MoneyGram 2010 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

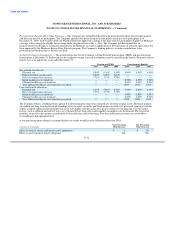

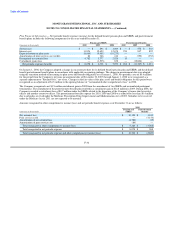

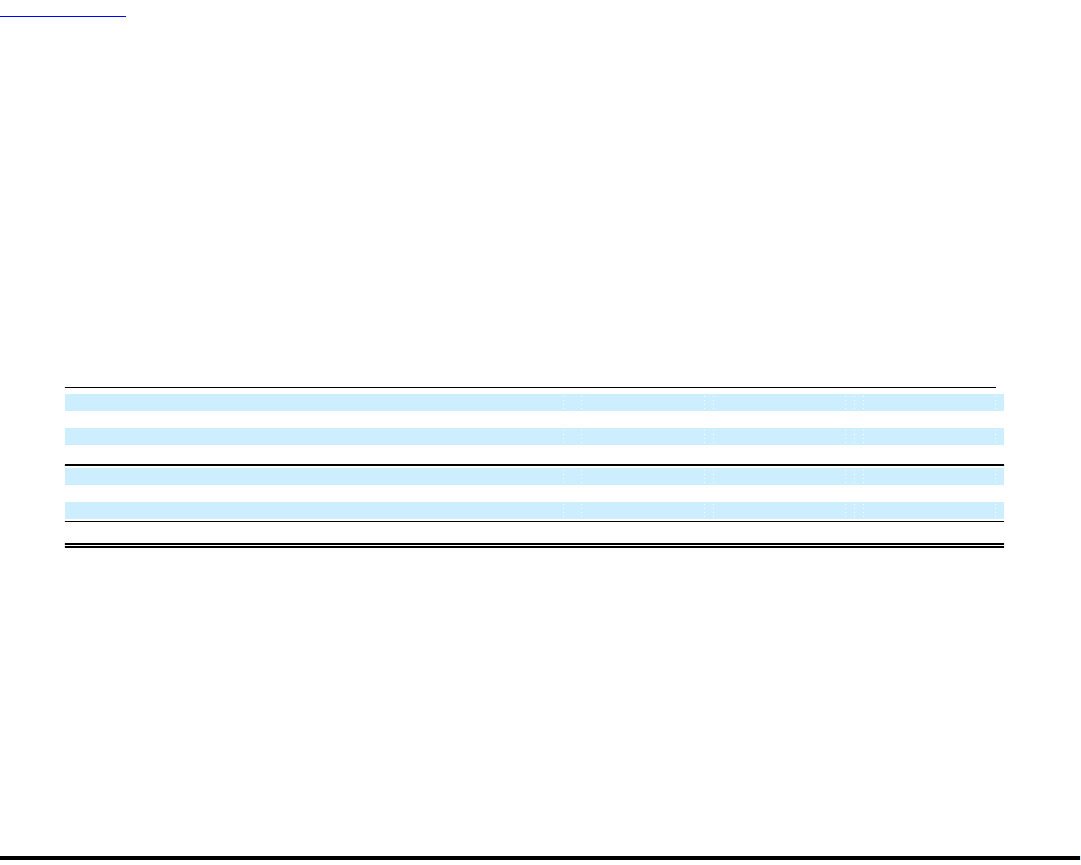

The Series B Stock is recorded in the Company's Consolidated Balance Sheets as "Mezzanine equity" as it has redemption features not

solely within the Company's control. The conversion feature in the B Stock met the definition of an embedded derivative requiring

bifurcation during a portion of 2008. The change of control redemption option contained in the Series B Stock meets the definition of an

embedded derivative requiring bifurcation. The original fair value of the embedded derivatives of $54.8 million was recognized as a

reduction of "Mezzanine equity." See Note 6 — Derivative Financial Instruments for further discussion of the embedded derivatives in

the Series B Stock. The Company capitalized transaction costs totaling $37.6 million and $17.2 million relating to the issuance of the B

Stock and B-1 Stock, respectively, through a reduction of "Mezzanine equity." As it is probable the Series B Stock will become

redeemable in 2018, these transaction costs, along with the discount recorded in connection with the embedded derivatives, will be

accreted to the Series B Stock redemption value of $767.5 million plus any accumulated but unpaid dividends over a 10-year period using

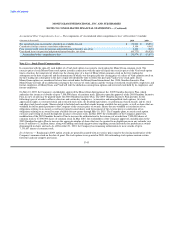

the effective interest method. Following is a summary of mezzanine equity activity:

Series

(Amounts in thousands) B Stock B-1 Stock B Stock

Balance at December 31, 2008 $ 458,408 $ 283,804 $ 742,212

Dividends accrued 71,124 39,155 110,279

Accretion 8,539 1,674 10,213

Tax benefit on transaction costs 1,013 611 1,624

Balance at December 31, 2009 539,084 325,244 864,328

Dividends accrued 80,622 44,383 125,005

Accretion 8,493 1,527 10,020

Balance at December 31, 2010 $ 628,199 $ 371,154 $ 999,353

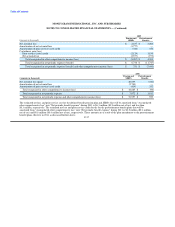

Equity Registration Rights Agreement — The Company and the Investors also entered into a Registration Rights Agreement (the "Equity

Registration Rights Agreement") on March 25, 2008, with respect to the Series B Stock and D Stock, and the common stock owned by

the Investors and their affiliates (collectively, the "Registrable Securities"). Under the terms of the Equity Registration Rights Agreement,

we are required, after a specified holding period, to use our reasonable best efforts to promptly file with the SEC a shelf registration

statement relating to the offer and sale of the Registrable Securities. We are obligated to keep such shelf registration statement

continuously effective under the Securities Act of 1933, as amended (the "Securities Act"), until the earlier of (1) the date as of which all

of the Registrable Securities have been sold, (2) the date as of which each of the holders of the Registrable Securities is permitted to sell

its Registrable Securities without registration pursuant to Rule 144 under the Securities Act and (3) fifteen years. The holders of the

Registrable Securities are also entitled to five demand registrations and unlimited piggyback registrations during the term of the Equity

Registration Rights Agreement. On December 14, 2010, we filed a shelf registration statement on Form S-3 with the Securities and

Exchange Commission which would permit the offer and sale of the Registrable Securities, as required by the terms of the Equity

Registration Rights Agreement. The registration statement also would permit the Company to offer and sell up to $500 million of its

common stock, preferred stock, debt securities or any combination of these, from time to time, subject to market conditions and the

Company's capital needs. The registration statement is subject to review by the SEC and has not yet been declared effective by the SEC.

F-41