MoneyGram 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

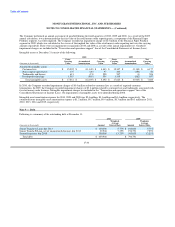

The Company realigned its investment portfolio during the first quarter of 2008, resulting in the sale of securities with a fair value of

$3.2 billion (after other-than-temporary impairment charges) for proceeds of $2.9 billion and a net realized loss of $256.3 million. The

net realized loss was the result of further deterioration in the markets during the first quarter of 2008 and the short timeframe over which

the Company sold its securities. Proceeds from the sales were reinvested in cash and cash equivalents to supplement the Company's assets

in excess of payment service obligations. Other-than-temporary impairment charges of $70.3 million during 2008 were the result of

further deterioration in the markets. The Company continues to have the intent to sell its investments classified as Other asset-backed

securities.

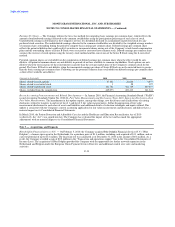

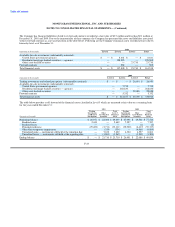

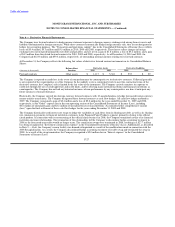

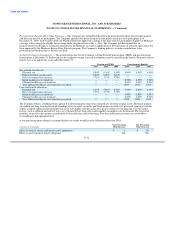

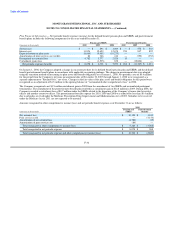

Investment Ratings — In rating the securities in its investment portfolio, the Company uses ratings from Moody's Investor Service

("Moody's"), Standard & Poors ("S&P") and Fitch Ratings ("Fitch"). If the rating agencies have split ratings, the Company uses the

highest rating across the rating agencies for disclosure purposes. Securities issued or backed by United States government agencies are

included in the AAA rating category. Investment grade is defined as a security having a Moody's equivalent rating of Aaa, Aa, A or Baa

or an S&P or Fitch equivalent rating of AAA, AA, A or BBB. The Company's investments at December 31 consisted of the following

ratings:

2010 2009

Number of Fair Percent of Number of Fair Percent of

(Dollars in thousands) Securities Value Investments Securities Value Investments

AAA, including United States agencies 25 $ 136,893 85% 34 $ 276,215 92%

A 0 — — 1 415 0%

BBB 0 — — 1 1,842 1%

Below investment grade 64 24,043 15% 69 20,161 7%

Total 89 $ 160,936 100% 105 $ 298,633 100%

Had the Company used the lowest rating from the rating agencies in the information presented above, there would be no change to

investments rated A or better as of December 31, 2010 and 2009.

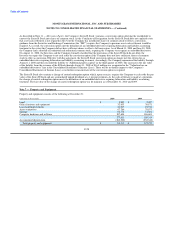

Contractual Maturities — The amortized cost and fair value of available-for-sale securities at December 31, by contractual maturity, are

shown below. Actual maturities may differ from contractual maturities as borrowers may have the right to call or prepay obligations,

sometimes without call or prepayment penalties. Maturities of mortgage-backed and other asset-backed securities depend on the

repayment characteristics and experience of the underlying obligations.

2010 2009

Amortized Fair Amortized Fair

(Amounts in thousands) Cost Value Cost Value

After one year through five years $ 7,273 $ 8,641 $ 6,854 $ 7,715

Mortgage-backed and other asset-backed securities 132,367 152,295 275,269 290,918

Total $ 139,640 $ 160,936 $ 282,123 $ 298,633

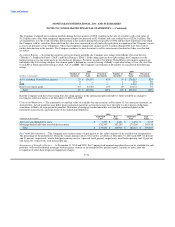

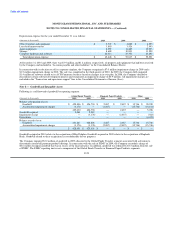

Fair Value Determination — The Company uses various sources of pricing for its fair value estimates of its available-for-sale portfolio.

The percentage of the portfolio for which the various pricing sources were used is as follows at December 31, 2010 and 2009: 81 percent

and 91 percent, respectively, used a third party pricing service; 6 percent and 4 percent, respectively, used broker pricing; and 13 percent

and 5 percent, respectively, used internal pricing.

Assessment of Unrealized Losses — At December 31, 2010 and 2009, the Company had nominal unrealized losses in its available-for-sale

portfolio, with one Residential mortgage-backed agency security in an unrealized loss position aged 12 months or more, after the

recognition of other-than-temporary impairment charges.

F-26