MoneyGram 2010 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Inter-creditor Agreement — In connection with the above financing arrangements, the lenders under both the senior facility and the

second lien notes entered into an inter-creditor agreement under which the lenders have agreed to waive certain rights and limit the

exercise of certain remedies available to them for a limited period of time, both before and following a default under the financing

arrangements.

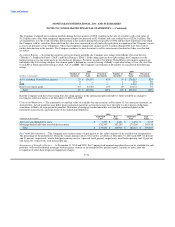

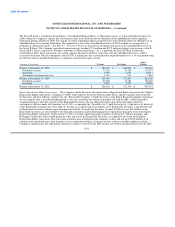

Debt Covenants and other restrictions — Borrowings under the Company's debt agreements are subject to various covenants that limit

the Company's ability to: incur additional indebtedness; effect mergers and consolidations; sell assets or subsidiary stock; pay dividends

and other restricted payments; invest in certain assets; and effect loans, advances and certain other transactions with affiliates. In addition,

the senior facility has a covenant that places limitations on the use of proceeds from borrowings under the facility.

Both the senior facility and the second lien notes contain a financial covenant requiring the Company to maintain a minimum liquidity

ratio of at least 1:1 for certain assets to outstanding payment service obligations. The senior facility also has two financial covenants

referred to as the interest coverage ratio and senior secured debt ratio. The Company must maintain a minimum interest coverage ratio of

1.75:1 through September 30, 2012 and 2:1 from December 31, 2012 through maturity. The senior secured debt ratio is not permitted to

exceed 5.5:1 through September 30, 2011, 5:1 from December 31, 2011 through September 30, 2012 and 4.5:1 from December 31, 2012

through maturity. At December 31, 2010, the Company is in compliance with its financial covenants.

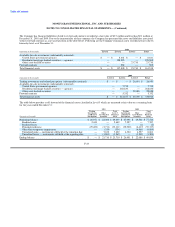

Deferred Financing Costs — In connection with the waivers obtained on the senior facility during the first quarter of 2008, the Company

capitalized financing costs of $1.5 million. The Company also capitalized $19.6 million and $33.4 million of financing costs for the

amendment and restatement of the senior facility and the issuance of the second lien notes, respectively. These costs were capitalized in

"Other assets" in the Consolidated Balance Sheets and are being amortized over the term of the related debt using the effective interest

method.

Amortization of deferred financing costs of $9.3 million, $8.0 million and $5.5 million for the years ended December 31, 2010, 2009, and

2008, respectively, is recorded in "Interest expense" in the Consolidated Statements of Income (Loss). Amortization during 2010 and

2009 includes $2.7 million and $0.9 million, respectively, for the write-off of a pro rata portion of deferred financing costs in connection

with the prepayments on Tranche B. In connection with the modification of the senior facility in 2008, the Company recognized a debt

extinguishment loss of $1.5 million, reducing deferred financing costs.

Interest Paid in Cash — The Company paid $83.5 million, $94.4 million and $84.0 million of interest in 2010, 2009 and 2008,

respectively.

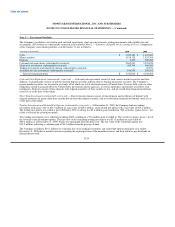

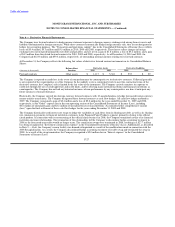

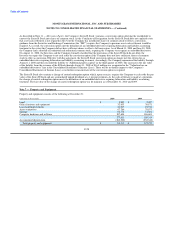

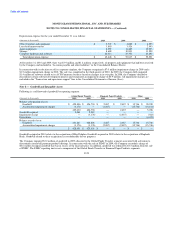

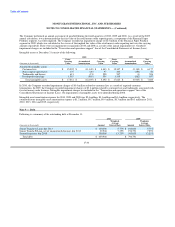

Note 10 — Pensions and Other Benefits

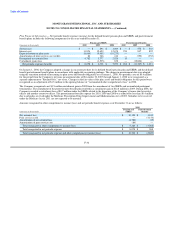

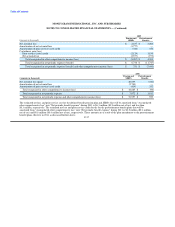

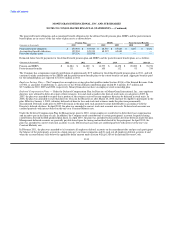

Pension Benefits — The Pension Plan is a frozen non-contributory funded defined benefit pension plan under which no new service or

compensation credits are accrued by the plan participants. Cash accumulation accounts continue to be credited with interest credits until

participants withdraw their money from the Pension Plan. It is the Company's policy to fund the minimum required contribution each

year.

Supplemental Executive Retirement Plans — The Company has obligations under various Supplemental Executive Retirement Plans

("SERPs"), which are unfunded non-qualified defined benefit pension plans providing postretirement income to their participants. As of

December 31, 2010, all benefit accruals under the SERPs are frozen with the exception of one plan for which service is frozen but future

pay increases are reflected for active participants. It is the Company's policy to fund the SERPs as benefits are paid.

F-32