the board of the entity. The Group's share of profits and losses of associates is included in the consolidated income statement in accordance with the equity method...

-

Page 212

... valued at the rates of exchange prevailing at the end of the accounting period. Foreign exchange gains and losses arising from statement of financial position items are reported in financial income and expenses. Unrealized foreign exchange gains and losses related to non-current available-for-sale...

-

Page 213

... probable and can be estimated reliably. Shipping and handling costs The costs of shipping and distributing products are included in cost of sales. Research and development Research and development costs are expensed as they are incurred as they do not meet the criteria for capitalization. F-12

-

Page 214

... benefit plans, pension costs are assessed using the projected unit credit method: Pension cost is recognized in the income statement so as to spread the service cost over the service lives of employees. Pension obligation is measured as the present value of the estimated future cash outflows using...

-

Page 215

... operating lease contracts. The related payments are treated as rentals and recognized in the income statement on a straight-line basis over the lease terms unless another systematic approach is more representative of the pattern of the user's benefit. Inventories Inventories are stated at the...

-

Page 216

... in publicly quoted equity shares are measured at fair value using exchange quoted bid prices. Other available-for-sale investments carried at fair value include holdings in unlisted shares. Fair value is estimated by using various factors, including, but not limited to: (1) the current market value...

-

Page 217

... statement of financial position under longterm loans receivable and the current portion under current portion of long-term loans receivable. Bank and cash Bank and cash consist of cash at bank and in hand. Accounts receivable Accounts receivable are carried at the original amount due from customers...

-

Page 218

... same manner as the cash flows of the position being hedged. Derivatives not designated in hedge accounting relationships carried at fair value through profit and loss Forward foreign exchange contracts are valued at the market forward exchange rates. Changes in fair value are measured by comparing...

-

Page 219

... in fair value and other reserves. The gain or loss related to the ineffective portion is recognized immediately in profit and loss as financial income and expenses. For hedging instruments closed before the maturity date of the related liability, hedge accounting will immediately discontinue...

-

Page 220

... in profit and loss in financial income and expenses. For qualifying foreign exchange options, the change in intrinsic value is deferred in translation differences within consolidated shareholder's equity. Changes in the time value are at all times recognized directly in profit and loss as financial...

-

Page 221

... are accounted for as cash-settled. Related employee services received, and the liability incurred, are measured at the fair value of the liability. The fair value of stock options is estimated based on the reporting date market value less the exercise price of the stock options. The fair value of...

-

Page 222

... Dividends proposed by the Board of Directors are not recorded in the financial statements until they have been approved by the shareholders at the Annual General Meeting. Earnings per share Basic earnings per share is calculated by dividing the profit attributable to equity holders of the parent...

-

Page 223

...a limited number of customer financing arrangements and agreed extended payment terms with selected customers. Should actual financial position of the customers or general economic conditions differ from assumptions, the ultimate collectability of such financings and trade credits may be required to...

-

Page 224