MoneyGram 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Goodwill — We perform impairment testing of our goodwill balances annually as of November 30, and whenever an impairment

indicator is identified. The testing is performed by comparing the estimated fair value of our reporting units to their carrying values. The

fair value of our reporting units is estimated based on expected future cash flows discounted using a weighted-average cost of capital rate

(the "discount rate"). Our discount rate is based on our debt and equity balances, adjusted for current market conditions and investor

expectations of return on our equity. In addition, an assumed terminal value is used to project future cash flows beyond base years.

Assumptions used in our impairment testing, such as forecasted growth rates and the discount rate, are consistent with our internal

forecasts and operating plans. The estimates and assumptions regarding expected cash flows, terminal values and the discount rate require

considerable judgment and are based on historical experience, financial forecasts and industry trends and conditions.

In connection with the annual impairment test for 2010, we assessed the Global Funds Transfer reporting unit, which had assigned

goodwill of $428.7 million. No goodwill is assigned to the other reporting units. The annual impairment test indicated a fair value for the

Global Funds Transfer reporting unit that was substantially in excess of the reporting unit's carrying value. This excess is consistent with

our expectations for the reporting unit and market indicators. Accordingly, we believe the goodwill assigned to the Global Funds Transfer

reporting unit is not impaired. If the discount rate for the Global Funds Transfer reporting unit increases by 50 basis points from the rate

used in our fair value estimate, fair value would be reduced by approximately $78.4 million, assuming all other components of the fair

value estimate remain unchanged. If the growth rate for the Global Funds Transfer reporting unit decreases by 50 basis points from the

rate used in our fair value estimate, fair value would be reduced by approximately $28.2 million, assuming all other components of the

fair value estimate remain unchanged. Our estimated fair value for the Global Funds Transfer reporting unit would continue to be

substantially in excess under either scenario.

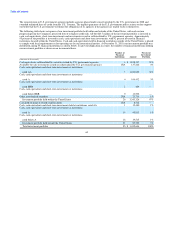

Pension obligations — Through our qualified pension plan and various supplemental executive retirement plans, collectively referred to

as our "pension" plans, we provide defined benefit pension plan coverage to certain of our employees and former employees of Viad. Our

pension obligations under these plans are measured as of December 31 (the "measurement date"). Pension benefits and the related

expense are based upon actuarial projections using assumptions regarding mortality, discount rates, long-term return on assets and other

factors. Following are the weighted-average actuarial assumptions used in calculating the benefit obligation as of each measurement date

and the net periodic benefit cost for the year ended December 31:

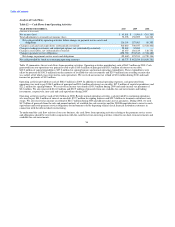

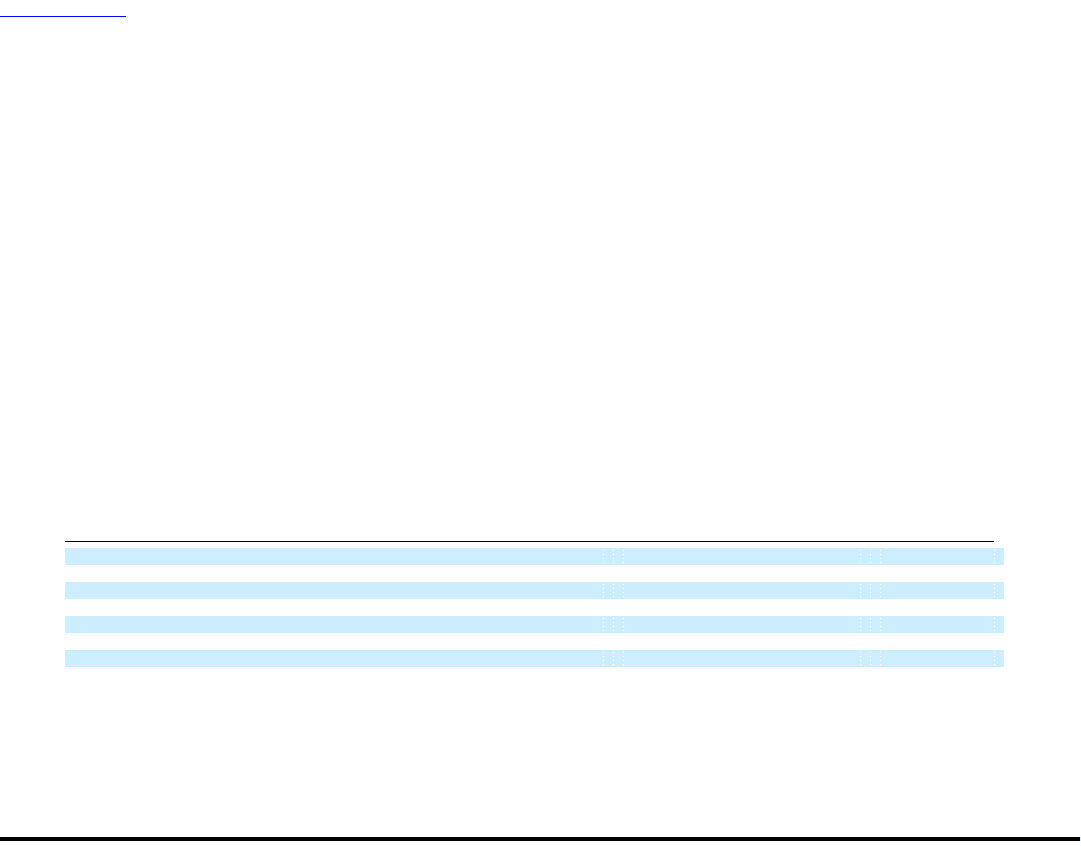

2010 2009 2008

Net periodic benefit cost:

Discount rate 5.80% 6.30% 6.50%

Expected return on plan assets 8.00% 8.00% 8.00%

Rate of compensation increase 5.75% 5.75% 5.75%

Projected benefit obligation:

Discount rate 5.30% 5.80% 6.30%

Rate of compensation increase 5.75% 5.75% 5.75%

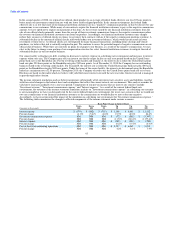

At each measurement date, the discount rate is based on the then current interest rates for high-quality, long-term corporate debt securities

with maturities comparable to our obligations. The rate of compensation increase is applicable to the supplemental executive retirement

plans (the "SERPs") only and is based on historical compensation patterns for the plan participants and management's expectations for

future compensation patterns. During 2010, benefit accruals under all but one of the SERPs were frozen; for the one SERP, service credit

is frozen, but future pay increases continue to be applicable for active participants. Accordingly, the rate of compensation has a nominal

impact on the valuation for 2010 and future years.

66