MoneyGram 2010 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

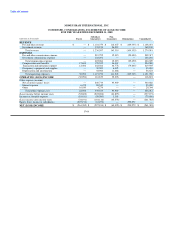

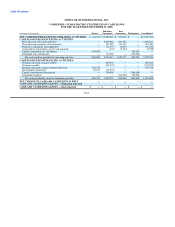

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

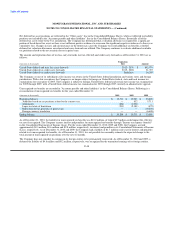

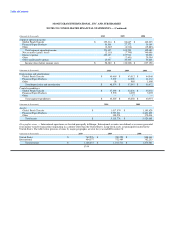

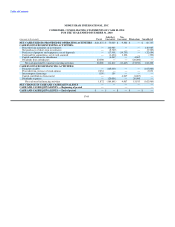

2010 Fiscal Quarters

(Amounts in thousands, except per share data) First Second (1) Third (1) Fourth (1)

Revenue $ 286,504 $ 283,897 $ 292,887 $ 303,365

Total operating expenses 251,442 247,119 254,413 255,281

Operating income 35,062 36,778 38,474 48,084

Total other expenses, net 22,015 27,717 24,689 25,597

Income before income taxes $ 13,047 $ 9,061 $ 13,785 $ 22,487

Net income $ 10,812 $ 6,848 $ 9,985 $ 16,156

Loss per common share

Basic and diluted $ (0.26) $ (0.31) $ (0.30) $ (0.23)

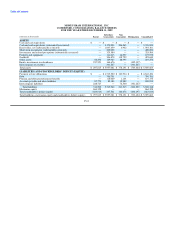

2009 Fiscal Quarters

(Amounts in thousands, except per share data) First Second (2) Third (2) Fourth (2)

Revenue $ 278,102 $ 286,280 $ 301,712 $ 295,617

Total operating expenses 240,446 268,123 297,027 280,717

Operating income 37,656 18,157 4,685 14,900

Total other expenses, net 25,252 21,747 23,389 27,332

Income (loss) before income taxes $ 12,404 $ (3,590) $ (18,704) $ (12,432)

Net income (loss) $ 11,841 $ (3,317) $ (18,304) $ 7,874

Loss per common share

Basic and diluted $ (0.20) $ (0.40) $ (0.60) $ (0.29)

(1) Operating expenses in the second quarter of 2010 include an impairment charge of $1.5 million. Operating expenses in the second,

third and fourth quarters of 2010 include restructuring and reorganization costs of $1.9 million, $1.6 million and $2.3 million,

respectively. Operating expenses in the third quarter of 2010 include legal accruals of $1.8 million. Operating expenses in the fourth

quarter of 2010 include the reversal of a legal accrual of $16.4 million.

(2) Operating expenses in the second and third quarters of 2009 include legal accruals of $12.0 million and $22.5 million, respectively.

Operating expenses in the fourth quarter of 2009 include $20.3 million of legal accruals and a $15.5 million curtailment gain on the

Company's benefit plans.

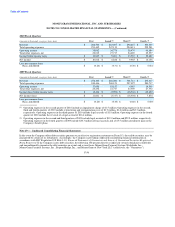

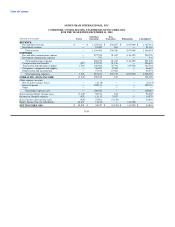

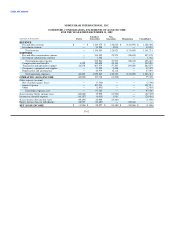

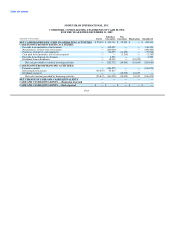

Note 19 — Condensed Consolidating Financial Statements

In the event the Company offers debt securities pursuant to an effective registration statement on Form S-3, these debt securities may be

guaranteed by certain of its subsidiaries. Accordingly, the Company is providing condensed consolidating financial information in

accordance with SEC Regulation S-X Rule 3-10, Financial Statements of Guarantors and Issuers of Guaranteed Securities Registered or

Being Registered. If the Company issues debt securities, the following 100 percent directly or indirectly owned subsidiaries could fully

and unconditionally guarantee the debt securities on a joint and several basis: MoneyGram Payment Systems Worldwide, Inc.;

MoneyGram Payment Systems, Inc.; PropertyBridge, Inc.; and MoneyGram of New York LLC (collectively, the "Guarantors").

F-56