MoneyGram 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The terms of our credit facilities also place restrictions on certain types of payments we may make, including dividends to our preferred

and common stockholders, acquisitions and the funding of foreign subsidiaries, among others. We do not anticipate these restrictions to

limit our ability to grow the business either domestically or internationally. In addition, we may only make dividend payments to

common stockholders subject to an incremental build-up based on our consolidated net income in future periods. No dividends were paid

on our common stock in 2010, and we do not anticipate declaring any dividends on our common stock during 2011.

Equity Registration Rights Agreement — The Company and the Investors also entered into a Registration Rights Agreement (the "Equity

Registration Rights Agreement") on March 25, 2008, with respect to the Series B Stock and D Stock, and the common stock owned by

the Investors and their affiliates (collectively, the "Registrable Securities"). Under the terms of the Equity Registration Rights Agreement,

we are required, after a specified holding period, to use our reasonable best efforts to promptly file with the SEC a shelf registration

statement relating to the offer and sale of the Registrable Securities. We are obligated to keep such shelf registration statement

continuously effective under the Securities Act of 1933, as amended (the "Securities Act"), until the earlier of (1) the date as of which all

of the Registrable Securities have been sold, (2) the date as of which each of the holders of the Registrable Securities is permitted to sell

its Registrable Securities without registration pursuant to Rule 144 under the Securities Act and (3) fifteen years. The holders of the

Registrable Securities are also entitled to five demand registrations and unlimited piggyback registrations during the term of the Equity

Registration Rights Agreement. On December 14, 2010, we filed a shelf registration statement on Form S-3 with the SEC which would

permit the offer and sale of the Registrable Securities, as required by the terms of the Equity Registration Rights Agreement. The

registration statement also would permit the Company to offer and sell up to $500 million of its common stock, preferred stock, debt

securities or any combination of these, from time to time, subject to market conditions and the Company's capital needs. The registration

statement is subject to review by the SEC and has not yet been declared effective by the SEC.

Credit Ratings — As of December 31, 2010 our credit ratings from Moody's, S&P and Fitch Ratings ("Fitch") were B1, B+ and B+,

respectively, with a stable outlook assigned by the three credit rating agencies. Our credit facilities, regulatory capital requirements and

other obligations are not impacted by the level of our credit ratings. However, higher credit ratings could increase our ability to attract

capital, minimize our weighted average cost of capital and obtain more favorable terms with our lenders, agents and clearing and cash

management banks.

Mezzanine Equity — Our Series B Stock pays a cash dividend of 10 percent. At the Company's option, we may accrue dividends at a rate

of 12.5 percent through March 25, 2013 and 15.0 percent thereafter. We have accrued dividends from the issuance of Series B Stock

through December 31, 2010.

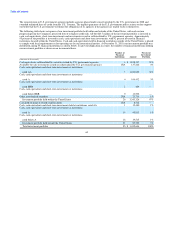

Contractual and Regulatory Capital

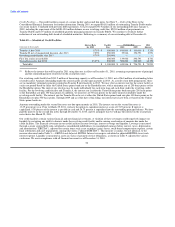

Regulatory Capital Requirements — We have capital requirements relating to government regulations in the United States and other

countries where we operate. Such regulations typically require us to maintain certain assets in a defined ratio to our payment service

obligations. Through our wholly owned subsidiary and licensed entity, MPSI, we are regulated in the United States by various state

agencies that generally require us to maintain a pool of liquid assets and investments in an amount generally equal to the regulatory

payment service obligation measure, as defined by each state, for our regulated payment instruments, namely teller checks, agent checks,

money orders and money transfers. The regulatory requirements do not require us to specify individual assets held to meet our payment

service obligations, nor are we required to deposit specific assets into a trust, escrow or other special account. Rather, we must maintain a

pool of liquid assets. Provided we maintain a total pool of liquid assets sufficient to meet the regulatory and contractual requirements, we

are able to withdraw, deposit or sell our individual liquid assets at will, without prior notice, penalty or limitations.

53