MoneyGram 2010 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

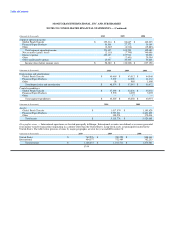

Note 14 — Income Taxes

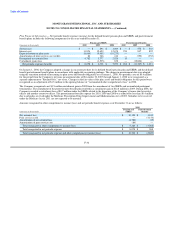

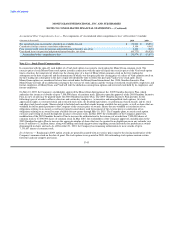

The components of income (loss) before income taxes are as follows for the year ended December 31:

(Amounts in thousands) 2010 2009 2008

United States $ 56,872 $ (19,975) $ (345,063)

Foreign 1,508 (2,347) 7,872

Income (loss) before income taxes $ 58,380 $ (22,322) $ (337,191)

International income consists of statutory income and losses from the Company's international subsidiaries. Most of the Company's

wholly owned subsidiaries recognize revenue based solely on services agreements with MPSI. Income tax expense (benefit) is as follows

for the year ended December 31:

(Amounts in thousands) 2010 2009 2008

Current:

Federal $ (757) $ (8,172) $ (55,980)

State 147 669 (8,064)

Foreign 5,166 2,002 (13,938)

Current income tax expense (benefit) 4,556 (5,501) (77,982)

Deferred income tax expense (benefit) 10,023 (14,915) 2,176

Income tax expense (benefit) $ 14,579 $ (20,416) $ (75,806)

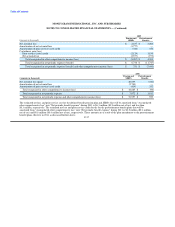

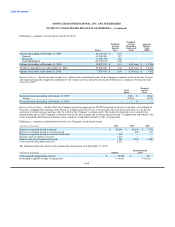

As of December 31, 2010 and 2009, the Company had a net income tax payable of $6.3 million recorded in the "Accounts payable and

other liabilities" line in the Consolidated Balance Sheets and a net income tax receivable of $1.3 million recorded in the "Other assets"

line in the Consolidated Balance Sheets, respectively. The Company received a $3.8 million federal income tax refund in 2010 and a

$43.5 million federal income tax refund in 2009. Income taxes paid were $3.9 million, $2.2 million and $1.7 million for 2010, 2009 and

2008, respectively.

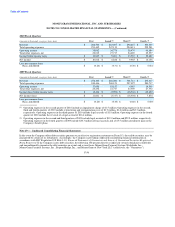

A reconciliation of the expected federal income tax at statutory rates for year ended to the actual taxes provided is as follows:

(Amounts in thousands) 2010 2009 2008

Income tax at statutory federal income tax rate $ 20,433 $ (7,813) $ (118,017)

Tax effect of:

State income tax, net of federal income tax effect 1,309 2,051 1,634

Valuation allowance (10,016) (16,090) 44,639

Non-taxable loss on embedded derivatives — — 5,611

Decrease in tax reserve (377) (2,469) (7,761)

Other 3,230 3,905 (1,186)

14,579 (20,416) (75,080)

Tax-exempt income — — (726)

Income tax expense (benefit) $ 14,579 $ (20,416) $ (75,806)

F-46