MoneyGram 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

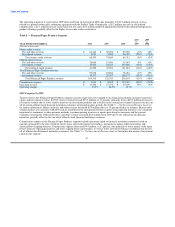

Segment Performance

Our reporting segments are primarily organized based on the nature of products and services offered and the type of consumer served. We

primarily manage our business through two reporting segments, Global Funds Transfer and Financial Paper Products. The Global Funds

Transfer segment provides global money transfers and bill payment services to consumers through a network of agents and, in select

markets, company-operated locations. The Financial Paper Products segment provides money orders to consumers through our retail and

financial institution locations in the United States and Puerto Rico, and provides official check services to financial institutions in the

United States. Businesses that are not operated within these segments are categorized as "Other," and primarily relate to discontinued

products and businesses. Segment pre-tax operating income and segment operating margin are used to review operating performance and

allocate resources.

The Global Funds Transfer segment is managed as two geographical regions or operating segments, the Americas and EMEAAP, to

coordinate sales, agent management and marketing activities. The Americas region includes the United States, Canada, Mexico, the

Caribbean and Latin America. The EMEAAP region includes Europe, the Middle East, Africa and the Asia Pacific region. We monitor

performance and allocate resources at both a regional and reporting segment level. As the two regions routinely interact in completing

money transfer transactions and share systems, processes and licenses, we view the Global Funds Transfer segment as one global

network. The nature of the consumers and products offered is the same for each region, and the regions utilize the same agent network,

systems and support functions. In addition, the regions have similar regulatory requirements and economic characteristics. Accordingly,

we aggregate the two operating segments into one reporting segment.

Segment accounting policies are the same as those described in Note 2 — Summary of Significant Accounting Policies in the Notes to the

Consolidated Financial Statements. We manage our investment portfolio on a consolidated level, with no specific investment security

assigned to a particular segment. However, investment revenue is allocated to each segment based on the average investment balances

generated by that segment's sale of payment instruments during the period. Net securities (gains) losses are not allocated to the segments

as the investment portfolio is managed at a consolidated level. While the derivatives portfolio is also managed on a consolidated level,

each derivative instrument is utilized in a manner that can be identified to a particular segment. Interest rate swaps historically used to

hedge variable rate commissions were identified with the official check product in the Financial Paper Products segment, while forward

foreign exchange contracts are identified with the money transfer product in the Global Funds Transfer segment. Any interest rate swaps

related to our credit agreements are not allocated to the segments.

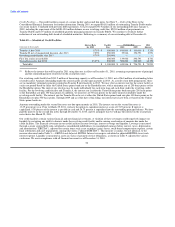

Also excluded from operating income for Global Funds Transfer and Financial Paper Products are interest and other expenses related to

our credit agreements, items related to our preferred stock, operating income from businesses categorized as "Other," certain pension and

benefit obligation expenses, director deferred compensation plan expenses, executive severance and related costs, certain legal and

corporate costs not related to the performance of the segments and restructuring and related costs. Unallocated expenses in 2010 include

$5.9 million of costs associated with our global transformation initiative and $1.8 million of asset impairments, in addition to other

corporate costs of $7.4 million not allocated to the segments.

43