MoneyGram 2010 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

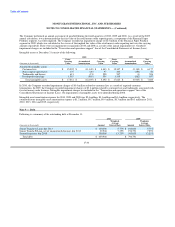

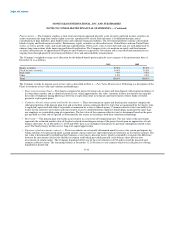

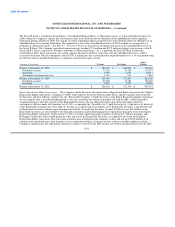

The deferred compensation plans are unfunded and unsecured, and the Company is not required to physically segregate any assets in

connection with the deferred accounts. The Company has rabbi trusts associated with each deferred compensation plan which are funded

through voluntary contributions by the Company. At December 31, 2010 and 2009, the Company had a liability related to the deferred

compensation plans of $3.8 million and $5.0 million, respectively, recorded in the "Accounts payable and other liabilities" component in

the Consolidated Balance Sheets. The rabbi trusts had a market value of $10.7 million and $10.0 million at December 31, 2010 and 2009,

respectively, recorded in "Other assets" in the Consolidated Balance Sheets.

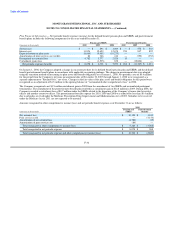

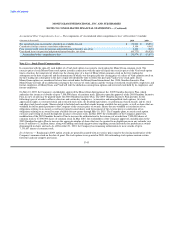

Note 11 — Mezzanine Equity

Preferred Stock — In connection with the 2008 Recapitalization, the Company issued 495,000 shares of B Stock and 265,000 shares of

B-1 Stock to the Investors for a purchase price of $495.0 million and $265.0 million, respectively. As a result of the issuance of the

Series B Stock, the Investors had an equity interest of approximately 79 percent on March 25, 2008. With the accrual of dividends, the

Investors had an equity interest of approximately 84 percent and 82 percent on December 31, 2010 and 2009, respectively. In addition,

the Company capitalized $107.5 million of transaction costs, including $7.5 million paid through the issuance of 7,500 shares of B-1

Stock to Goldman Sachs. The B Stock is convertible into shares of common stock of the Company at a price of $2.50 per share, subject to

adjustment. The B-1 Stock is convertible into B Stock by any stockholder other than Goldman Sachs. While held by Goldman Sachs, the

B-1 Stock is convertible into Series D Participating Convertible Preferred Stock ("Series D Stock").

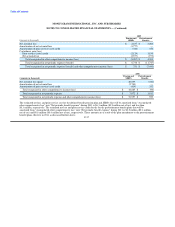

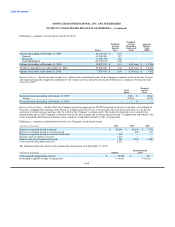

The Series B Stock pays a cash dividend of 10 percent. At the Company's option, dividends may be accrued through March 25, 2013 at a

rate of 12.5 percent in lieu of paying a cash dividend. If the Company is unable to pay the dividends in cash after March 25, 2013,

dividends will accrue at a rate of 15 percent. The Company anticipates that it will accrue dividends on the Series B Stock for at least the

next 12 months. While no dividends have been declared as of December 31, 2010, the Company has accrued dividends through a charge

to "Additional paid-in capital" to the extent available and through a charge to "Retained loss" for the remainder as accumulated and

unpaid dividends are included in the redemption price of the Series B Stock. The Series B Stock also participates in any dividends

declared on the common stock on an as-converted basis.

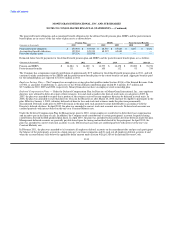

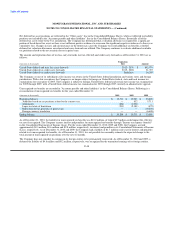

The Series B Stock may be redeemed at the option of the Company after March 25, 2013 if the average market price of its common stock

exceeds $15.00, subject to adjustment, during a period of thirty consecutive trading days. The Series B Stock will be redeemable at the

option of the Investors after March 25, 2018 or upon a change of control. As of December 31, 2010, the Company believes that it is not

probable that the Series B Stock will become redeemable as (a) the contingencies for the change of control redemption option and the

optional redemption by the Company are not met, and (b) these two contingencies may occur prior to the ability of the Investors to

exercise their option to redeem. The B Stock votes as a class with the common stock of the Company and has a number of votes equal to

(i) the number of shares of common stock issuable if all outstanding shares of B Stock were converted plus (ii) the number of shares of

common stock issuable if all outstanding shares of B-1 Stock were converted into B Stock and subsequently converted into common

stock.

F-40