MoneyGram 2010 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

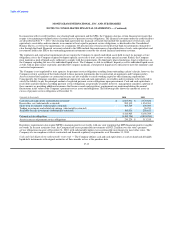

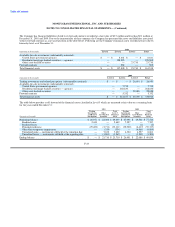

Receivables, net (substantially restricted) — The Company has receivables due from financial institutions and agents for payment

instruments sold and amounts advanced by the Company to certain agents for operational and local regulatory compliance purposes.

These receivables are outstanding from the day of the sale of the payment instrument until the financial institution or agent remits the

funds to the Company. The Company provides an allowance for the portion of the receivable estimated to become uncollectible as

determined based on known delinquent accounts and historical trends. Receivables are generally considered past due one day after the

contractual remittance schedule, which is typically one to three days after the sale of the underlying payment instrument. Receivables are

evaluated for collectability by examining the facts and circumstances surrounding each customer where an account is delinquent and a

loss is deemed possible. Receivables are generally written off against the allowance one year after becoming past due. Following is a

summary of activity within the allowance for losses:

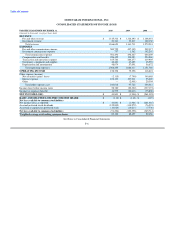

(Amounts in thousands) 2010 2009 2008

Beginning balance $ 24,535 $ 16,178 $ 8,019

Charged to expense 6,404 21,432 12,396

Write-offs, net of recoveries (10,968) (13,075) (4,237)

Ending balance $ 19,971 $ 24,535 $ 16,178

Investments (substantially restricted) — The Company classifies securities as short-term, trading or available-for-sale in its Consolidated

Balance Sheets. The Company has no securities classified as held-to-maturity. Time deposits and certificates of deposits with original

maturities of greater than three months are classified as short-term investments and recorded at amortized cost. Securities that are bought

and held principally for the purpose of resale in the near term are classified as trading securities. The Company records trading securities

at fair value, with gains or losses reported in the Consolidated Statements of Income (Loss). Securities held for indefinite periods of time,

including any securities that may be sold to assist in the clearing of payment service obligations or in the management of the investment

portfolio, are classified as available-for-sale securities. These securities are recorded at fair value, with the net after-tax unrealized gain or

loss recorded as a separate component of stockholders' deficit. Realized gains and losses and other-than-temporary impairments are

recorded in the Consolidated Statements of Income (Loss).

Interest income on "Residential mortgage-backed securities" for which risk of credit loss is deemed remote is recorded utilizing the level

yield method. Changes in estimated cash flows, both positive and negative, are accounted for with retrospective changes to the carrying

value of investments in order to maintain a level yield over the life of the investment. Interest income on mortgage-backed securities for

which risk of credit loss is not deemed remote is recorded under the prospective method as adjustments of yield.

Starting in the second quarter of 2008, the Company applies the cost recovery method of accounting for interest to its investments

categorized as "Other asset-backed securities." The cost recovery method accounts for interest on a cash basis and treats any interest

payments received as deemed recoveries of principal, reducing the book value of the related security. When the book value of the related

security is reduced to zero, interest payments are then recognized as income upon receipt. The Company began applying the cost recovery

method of accounting as it believes it is probable that the Company will not recover all, or substantially all, of its principal investment

and interest for its "Other asset-backed securities" given the sustained deterioration in the market, the collapse of many asset-backed

securities and the low levels to which the securities have been written down.

F-14