MoneyGram 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

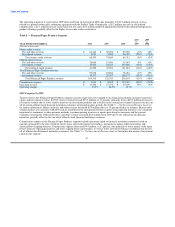

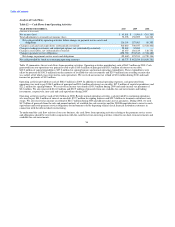

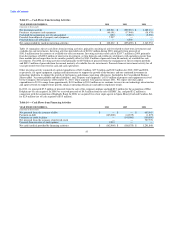

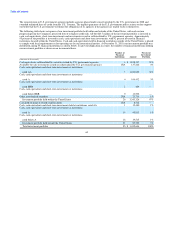

Debt consists of amounts outstanding under our senior facility and the second lien notes at December 31, 2010, as shown in Table 10 —

Schedule of Credit Facilities. Our Consolidated Balance Sheet at December 31, 2010 includes $639.9 million of debt, net of unamortized

discounts of $1.3 million, and less than $0.1 million of accrued interest on the debt. The above table reflects the principal and interest that

will be paid through the maturity of the debt using the rates in effect on December 31, 2010, and assuming no prepayments of principal

and the continued payment of interest on the second lien notes. Operating leases consist of various leases for buildings and equipment

used in our business. Other obligations are unfunded capital commitments related to our limited partnership interests included in "Other

asset-backed securities" in our investment portfolio. We have other commitments as described further below that are not included in

Table 11 as the timing and/or amount of payments are difficult to estimate.

The Company's Series B Stock has a cash dividend rate of 10 percent. At the Company's option, dividends may be accrued through

March 25, 2013 at a rate of 12.5 percent in lieu of paying a cash dividend. Due to restrictions in our debt agreements, we elected to accrue

the dividends in 2010 and expect that dividends will be accrued for at least the next 12 months. While no dividends have been declared as

of December 31, 2010, we have accrued dividends of $125.0 million in our Consolidated Balance Sheets as accumulated and unpaid

dividends are included in the redemption price of the Series B Stock regardless of whether dividends have been declared.

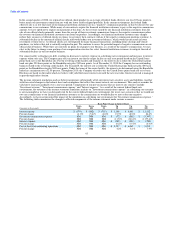

We have a funded, noncontributory pension plan that is frozen to both future benefit accruals and new participants. Our funding policy

has historically been to contribute the minimum contribution required by applicable regulations. We made contributions of $3.1 million

to the defined benefit pension plan during 2010. We anticipate a minimum contribution of up to $7.9 million to the pension plan trust in

2011. We also have certain unfunded pension and postretirement plans that require benefit payments over extended periods of time.

During 2010, we paid benefits totaling $5.4 million related to these unfunded plans. Benefit payments under these unfunded plans are

expected to be $4.6 million in 2011. Expected contributions and benefit payments under these plans are not included in the above table as

it is difficult to estimate the timing and amount of benefit payments and required contributions beyond the next 12 months. See Note 10

— Pensions and Other Benefits of the Notes to the Consolidated Financial Statements for further information.

As of December 31, 2010, the liability for unrecognized tax benefits was $10.2 million. As there is a high degree of uncertainty regarding

the timing of potential future cash outflows associated with liabilities, we are unable to make a reasonably reliable estimate of the amount

and period in which these liabilities might be paid.

In limited circumstances, we may grant minimum commission guarantees as an incentive to new or renewing agents for a specified

period of time at a contractually specified amount. Under the guarantees, we will pay to the agent the difference between the

contractually specified minimum commission and the actual commissions earned by the agent. As of December 31, 2010, the minimum

commission guarantees had a maximum payment of $2.2 million over a weighted average remaining term of 1.7 years. The maximum

payment is calculated as the contractually guaranteed minimum commission times the remaining term of the contract and, therefore,

assumes that the agent generates no money transfer transactions during the remainder of its contract. As of December 31, 2010, the

liability for minimum commission guarantees is $0.3 million. Minimum commission guarantees are not reflected in the table above.

55