MoneyGram 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

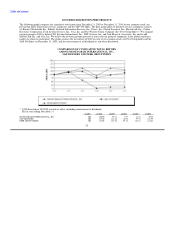

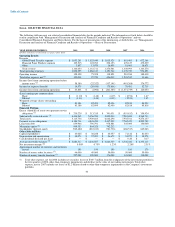

(2) Income from continuing operations before income taxes for 2010 includes a $16.4 million gain related to the reversal of a patent

lawsuit; $1.8 million of legal accruals related primarily to shareholder litigation; $1.8 million of asset impairments and $5.9 million

of expense related to our global transformation initiative. Loss from continuing operations before income taxes for 2009 includes

$54.8 million of legal reserves relating to securities litigation, stockholder derivative claims, a patent lawsuit and a settlement with

the FTC; $18.3 million of goodwill and asset impairments and a $14.3 million net curtailment gain on our benefit plans. Loss from

continuing operations before income taxes for 2008 includes a $29.7 million net loss on the termination of swaps, a $26.5 million

gain from put options on our trading investments, a $16.0 million valuation loss from changes in the fair value of embedded

derivatives on our Series B Stock and a goodwill impairment of $8.8 million related to a discontinued business. Loss from

continuing operations before income taxes for 2007 includes a goodwill impairment of $6.4 million related to a discontinued

business.

(3) Assets in excess of payment service obligations are substantially restricted assets less payment service obligations as calculated in

Note 2 — Summary of Significant Accounting Policies of the Notes to Consolidated Financial Statements. Substantially restricted

assets are composed of cash and cash equivalents, receivables and investments.

(4) Mezzanine Equity relates to our Series B Stock. See Note 11 — Mezzanine Equity of the Notes to Consolidated Financial

Statements for the terms of the Series B Stock.

(5) Investable balances are composed of cash and cash equivalents and all classes of investments.

(6) Net investment margin is determined as net investment revenue (investment revenue less investment commissions) divided by daily

average investable balances.

(7) Includes 27,000, 28,000, 30,000, 18,000 and 16,000 locations in 2010, 2009, 2008, 2007 and 2006, respectively, that offer both

money order and money transfer services.

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

The following discussion should be read in conjunction with our Consolidated Financial Statements and related Notes. This discussion

contains forward-looking statements that involve risks and uncertainties. MoneyGram's actual results could differ materially from those

anticipated due to various factors discussed below under "Cautionary Statements Regarding Forward-Looking Statements" and under the

caption "Risk Factors" in Part 1, Item 1A of this Annual Report on Form 10-K.

Basis of Presentation

The financial statements in this Annual Report on Form 10-K are presented on a consolidated basis and include the accounts of the

Company and our subsidiaries. See Note 2 — Summary of Significant Accounting Policies of the Notes to the Consolidated Financial

Statements for further information regarding consolidation. References to "MoneyGram," the "Company," "we," "us" and "our" are to

MoneyGram International, Inc. and its subsidiaries and consolidated entities. Our Consolidated Financial Statements are prepared in

conformity with accounting principles generally accepted in the United States of America ("GAAP").

During the fourth quarter of 2010, the Company revised the presentation of its Consolidated Statements of Income (Loss) as a result of an

internal review to enhance our external reporting and management reporting. As a result of this review, the Company will no longer

present net revenue, previously measured as total revenue less total commissions expense, as this measure was not found to be a

meaningful metric internally or to our external users. The Company will continue to separately disclose "Commissions expense." In

addition, the Company has created an operating income measure consistent with management reporting and to more clearly delineate

operating and non-operating items. As a result, certain items are now presented below the operating income line based on management's

assessment of their nature as non-operating, including securities (gains) losses, interest expense and (gains) losses related to cash flow

hedges. The securities (gains) losses and $2.4 million of gains and $2.8 million of losses related to historical cash flow hedges for the

year ended December 31, 2009 and 2008, respectively, were previously presented in revenue. All prior periods have been reclassified to

conform to this new presentation.

31