MoneyGram 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

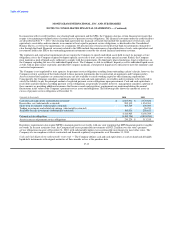

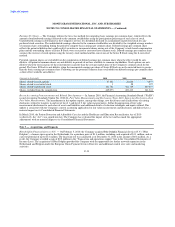

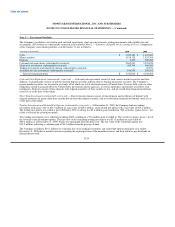

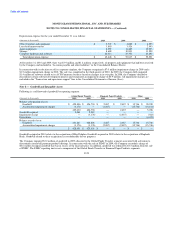

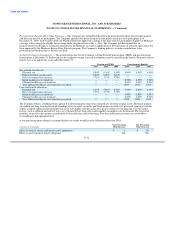

The Company has financial liabilities related to its forward contracts recorded at a fair value of $0.5 million and less than $0.1 million at

December 31, 2010 and 2009. Due to the immateriality of these amounts, the Company has presented the assets and liabilities associated

with its forward contracts as a net asset position in the table below. Following are the Company's financial assets recorded at fair value by

hierarchy level as of December 31:

2010

(Amounts in thousands) Level 1 Level 2 Level 3 Total

Available-for-sale investments (substantially restricted):

United States government agencies $ — $ 8,641 $ — $ 8,641

Residential mortgage-backed securities — agencies — 128,585 — 128,585

Other asset-backed securities — — 23,710 23,710

Forward contracts — 582 — 582

Total financial assets $ — $ 137,808 $ 23,710 $ 161,518

2009

(Amounts in thousands) Level 1 Level 2 Level 3 Total

Trading investments and related put options (substantially restricted) $ — $ — $ 26,951 $ 26,951

Available-for-sale investments (substantially restricted):

United States government agencies — 7,715 — 7,715

Residential mortgage-backed securities — agencies — 268,830 — 268,830

Other asset-backed securities — — 22,088 22,088

Forward contracts — 5,332 — 5,332

Total financial assets $ — $ 281,877 $ 49,039 $ 330,916

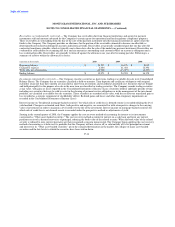

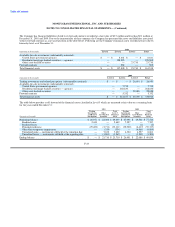

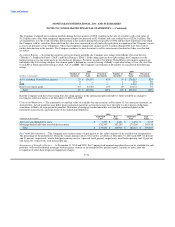

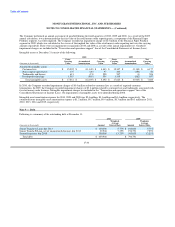

The table below provides a roll-forward of the financial assets classified in Level 3 which are measured at fair value on a recurring basis

for the years ended December 31:

2010 2009

Trading Total Trading Total

Investments Other Level 3 Investments Other Level 3

and Related Asset-Backed Financial and Related Asset-Backed Financial

(Amounts in thousands) Put Options Securities Assets Put Options Securities Assets

Beginning balance $ 26,951 $ 22,088 $ 49,039 $ 47,990 $ 29,528 $ 77,518

Realized gains 2,449 — 2,449 7,557 — 7,557

Realized losses — — — — (2) (2)

Principal paydowns (29,400) (3,711) (33,111) (32,900) (6,417) (39,317)

Other-than-temporary impairments — (334) (334) — (4,069) (4,069)

Unrealized gains — instruments still held at the reporting date — 7,632 7,632 4,304 4,557 8,861

Unrealized losses — instruments still held at the reporting date — (1,965) (1,965) — (1,509) (1,509)

Ending balance $ — $ 23,710 $ 23,710 $ 26,951 $ 22,088 $ 49,039

F-23