MoneyGram 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Item 1B. UNRESOLVED SEC COMMENTS

None.

Item 2. PROPERTIES

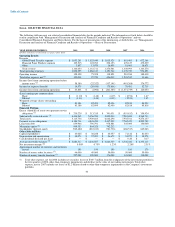

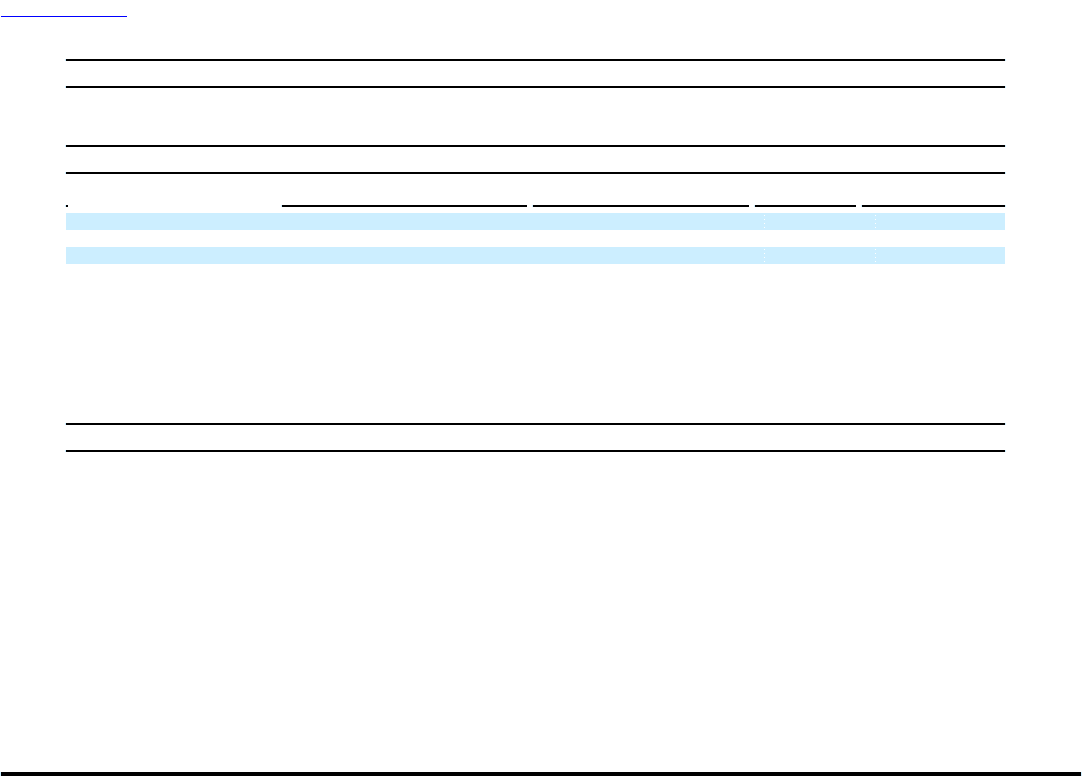

Location Use Segment(s) Using Space Square Feet Lease Expiration

Dallas, TX Corporate Headquarters Both 34,921 6/30/2021

Minneapolis, MN Global Operations Center Both 153,592 12/31/2015

Brooklyn Center, MN Global Operations Center Both 75,000 4/30/2015

Lakewood, CO Call Center Global Funds Transfer 114,240 3/31/2015

Information concerning our material properties, all of which are leased, including location, use, approximate area in square feet and lease

terms, is set forth above. Per lease terms, we will be adding 12,000 square feet to our corporate headquarters in Dallas in 2012. Not

included in the above table is approximately 14,600 square feet in Minneapolis, Minnesota that has been sublet. We also have a number

of other smaller office locations in Arkansas, California, Florida, New York, France, Germany, Italy, Spain and the United Kingdom, as

well as small sales and marketing offices in Australia, China, Greece, India, Italy, the Netherlands, Nigeria, Russia, South Africa, Spain,

Ukraine, United Arab Emirates, and Switzerland. We believe that our properties are sufficient to meet our current and projected needs.

Item 3. LEGAL PROCEEDINGS

Legal Proceedings — The Company is involved in various claims, litigation and government inquiries that arise from time to time in the

ordinary course of the Company's business. All of these matters are subject to uncertainties and outcomes that are not predictable with

certainty. The Company accrues for these matters as any resulting losses become probable and can be reasonably estimated. Further, the

Company maintains insurance coverage for many claims and litigation alleged. Management does not believe that after final disposition

any of these matters is likely to have a material adverse impact on the Company's financial condition, results of operations and cash

flows.

Federal Securities Class Actions — As previously disclosed, on March 9, 2010, the Company and certain of its present and former

officers and directors entered into a Settlement Agreement, subject to final approval of the court, to settle a consolidated class action case

originally filed on October 3, 2008 in the United States District Court for the District of Minnesota captioned In re MoneyGram

International, Inc. Securities Litigation. The settlement provides for a cash payment of $80.0 million, all but $20.0 million of which

would be paid by the Company's insurance carriers. At a hearing on June 18, 2010, the Court issued a final order and judgment approving

the settlement. The settlement became effective on July 26, 2010, when the time to appeal the Court's final order and judgment expired

without any appeal having been filed. The Company paid $20.0 million into an escrow account in March 2010 and the insurance carrier

paid $60.0 million in April 2010, resulting in full settlement of the Company's liability in this matter.

25