MoneyGram 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

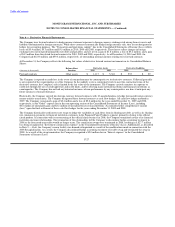

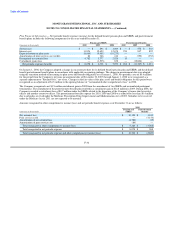

Senior Facility — On March 25, 2008, the Company's wholly owned subsidiary MoneyGram Payment Systems Worldwide, Inc.

("Worldwide") entered into a senior secured amended and restated credit agreement of $600.0 million with JPMorgan Chase Bank, N.A.

("JPMorgan") as Administrative Agent for a group of lenders (the "senior facility"). The senior facility was composed of a $100.0 million

tranche A term loan ("Tranche A"), a $250.0 million tranche B term loan ("Tranche B") and a $250.0 million revolving credit facility,

each of which matures in March 2013. Tranche B was issued by the Company at a discount of 93.5 percent, or $16.3 million, which was

recorded as a reduction to the carrying value of Tranche B and is being amortized over the life of the debt using the effective interest

method. A portion of the proceeds from the issuance of Tranche B was used to repay $100.0 million of the revolving credit facility on

March 25, 2008.

The Company may elect an interest rate for the senior facility at each reset period based on the United States prime bank rate or the

Eurodollar rate. The interest rate election may be made individually for each term loan and each draw under the revolving credit facility.

For Tranche A and the revolving credit facility, the interest rate is either the United States prime bank rate plus 250 basis points or the

Eurodollar rate plus 350 basis points. For Tranche B, the interest rate is either the United States prime bank rate plus 400 basis points or

the Eurodollar rate plus 500 basis points. Under the terms of the senior facility, the interest rate determined using the Eurodollar index has

a minimum rate of 2.50 percent. Fees on the daily unused availability under the revolving credit facility are 50 basis points. Substantially

all of the Company's non-financial assets are pledged as collateral for the loans under the senior facility, with the collateral guaranteed by

the Company's material domestic subsidiaries. The non-financial assets of the material domestic subsidiaries are pledged as collateral for

these guarantees.

During 2010 and 2009, the Company elected the United States prime bank rate as its interest basis. In 2010 and 2009, the Company

prepaid $165.0 million and $40.0 million, respectively, of its Tranche B loan. In 2009, the Company also paid $1.9 million of mandatory

quarterly Tranche B payments. All mandatory payments through maturity have been satisfied. In 2009, the Company repaid

$145.0 million outstanding under its revolving credit facility. As of December 31, 2010, the Company has $243.2 million of availability

under the revolving credit facility, net of $6.8 million of outstanding letters of credit which reduce the amount available. Amortization of

the debt discount on Tranche B of $8.2 million, $4.8 million and $2.0 million during 2010, 2009 and 2008, respectively, is recorded in

"Interest expense" in the Consolidated Statements of Income (Loss). Amortization of the debt discount in 2010 and 2009 includes pro-

rata write-offs of $5.9 million and $1.9 million, respectively, as a result of the Tranche B prepayments.

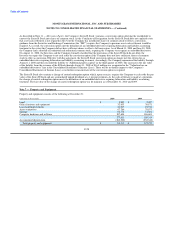

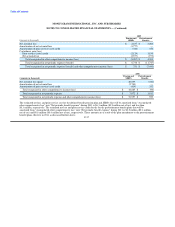

Second Lien Notes — As part of the 2008 Recapitalization, Worldwide issued $500.0 million of senior secured second lien notes to

Goldman Sachs (the "second lien notes"), which will mature in March 2018. The interest rate on the second lien notes is 13.25 percent

per year. Prior to March 25, 2011, the Company has the option to capitalize interest at a rate of 15.25 percent. If interest is capitalized,

0.50 percent of the interest is payable in cash and 14.75 percent is capitalized into the outstanding principal balance. The Company paid

the interest through December 31, 2010 and anticipates that it will continue to pay the interest on the second lien notes for the foreseeable

future.

Prior to the fifth anniversary, the Company may redeem some or all of the second lien notes at a price equal to 100 percent of the

principal, plus any accrued and unpaid interest plus a premium equal to the greater of 1 percent or an amount calculated by discounting

the sum of (a) the redemption payment that would be due upon the fifth anniversary plus (b) all required interest payments due through

such fifth anniversary using the treasury rate plus 50 basis points. Starting with the fifth anniversary, the Company may redeem some or

all of the second lien notes at prices expressed as a percentage of the outstanding principal amount of the second lien notes plus accrued

and unpaid interest, starting at approximately 107 percent on the fifth anniversary, decreasing to 100 percent on or after the eighth

anniversary. Upon a change of control, the Company is required to make an offer to repurchase the second lien notes at a price equal to

101 percent of the principal amount plus accrued and unpaid interest. The Company is also required to make an offer to repurchase the

second lien notes with proceeds of certain asset sales that have not been reinvested in accordance with the terms of the second lien notes

or have not been used to repay certain debt.

F-31